FTSE 100 Analysis – February 4

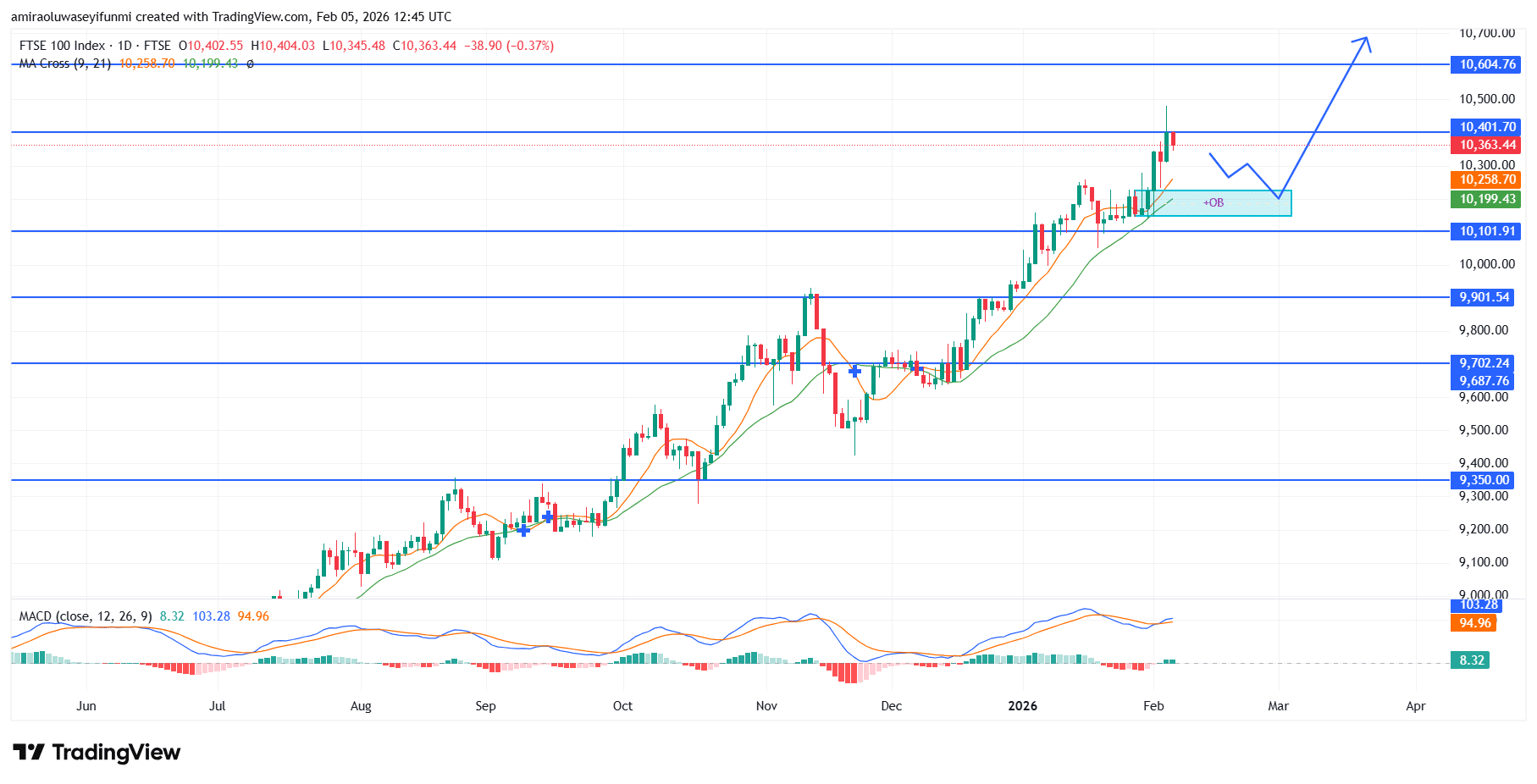

FTSE 100 maintains bullish structure with strong uptrend bias. The FTSE 100 continues to operate within an upward-leaning environment where price behavior and indicator positioning remain mutually reinforcing. Trading activity is holding above the ascending dynamic benchmarks around $10,200–$10,260, signaling that demand continues to dictate market tempo rather than reacting defensively to supply. Momentum conditions remain constructive, with the MACD sustaining positive displacement, indicating active participation rather than signs of fatigue.

FTSE 100 Key Levels

Supply Levels: $10,400, $10,600, $10700

Demand Levels: $10100, $9700, $9350

FTSE100 Long-Term Trend: Bullish

The index has advanced through successive price expansions since clearing the $9,900 threshold, establishing a durable higher-value framework. The recent pause above $10,100 reflects orderly consolidation of gains rather than distributional pressure, while pullbacks into the $10,200–$10,250 demand pocket have consistently attracted responsive buying. Sustained trade above $10,300 further reinforces the market’s capacity to defend newly established value zones.

