NAS100 Analysis – February 8

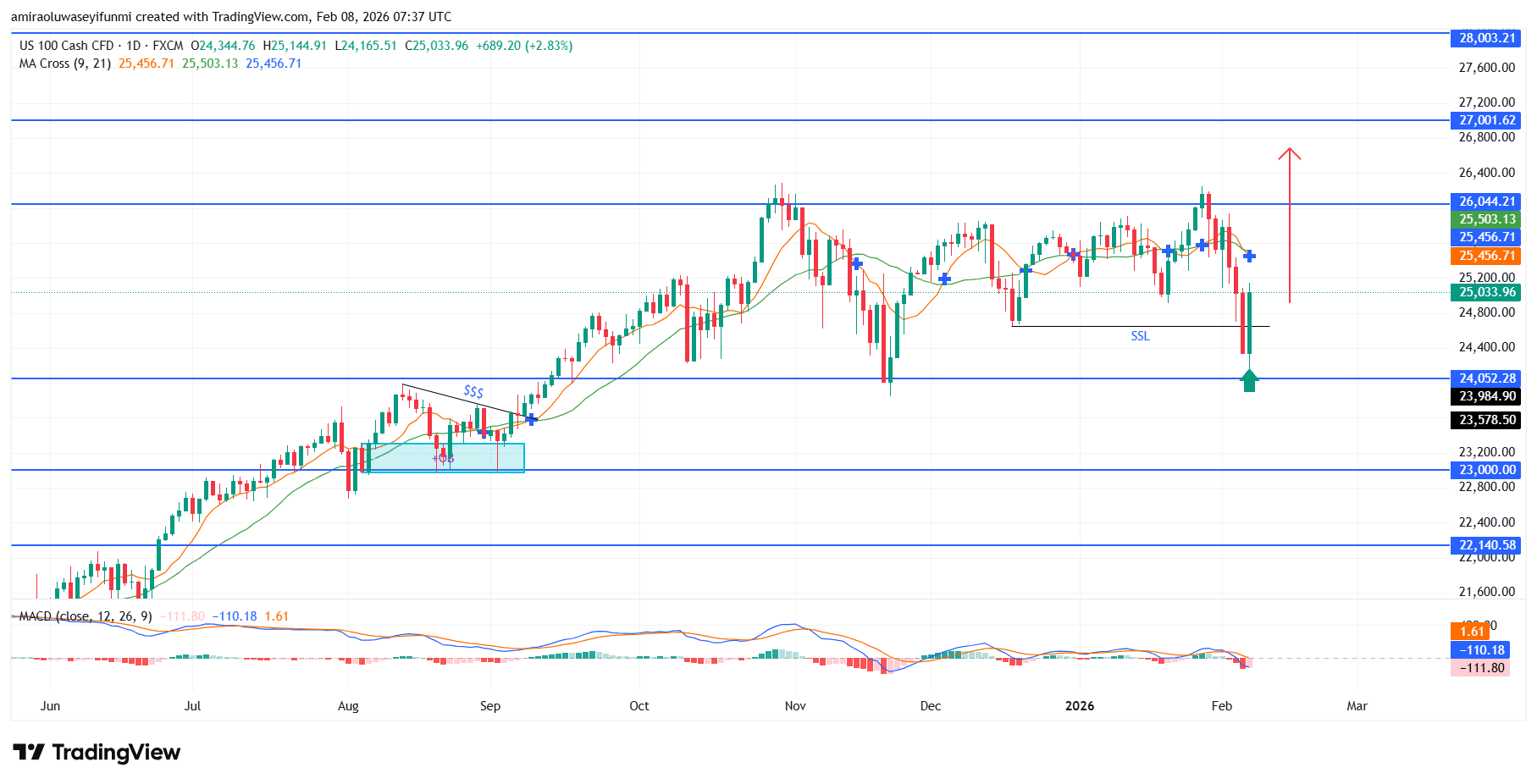

NAS100 reflects measured retracement within an entrenched upward framework. NAS100 remains positioned within a broader ascending environment, with intermediate trend metrics continuing to lean favorably despite recent price volatility. Market pricing is still holding above the upward-sloping long-term moving average band around $25,450–$25,500, indicating that directional control remains biased to the upside. While short-term momentum indicators such as the MACD have softened into mildly negative territory, the lack of aggressive selling pressure suggests momentum cooling rather than structural deterioration, consistent with a pause within a mature bullish cycle.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

From a price-action standpoint, the recent decline has been efficiently absorbed within a clearly defined demand zone around $24,050–$24,100, where sell-side pressure met immediate buying interest. This region aligns with prior structural support, reinforcing its validity as a value re-entry area. The ensuing rebound has guided price back toward the $25,030 region, while overhead supply near $26,040 remains the next significant upside reference. Overall price sequencing continues to reflect a series of rising lows on the daily timeframe, preserving the underlying bullish structure.

