Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 5

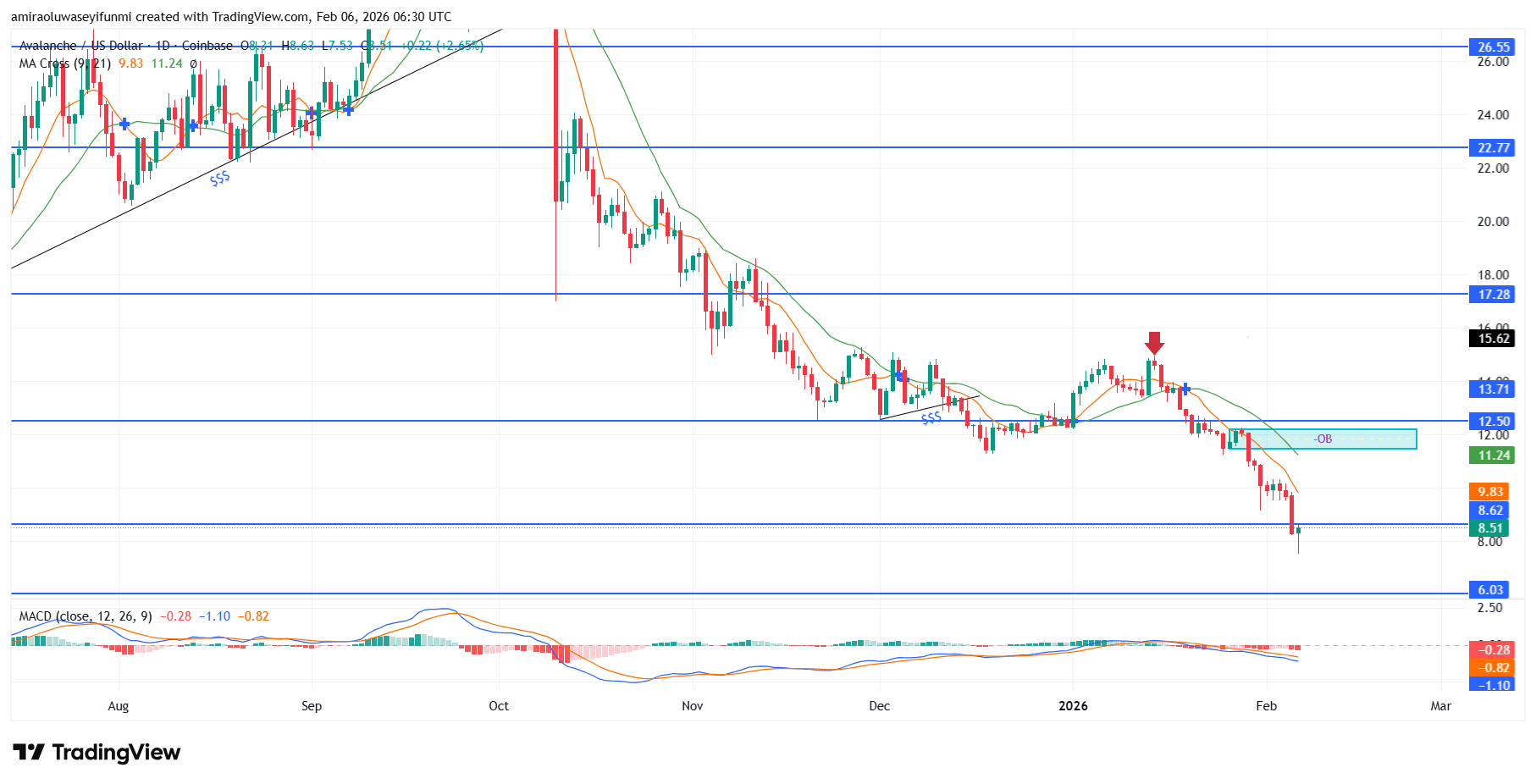

AVAXUSD remains bearish amid sustained distribution and deteriorating momentum. AVAXUSD continues to trade within a firmly established bearish regime, with directional bias consistently aligned across both trend and momentum indicators. Price remains well below the short- and medium-term moving averages, which are negatively stacked and sloping lower, reinforcing trend continuation rather than exhaustion. The MACD remains below the zero line with expanding negative histogram bars, indicating persistent downside momentum and limited recovery potential. This indicator configuration reflects institutional-grade distribution conditions rather than short-term retail-driven volatility.

AVAXUSD Key Levels

Resistance Levels: $12.00, $17.30

Support Levels: $12.50, $8.00, $6.00

AVAXUSD Long-Term Trend: Bearish

AVAXUSD has maintained a descending market structure characterized by consistent lower highs and lower lows since the breakdown from the $22.770 and $17.280 supply zones. Repeated rejection around the $13.710–$12.500 region confirms that former demand has transitioned into active supply, with the highlighted order block near $12.000 failing to attract sustained buying interest. The decisive breach of $8.620, followed by acceleration toward the $8.510 area, highlights bearish efficiency and limited absorption, while upside attempts continue to stall beneath declining dynamic resistance.

