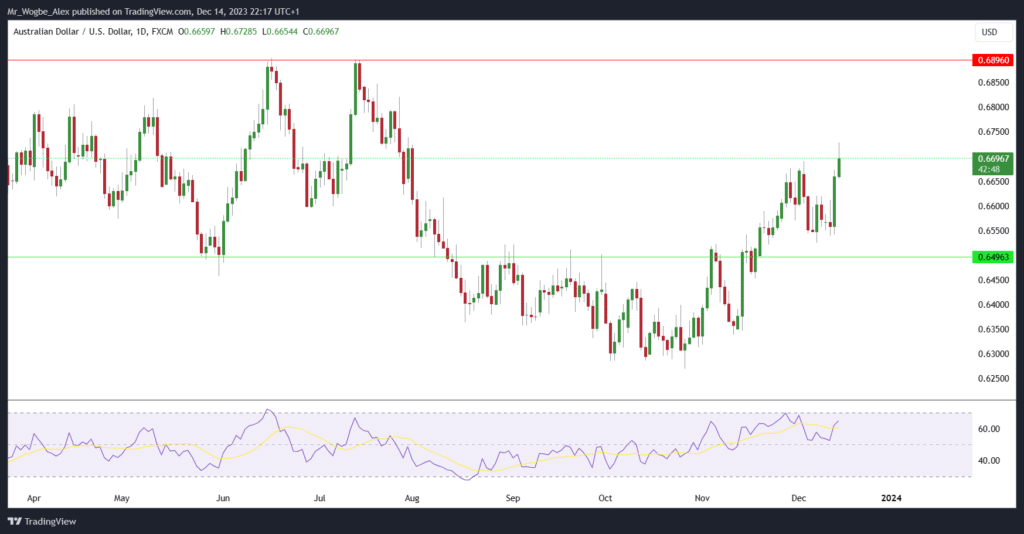

The Australian dollar (AUD) catapulted to a three-month high against the US dollar on Thursday, reaching $0.6728 after a 1% rise. This surge was ignited by the Federal Reserve’s decision to maintain unchanged interest rates and convey a more cautious stance on future rate hikes.

The market, although expecting the decision, was taken aback by the dovish tone struck by Fed Chair Jerome Powell. Powell acknowledged the risks posed by slowing global growth and inflation, signaling a potential strategy shift.

The Fed’s move is seen as an effort to avert a harsh economic downturn in the US while grappling with mounting inflationary pressures and disruptions in the supply chain. The timing and extent of future rate adjustments become pivotal, as a swift rebound in inflation could undermine the Fed’s endeavors to temper the economy.

Interestingly, this decision has set off a chain reaction, prompting expectations that the Reserve Bank of Australia (RBA) may slash rates by 50 basis points in 2024.

The AUD’s upward trajectory found additional support from favorable domestic data, revealing the resilience of the Australian labor market despite a yearly high in the unemployment rate. Positive US retail sales data, surpassing expectations, contributed to the AUD’s strength by signaling robust consumer spending amid tight monetary policies.

Looking ahead, the impact of the Fed’s policy shift will likely dominate market sentiment, overshadowing the upcoming Australian and US PMI and industrial production data. The ripple effect on central banks globally underscores the significance of the Fed’s cautious approach.

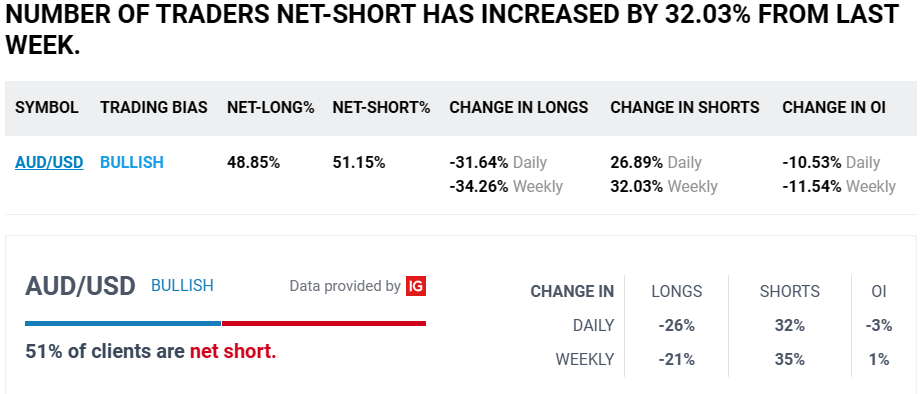

Australian Dollar Traders Are Net Short

In a snapshot of retail trader sentiment from DailyFX, 48.85% are net-long on the Australian dollar vs. the US dollar, with a short-to-long ratio of 1.05 to 1. Notably, traders have shifted their positions, turning net-short for the first time since December 4, 2023, indicating a bullish contrarian trading bias for AUD/USD amidst changing market dynamics.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.