Market Analysis – January 5

The AUD/JPY pair continues to be fundamentally supported by a combination of monetary policy divergence and favorable global risk conditions. A key driver remains the wide interest rate differential between Australia and Japan, as the Reserve Bank of Australia maintains a restrictive stance with its policy rate around 4.35%, while the Bank of Japan has only cautiously moved away from its long-standing ultra-loose policy, keeping interest rates near 0.10%. This pronounced yield spread has sustained carry trade flows into the Australian dollar, leaving the Japanese yen structurally weak.

In addition, persistent risk-on sentiment across global markets has favored higher-yielding, risk-sensitive currencies such as the AUD over traditional safe-haven currencies like the JPY. This backdrop has been further reinforced by resilient demand for Australia’s key commodity exports, particularly iron ore, which continues to support the country’s trade balance and underpin confidence in the Australian dollar.

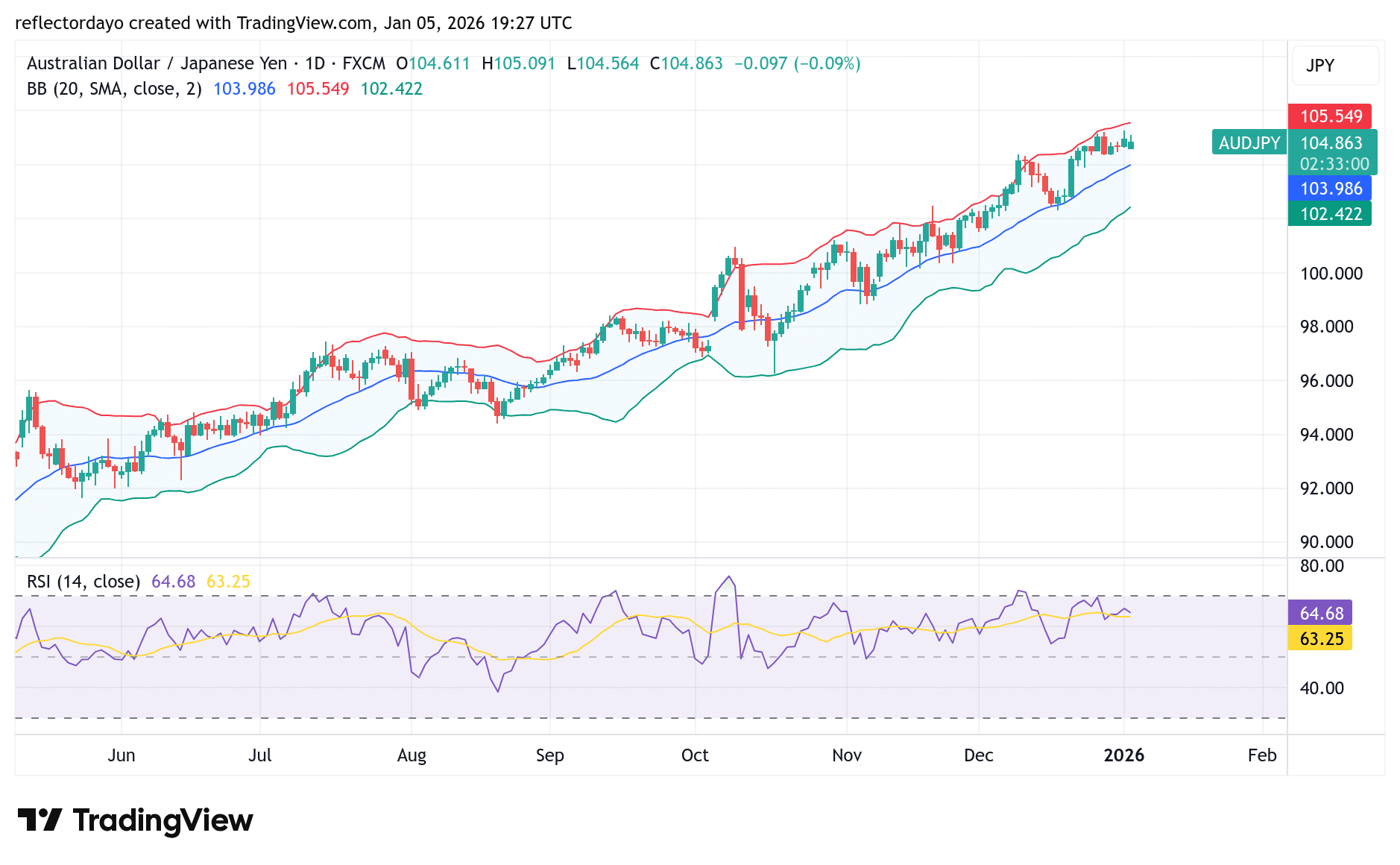

AUD/JPY Key Levels

Supply Levels: 105, 106, 107

Demand Levels: 103, 102, 101

AUD/JPY Sustains Above 104

The AUD/JPY pair continues to be fundamentally supported by a combination of monetary policy divergence and favorable global risk conditions. A key driver remains the wide interest rate differential between Australia and Japan, as the Reserve Bank of Australia maintains a restrictive stance with its policy rate around 4.35%, while the Bank of Japan has only cautiously moved away from its long-standing ultra-loose policy, keeping interest rates near 0.10%. This pronounced yield spread has sustained carry trade flows into the Australian dollar, leaving the Japanese yen structurally weak.

