Market Analysis – January 20

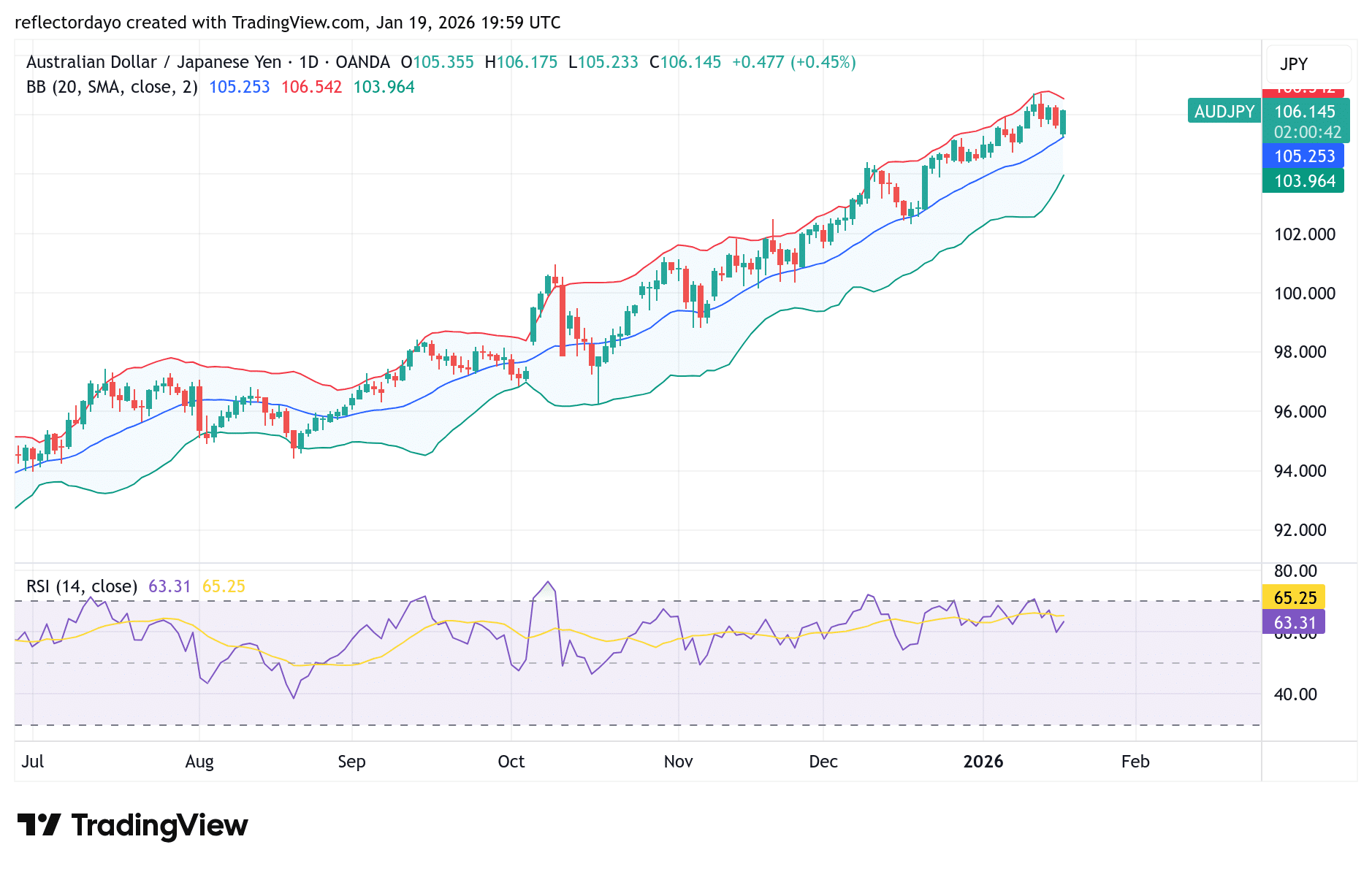

The AUD/JPY pair continues to be shaped by a clear divergence in monetary policy and global risk sentiment. On one side, the Australian Dollar draws support from the Reserve Bank of Australia’s relatively hawkish stance and elevated interest rates, which make the AUD attractive in carry trades. On the other, the Japanese Yen remains under pressure due to the Bank of Japan’s reluctance to tighten policy aggressively, compounded by domestic political uncertainty. This yield gap encourages investors to fund positions in low-yielding JPY and rotate into higher-yielding AUD, a dynamic that strengthens AUD/JPY during periods of risk-on sentiment, particularly when commodity demand and global growth expectations remain favorable.

AUD/JPY Key Levels

Supply Levels: 106, 107, 108

Demand Levels: 103, 102, 101

AUD/JPY May Consolidate at 106

The AUD/JPY market has maintained a consistent upward trend, largely supported by ongoing carry-trade activity. However, in recent trading sessions, rising geopolitical tensions have begun to influence market sentiment. Amid these developments, price action is now struggling around the critical 106 level, placing the pair at a key crossroads.

