Market Analysis – February 5

Gold (XAUUSD) stays upward as bullish trend strength persists. XAUUSD continues to trade within a firmly positive market environment, with price consistently anchored above its ascending short- and intermediate-term averages, confirming sustained directional control by buyers. Although momentum has moderated slightly, oscillator behavior remains constructive, with MACD readings holding in positive territory and signaling continuation rather than exhaustion. The broader trend orientation remains upward, supported by the market’s ability to absorb retracements without disrupting its rising trajectory.

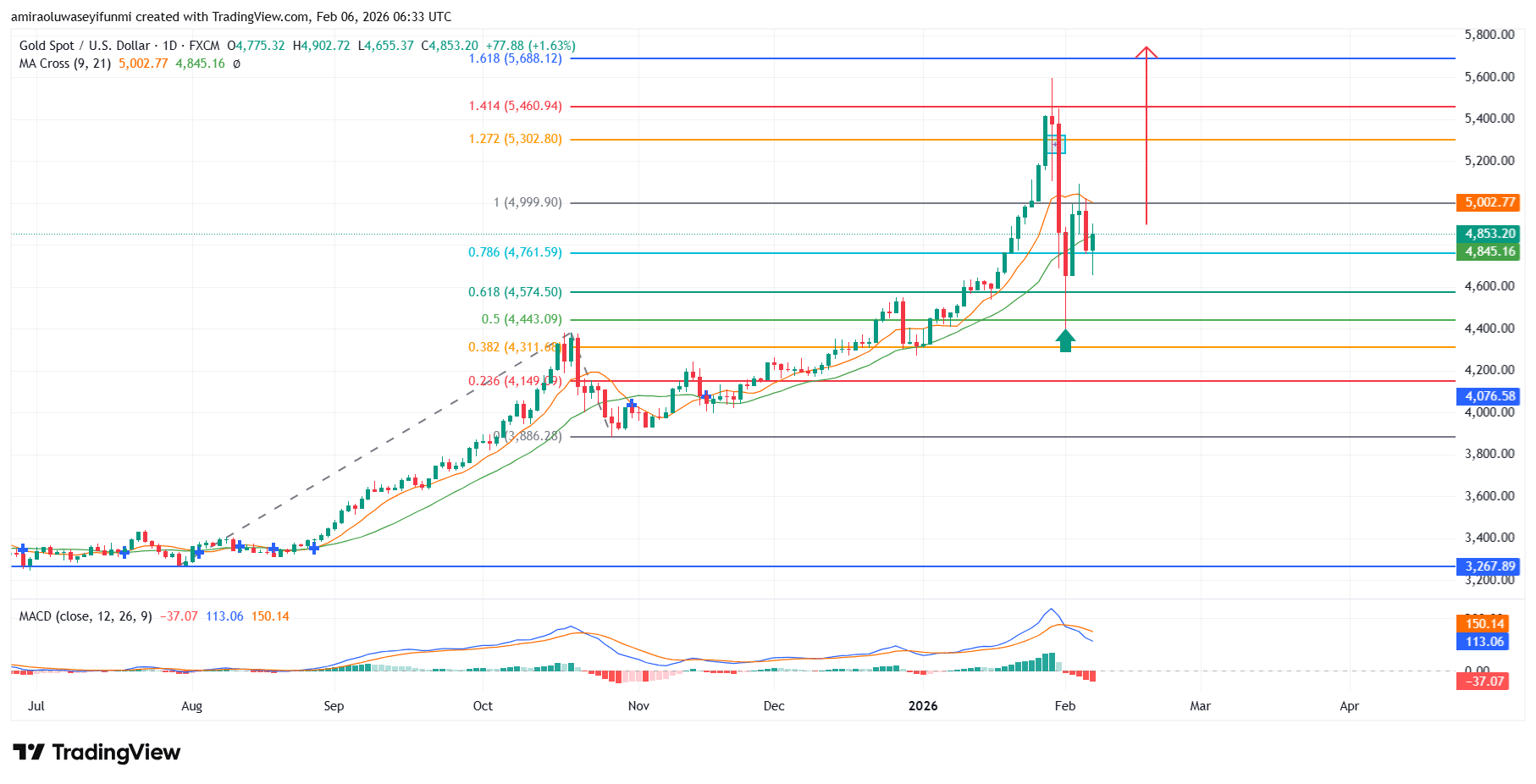

Gold Key Levels

Resistance Levels: $5000, $5300, $5460

Support Levels: $4760, $4570, $4430

Gold Long-Term Trend: Bullish

From a technical standpoint, price has undergone an orderly pullback from the $5,400–$5,500 peak region into the $4,760–$4,850 demand zone, an area aligned with key proportional retracement levels. This zone has functioned as an effective stabilization area, with prior breakout structure near $4,800 attracting renewed buying interest. The preservation of successive higher troughs above $4,750 confirms structural integrity and characterizes the decline as a controlled correction rather than a breakdown in trend.

