Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 13

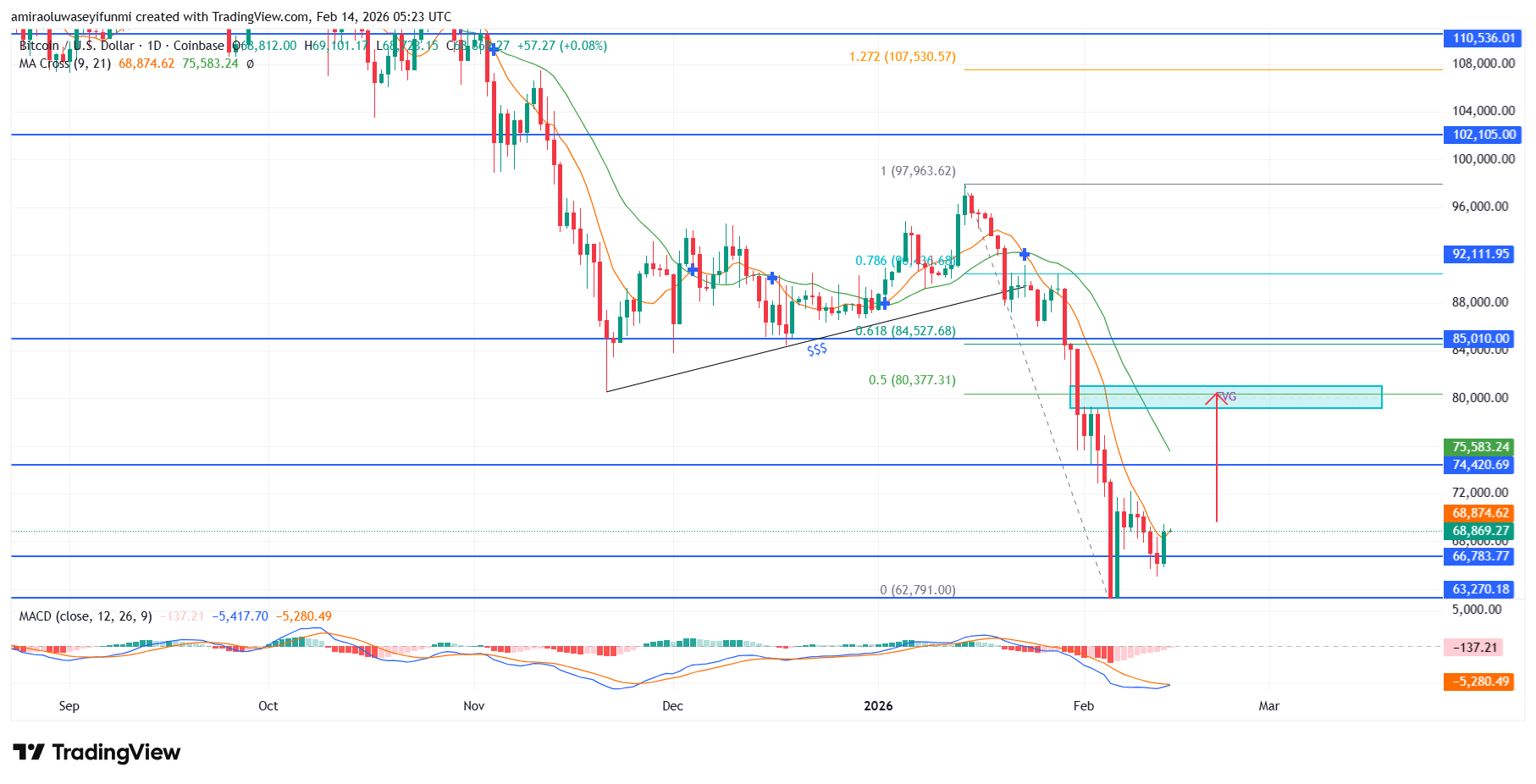

BTCUSD is realigning toward intermediate upside expansion. BTCUSD appears to be transitioning from an extended corrective sequence into an emerging intermediate recovery structure. After the climactic selloff to roughly $63,270, momentum oscillators are beginning to flatten, with MACD downside velocity easing as price attempts to re-establish acceptance above the short-term averages near $68,880 and $75,580. Although the higher-timeframe profile still reflects distribution from the $97,960 peak, the evolving base formation suggests waning supply pressure and the early stages of re-accumulation.

BTCUSD Key Levels

Supply Levels: $80,000, $85,010

Demand Levels: $66,780, $63,260

BTCUSD Long-Term Trend: Bullish

The market engineered a decisive stop run beneath $66,780 before delivering a forceful rejection and vertical snapback. The move back into the $68,880 to $70,000 corridor signals tentative demand sponsorship, while the $74,420 to $75,580 band marks the first substantive overhead supply aligned with the prior breakdown pivot. Maintaining value above $66,780 increases the probability that $63,270 represents a provisional swing floor. Current price compression just under $75,580 reflects volatility contraction typically preceding directional expansion.

