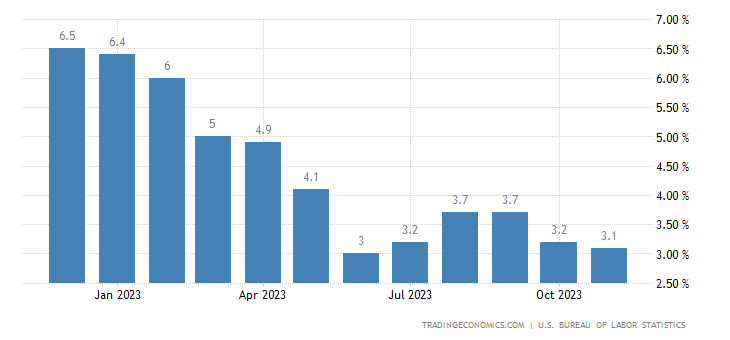

In a rollercoaster ride, the U.S. dollar faced turbulence on Tuesday following the publication of November’s consumer price inflation data. The U.S. Bureau of Labor Statistics reported a headline inflation rate of 3.1% year-on-year, marking a five-month low. Meanwhile, the core inflation rate held steady at 4%, aligning with market expectations.

Despite the annual dip, monthly figures revealed a 0.1% uptick in the inflation rate, slightly surpassing forecasts for no change. Core inflation also surprised, rising by 0.3%, beating the estimated 0.2%. This mixed bag of data suggested lingering inflation pressures, with a hint that the peak might be in the rearview mirror.

Dollar Losing Its Grip; Returns to 145 Against the Yen

The dollar index, measuring the greenback against major currencies, experienced a momentary dip to 103.487 post-data, only to rebound to 103.871, marking a 0.21% decline for the day.

Against the Japanese yen, the greenback fell to the 145.00 mark following the data release today, ending a two-day streak of aggressive bullish resurgence.

All eyes are now on the Federal Reserve’s impending monetary policy meeting tomorrow. Anticipation swirls around an expected announcement of tapering in the bond-buying program and insights into the interest rate outlook. Market speculation is rife, with futures contracts hinting at potential rate hikes in 2024, while some foresee a rate cut as early as March 2024.

Investors eagerly await Chair Jerome Powell’s remarks, recognizing their potential to shape the currency landscape. The Fed’s decision could challenge prevailing views, leaning towards a more hawkish stance amid persistent inflation risks and a robust economic recovery.

As the curtain rises on the Federal Reserve’s stage, the dollar’s fate hangs in the balance. Market participants brace for impact, knowing that Powell’s words could echo through the currency markets, setting the tone for the opening act in 2024.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.