From a forward-looking standpoint, the FTSE 100 appears well positioned to explore higher price territory provided $10,100 continues to serve as a structural floor. Acceptance above $10,400 would likely encourage continuation toward $10,600, with scope for further extension into the $10,700–$10,800 region if momentum persists. Any retracements toward the $10,200–$10,300 band are likely to be viewed as rotational pauses within an advancing market environment rather than trend deterioration.

FTSE100 Short-Term Trend: Bullish

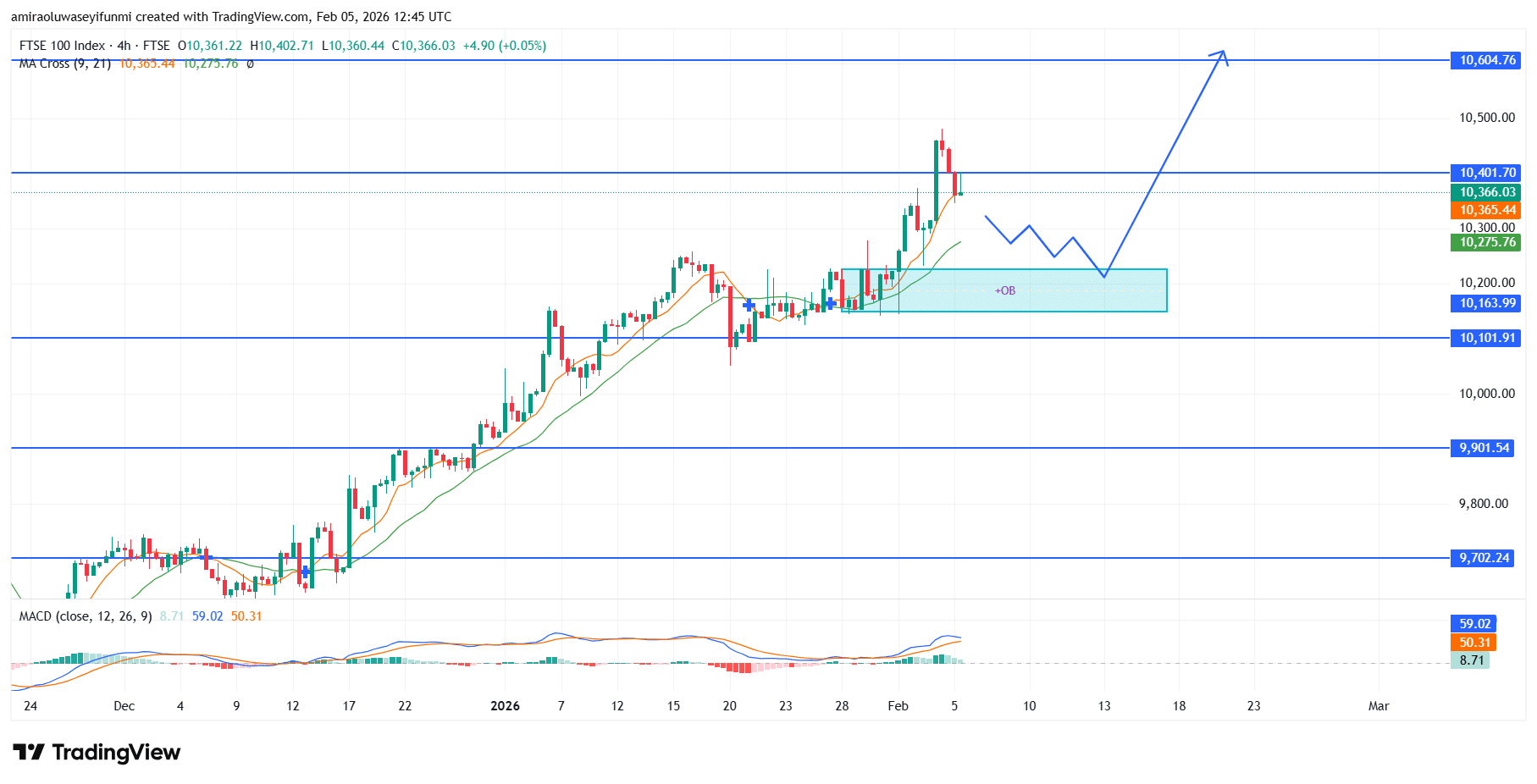

On the four-hour chart, the FTSE 100 maintains a bullish structure, with price holding above the rising moving averages around $10,280–$10,360. Momentum remains constructive as the MACD continues to trade in positive territory, reflecting sustained upside participation rather than exhaustion.

The recent pullback from $10,400 appears corrective and is being absorbed above the $10,200 order block, preserving the higher-low sequence. As long as price remains supported above $10,100, the technical outlook favors continued upside toward $10,600, in alignment with prevailing forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.