Looking ahead, a confirmed breakout through $75,580 would likely catalyze upside continuation toward the $80,380 liquidity concentration, with scope to probe $85,010 where the previous balance deteriorated. A sustained bid above $85,010 would materially validate the intermediate bullish framework and position price for rotation toward $92,110. Alternatively, losing $66,780 would weaken the constructive narrative and reopen downside risk toward $63,270, though prevailing flow dynamics presently favor incremental upside progression.

BTCUSD Short-Term Trend: Bullish

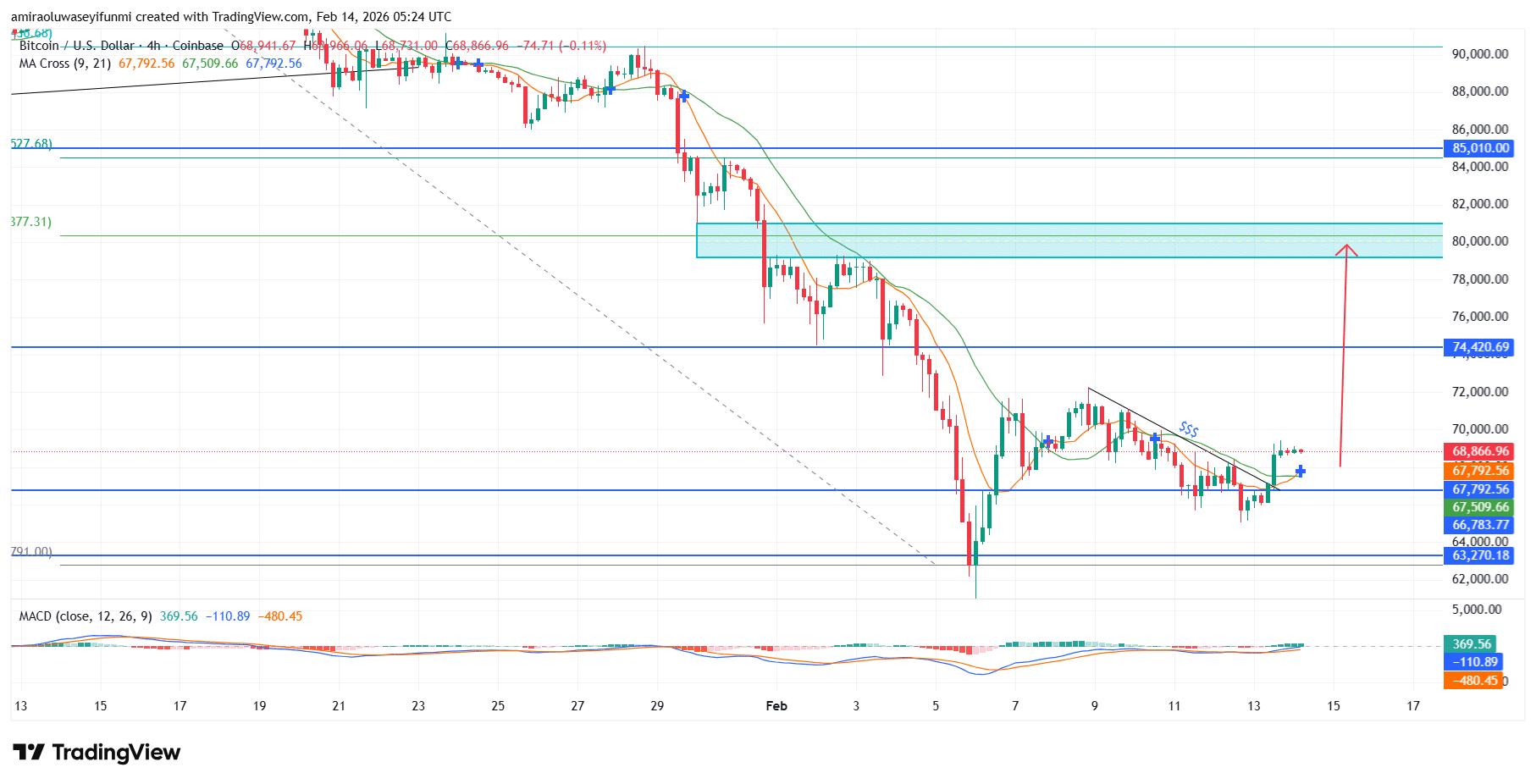

BTCUSD on the four-hour chart is exhibiting early-stage bullish reversal characteristics following its rebound from approximately $63,270, with price now stabilizing above the $66,780 support band. Short-term moving averages are curling higher around $67,510 to $67,790, indicating improving upside momentum as MACD transitions into positive territory.

The market is compressing beneath the $68,870 pivot, and a sustained break above this level would likely accelerate buying pressure toward $74,420. Clearance of $74,420 would expose the $80,380 supply zone as the next upside objective, reinforcing the near-term bullish bias and aligning with expectations often derived from crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.