Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

TONUSD Analysis – February 4

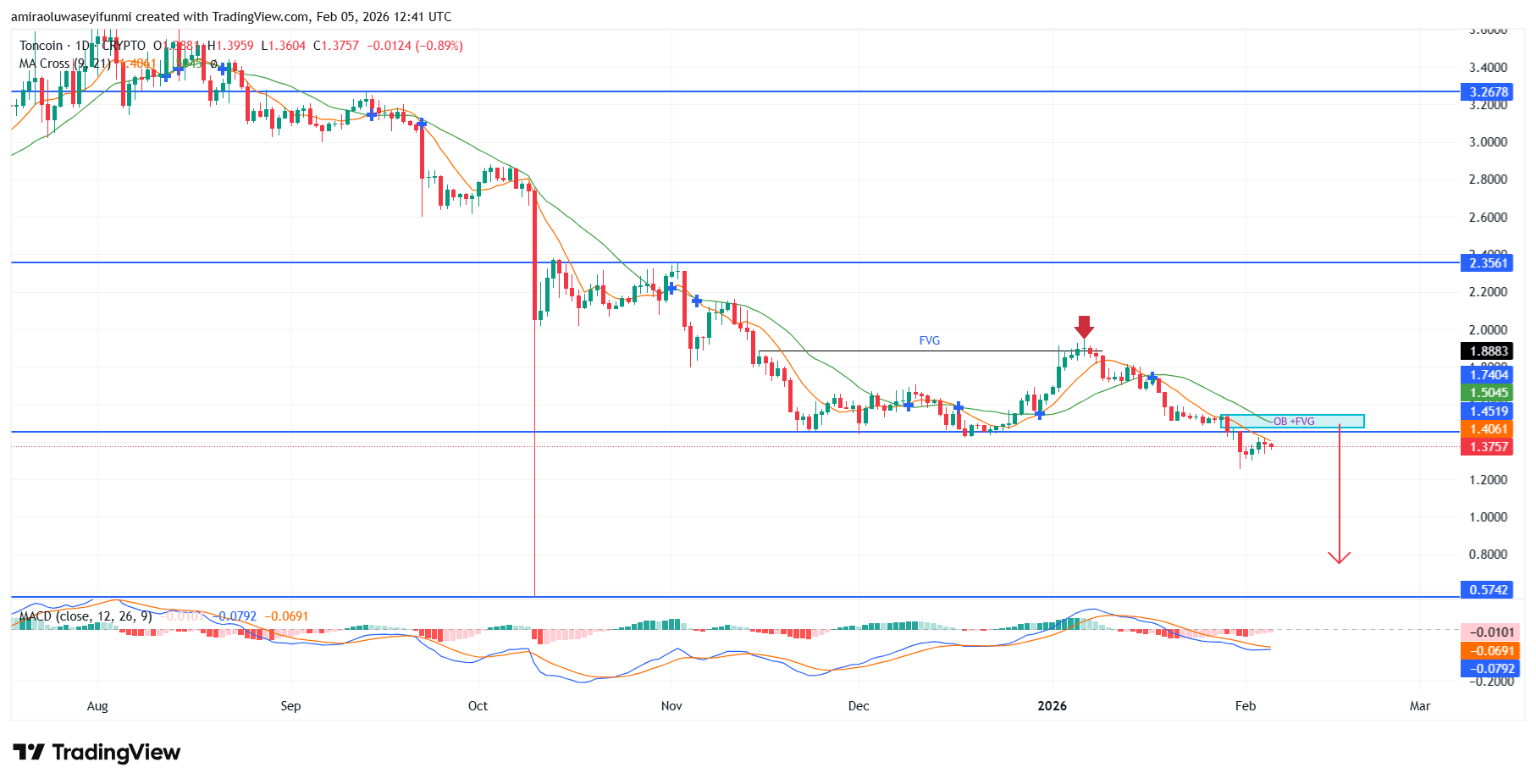

TONUSD falls further as buyers keep exiting the market. With overall market behavior aligned with declining trend and momentum indicators, TONUSD continues to trade within a clearly defined bearish regime. Price remains well below the falling short- and medium-term moving averages, clustered between $1.45 and $1.50, reinforcing sustained downside control. With weakening histogram readings and positioning below the zero line, the MACD reflects persistently negative momentum and very limited signs of bullish re-accumulation.

TONUSD Key Levels

Supply Levels: $2.3560, $3.2680

Demand Levels: $1.4520, $0.5740

TONUSD Long-Term Trend: Bearish

The market has preserved a sequence of lower highs and lower lows following the decisive breakdown from the $2.35 region. Recent recovery attempts have been shallow and corrective, with price repeatedly rejected near the $1.75–$1.90 fair value gap and failing to reclaim former demand zones. The loss of structural support around $1.45 has transformed this level into an active supply area, while current consolidation near $1.40 suggests trend continuation rather than base development.