Looking ahead, the prevailing setup continues to favor renewed upside rotation as long as the $24,050 base remains intact. A decisive recovery above $25,500 would likely reinvigorate bullish momentum toward $26,040, with extension potential into the $27,000–$27,010 area where higher-timeframe supply may re-emerge. A sustained loss of acceptance above $24,050 would temporarily delay the bullish outlook, but while this level holds, the dominant bias continues to support continuation scenarios often tracked through forex signals.

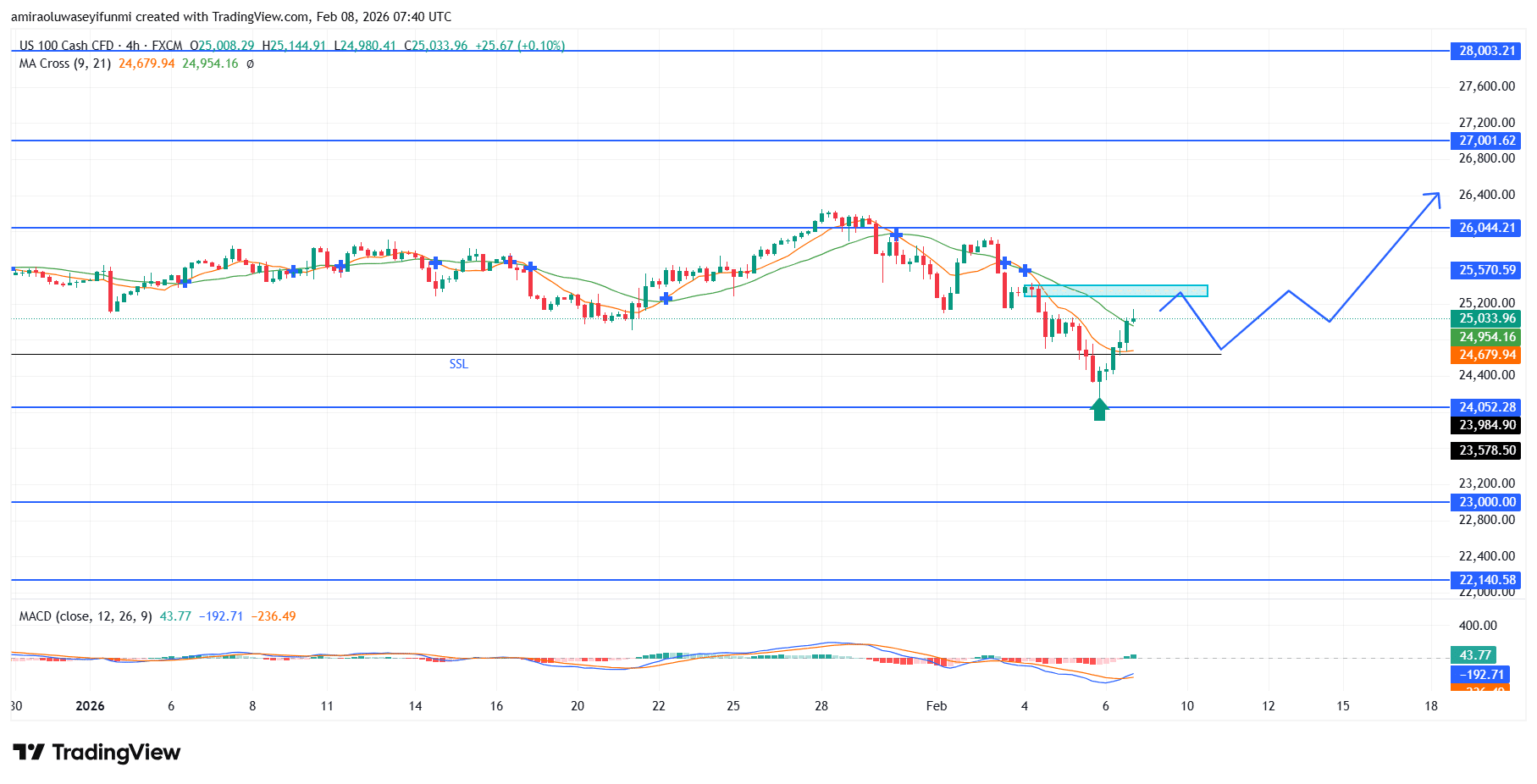

NAS100 Short-Term Trend: Bullish

NAS100 on the four-hour timeframe maintains a bullish bias, supported by a rebound from demand near $24,050 and gradual improvement in short-term momentum. Price has reclaimed the $25,000 level and is stabilizing above the rising fast moving average near $24,950, indicating renewed upside participation.

The formation of a higher low suggests selling pressure has been effectively absorbed, while resistance clustered around $25,550–$25,570 represents the next technical hurdle. A sustained break above this zone would likely open the path toward $26,040 and potentially $27,000 in extension.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.