Looking ahead, the technical outlook favors further downside continuation unless a structural reclaim above $12.000 materializes. A corrective retracement into the $11.24–$12.000 zone remains possible, but such a move is likely to be corrective and invite renewed sell-side pressure rather than signal a trend reversal. Sustained weakness below $8.500 exposes AVAXUSD to a measured continuation toward the $6.00 liquidity pool, with broader downside scenarios often reflected in prevailing crypto signals unless momentum conditions meaningfully reset.

AVAXUSD Short-Term Trend: Bullish

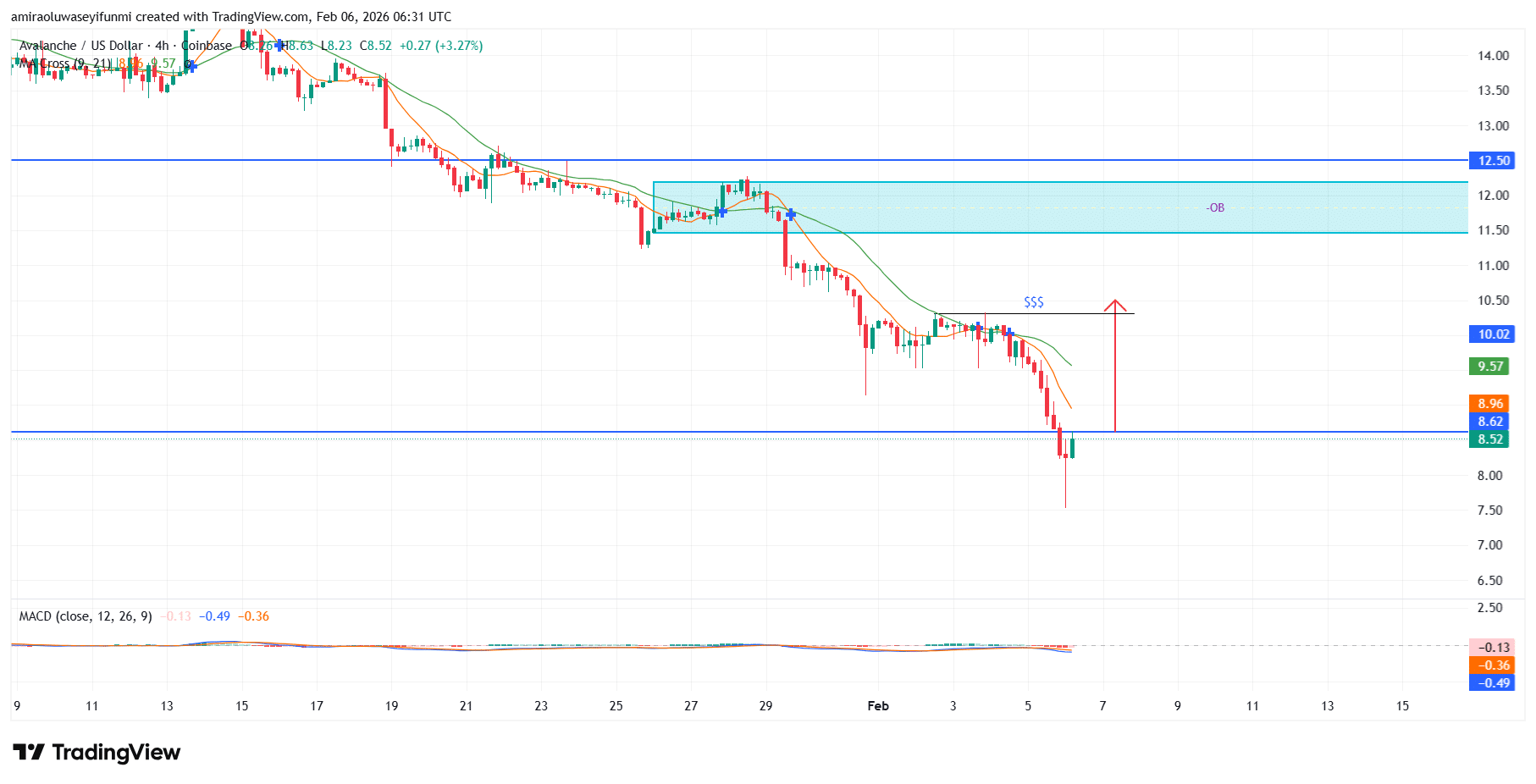

AVAXUSD on the four-hour chart is exhibiting a short-term bullish reaction after firmly defending the $8.510–$8.620 demand zone with a sharp rejection. Price is attempting to reclaim the $8.950 and $9.570 levels, suggesting improving bid strength despite the dominant bearish higher-timeframe structure.

A sustained push above $10.020 would likely allow upside continuation toward the $12.000 supply and order block region. This rebound remains best classified as a corrective bullish phase, with short-term momentum favoring the upside as long as price holds above the $8.500 level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.