TONUSD is likely to extend lower as long as price remains capped below $1.50 on a closing basis. A sustained breakdown beneath $1.35 would likely expose $1.20 as an initial downside target, followed by a deeper decline toward the $1.00 psychological level. In a more aggressive selloff scenario, downside liquidity could be targeted near $0.60, aligning with prior structural lows and unmitigated demand inefficiencies.

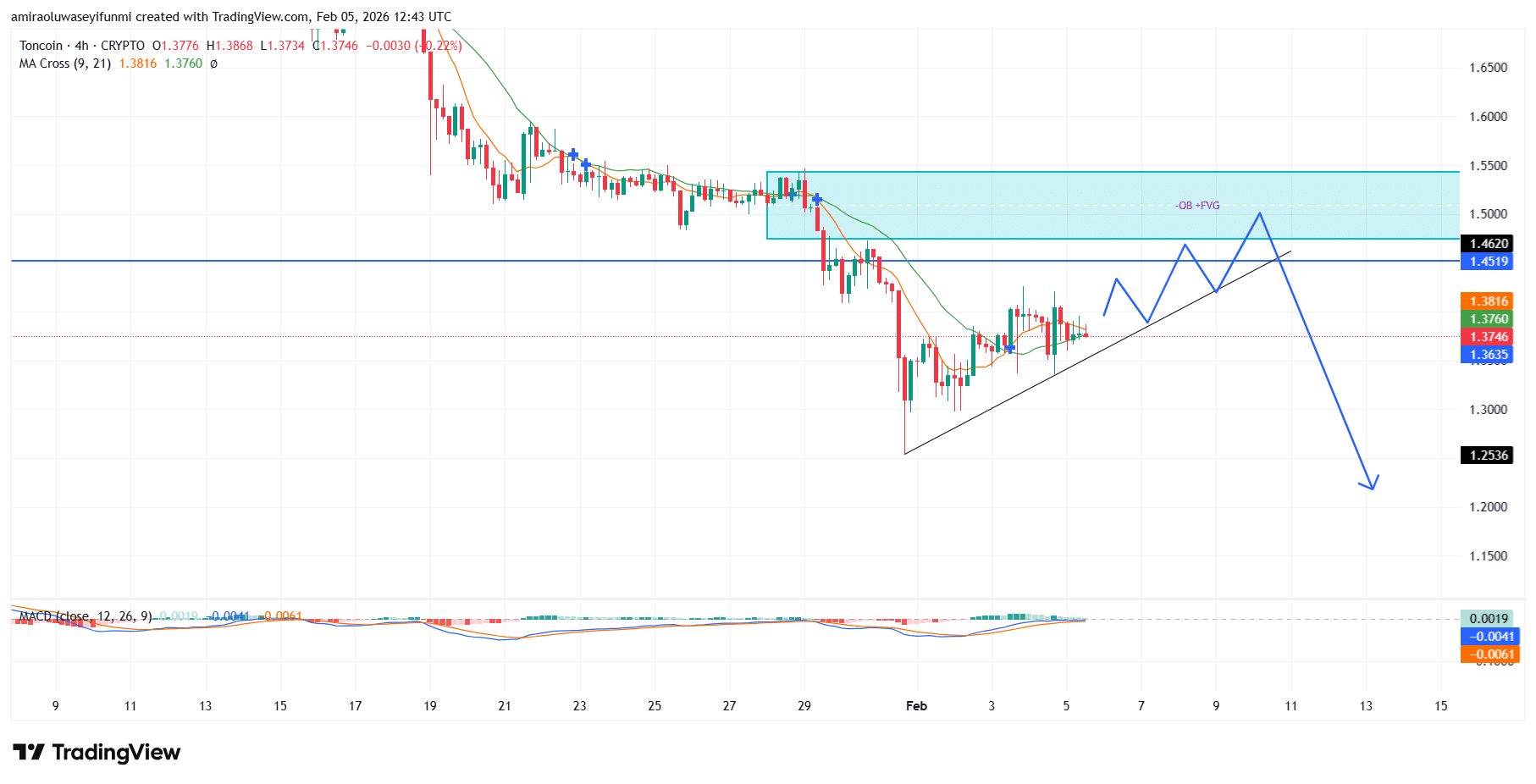

TONUSD Short-Term Trend: Bearish

TONUSD on the four-hour chart remains structurally bearish, with price trading below the declining moving averages around the $1.38–$1.40 region. Recent upside attempts remain corrective in nature and are capped by the supply confluence between $1.45 and $1.55, where prior order flow imbalance remains unresolved.

The rising intraday trendline from recent lows appears corrective within the broader downtrend and remains vulnerable to failure. A breakdown below support near $1.35 would likely trigger downside continuation toward $1.25, with extended risk toward the $1.20 region, a move often anticipated in broader crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.