Looking ahead, price dynamics favor renewed upside as long as value is defended above $4,800, with initial upside scope toward the $5,300 region. A decisive push through $5,400 would likely open the door for further appreciation toward the $5,600–$5,700 range in subsequent sessions. Risk remains skewed to the upside while $4,600 holds as a structural floor, keeping the broader advance intact and recent highs well within reach.

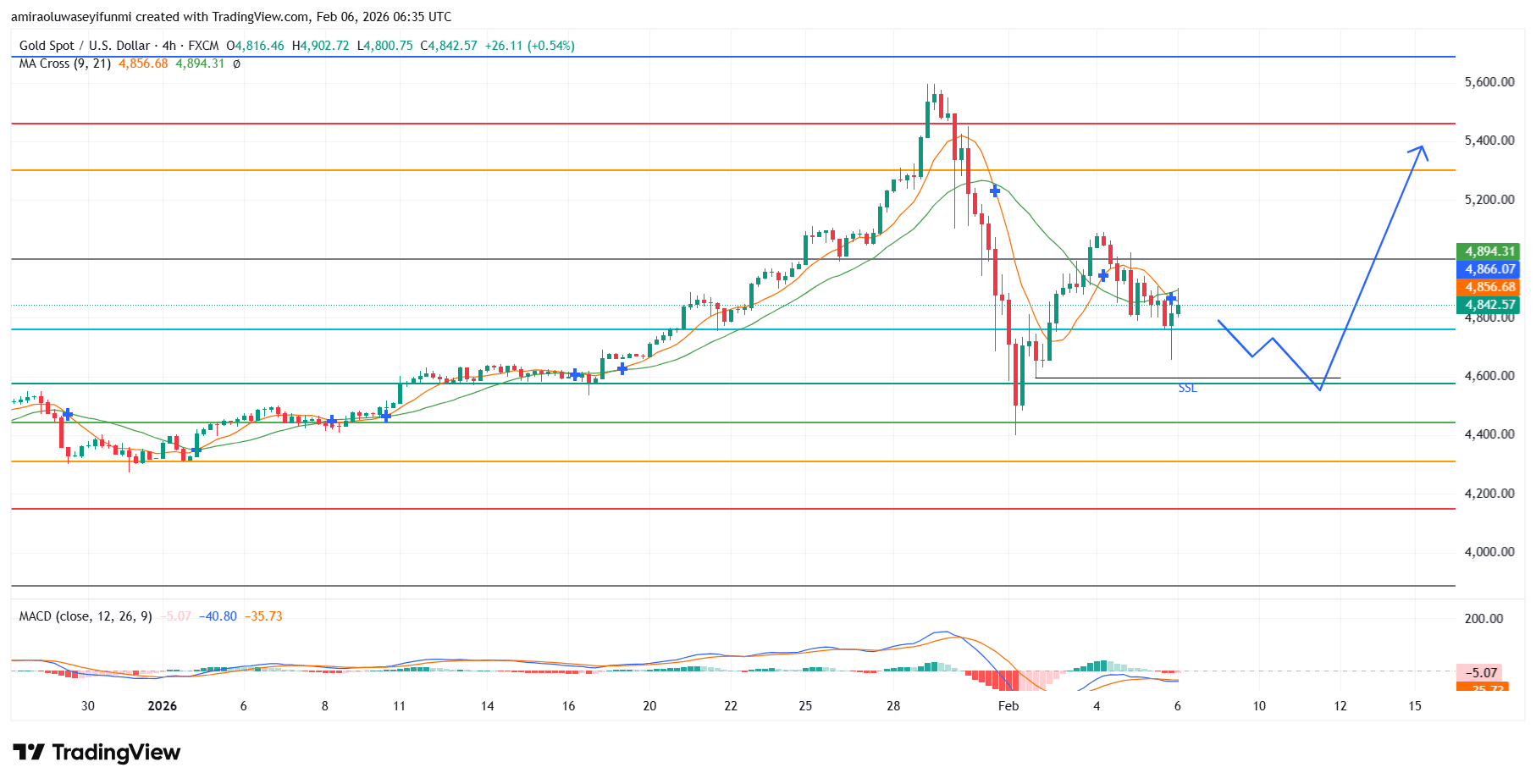

Gold Short-Term Trend: Bullish

Gold (XAUUSD) on the four-hour chart maintains a bullish corrective structure, with price holding above the $4,600–$4,650 support band following a sharp liquidity sweep. The market is consolidating near $4,850, suggesting absorption of recent sell pressure rather than trend deterioration.

A sustained reclaim above $4,900 would likely trigger upside continuation toward the $5,300–$5,400 resistance zone, keeping the technical outlook aligned with prevailing forex signals as long as price remains supported above $4,600.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.