FTSE 100 Analysis – January 28

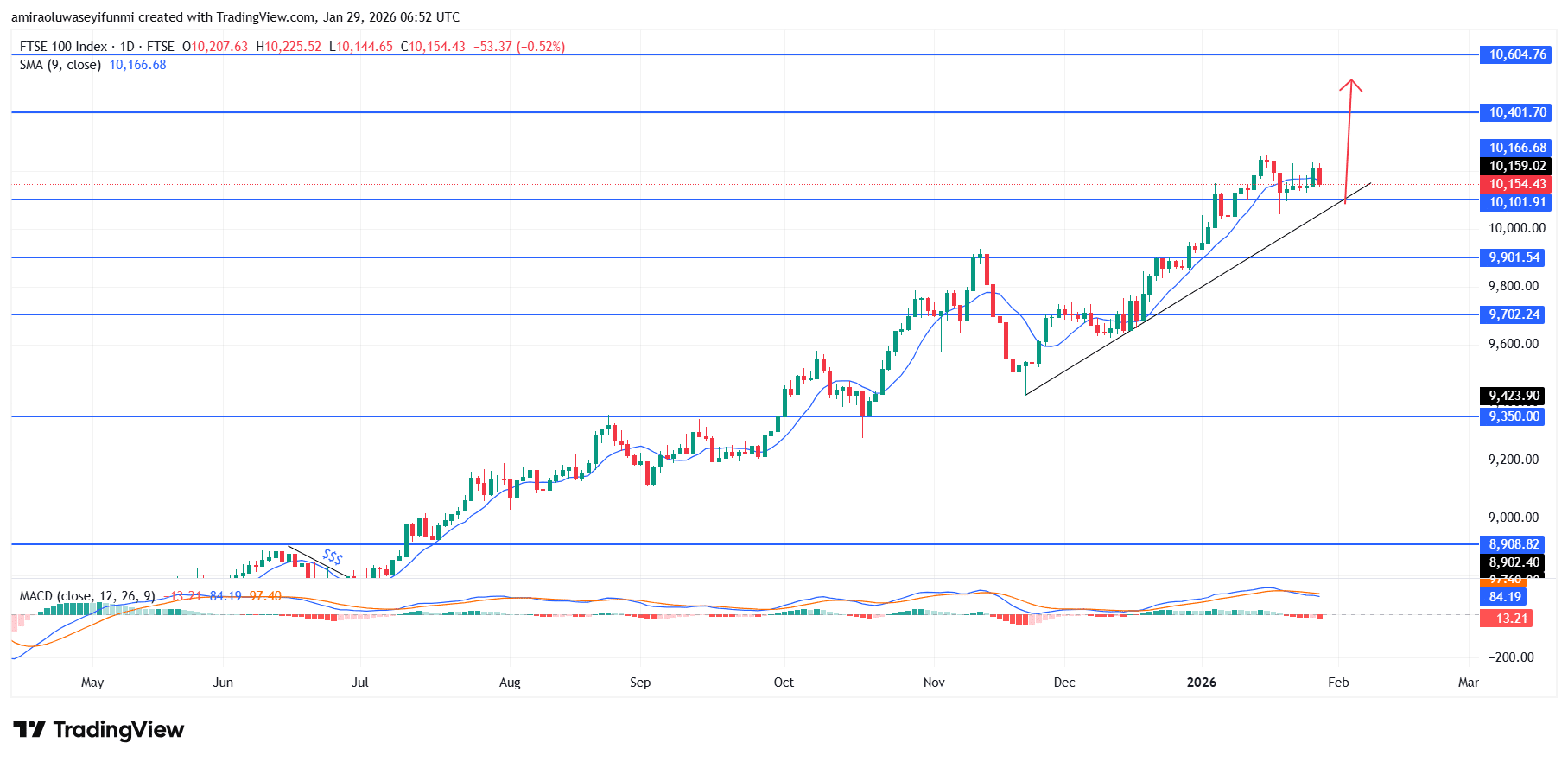

The FTSE 100 market maintains a bullish structure with a strong uptrend bias. The FTSE 100 continues to display a constructive upward trajectory, with trend-following indicators broadly aligned in support of further gains. Price remains comfortably above the short-term moving average around $10,170, reinforcing positive momentum conditions despite mild near-term consolidation. The broader indicator configuration suggests that bullish participation remains intact, as momentum has moderated without shifting into outright bearish territory, a characteristic commonly associated with healthy trends rather than reversals.

FTSE 100 Key Levels

Supply Levels: $10100, $10,400, $10,600

Demand Levels: $9900, $9700, $9350

FTSE100 Long-Term Trend: Bullish

From a price-action perspective, the index continues to respect an ascending support structure, with higher lows developing from the $9,700 region through to approximately $10,100. Recent candles show compression above former resistance near $10,150, signaling acceptance above this level rather than rejection. Pullbacks toward trend support have remained orderly and shallow, reflecting sustained demand and a lack of aggressive distribution even as price engages upper resistance zones.