As uncertainty increases, many traders are likely to adopt a more cautious stance. As a result, there is a strong possibility that price action may consolidate around the 106 level before the market determines its next directional move.

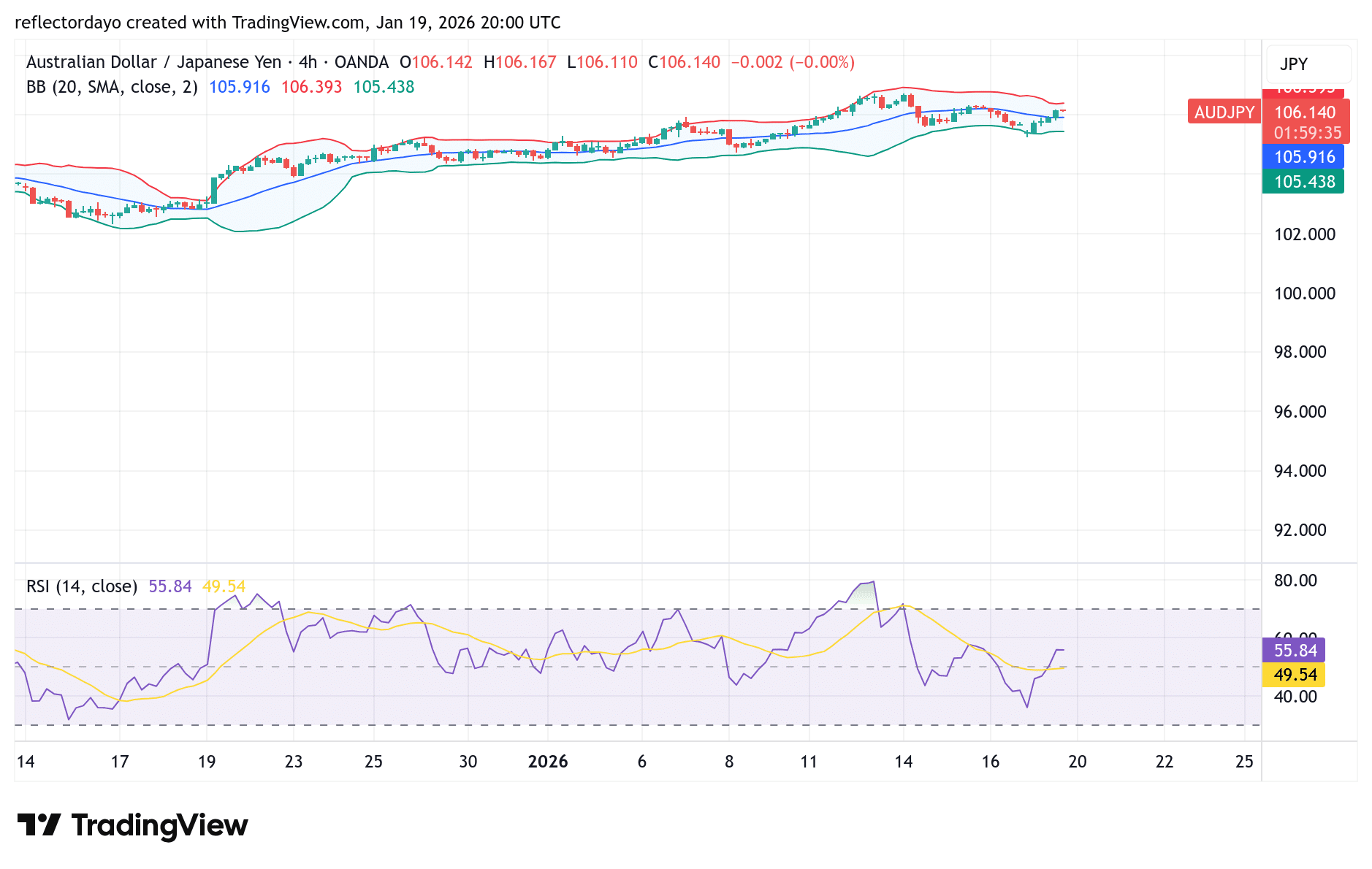

AUD/JPY Short-Term Trend

Zooming into a lower timeframe, the market bias appears to confirm consolidation around the 106 price level. Notably, in the most recent trading session, the candlestick representing today’s trading activity formed a four-price doji, a pattern that reflects market indecision.

This indecision suggests that even if a breakout occurs near this level, it may lack strong follow-through. As a result, price action may continue to fluctuate around the 106 zone for a while.

Additionally, the Japanese yen tends to strengthen during periods of heightened geopolitical tension. If such tensions persist, this could increase downside pressure on the pair, potentially leading to a downward price movement.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.