In addition, persistent risk-on sentiment across global markets has favored higher-yielding, risk-sensitive currencies such as the AUD over traditional safe-haven currencies like the JPY. This backdrop has been further reinforced by resilient demand for Australia’s key commodity exports, particularly iron ore, which continues to support the country’s trade balance and underpin confidence in the Australian dollar

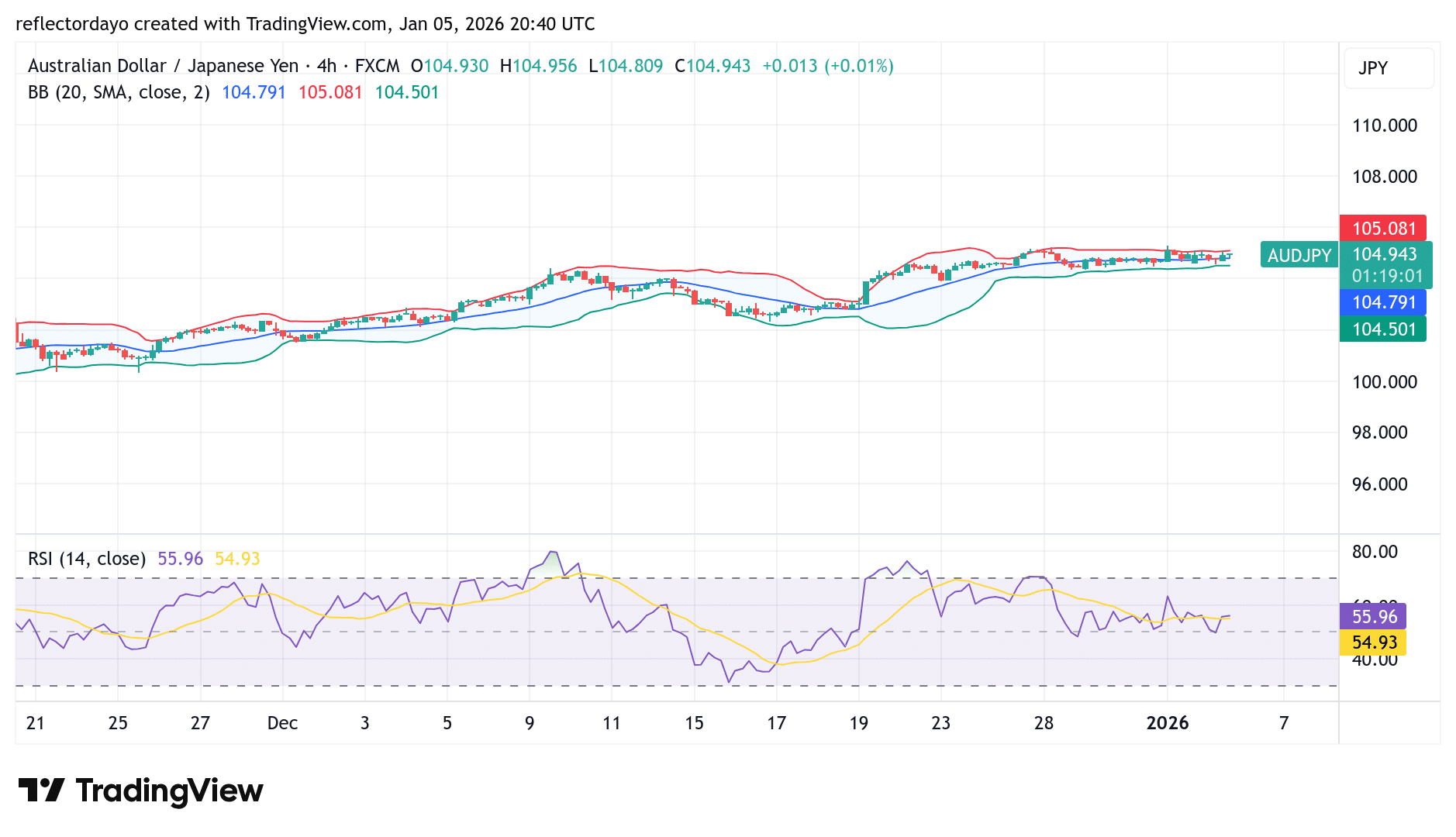

AUD/JPY Short-Term Trend

Currently, AUD/JPY is consolidating above the 104 price level, a phase that has persisted for some time. Given the preceding prolonged upward move, this consolidation may eventually give way to a breakout, with the market potentially targeting the 105 level. The initial breakout above 104 prompted increased trader caution, which helps explain the ongoing range-bound price action. If this consolidation continues, it could serve to strengthen the market structure and prepare the pair for its next significant move.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.