Looking ahead, continuation of this structure favors an upside resolution, with a measured advance toward the $10,400 region as the initial objective. A decisive daily close above this level would likely open scope for extension toward $10,600, aligning with the broader trend channel. Downside risk remains contained above $10,000, and unless price breaks below this threshold with momentum, the prevailing outlook continues to support trend continuation rather than exhaustion.

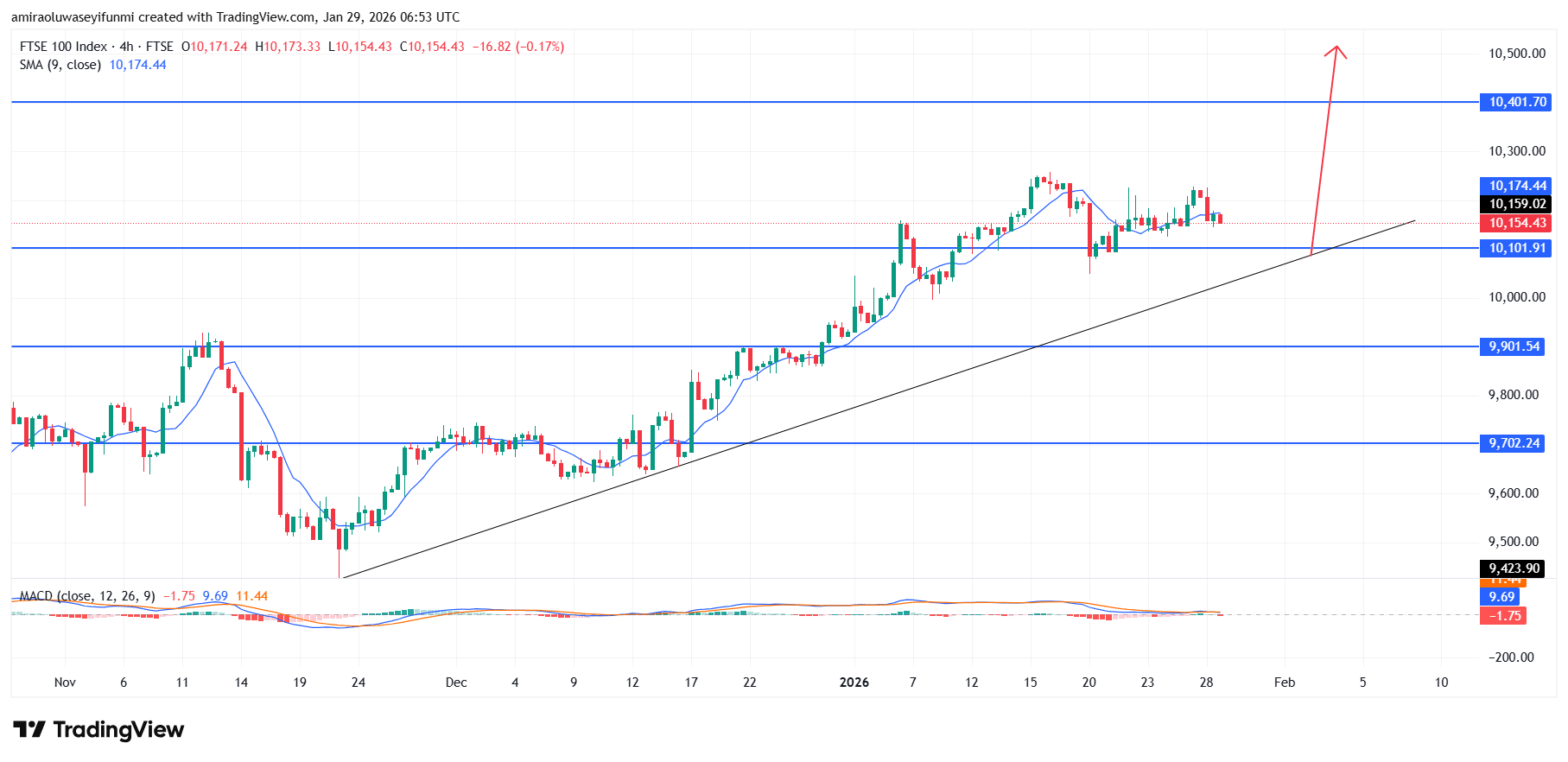

FTSE100 Short-Term Trend: Bullish

On the four-hour chart, the FTSE 100 maintains a bullish bias, with price holding above the rising trendline and stabilizing around the $10,150 area. The index continues to respect higher-low formations, while the short-term moving average near $10,170 functions as dynamic support rather than resistance. Consolidation above the $10,100 zone points to accumulation instead of weakness, indicating that buyers remain in control of the market structure, a setup that aligns with broader expectations often reflected in forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.