In a surprising turn of events, the Japanese yen has experienced a remarkable surge, hitting its highest level against the US dollar in months. The Bank of Japan (BOJ) has hinted at a potential shift away from its long-standing negative interest rate policy, triggering a wave of investor interest in the yen.

On Thursday, the yen skyrocketed by an astounding 3.5%, reaching approximately 142.5 per dollar. BOJ Governor Kazuo Ueda’s announcement that policy management would face increasing challenges in the coming year, coupled with discussions from Deputy Ryozo Himino about the potential impact of exiting ultra-loose monetary policies, ignited a frenzy among yen buyers.

Yen Flexes Muscle Across Board

This sudden surge is not limited to the dollar alone; the yen strengthened against other major currencies as well. Against the pound, it rose by 2.6%, marking the most significant increase in a year. Additionally, it marked its ninth consecutive gain against the euro, with a substantial 2.5% rise—the longest winning streak since 2017.

Analysts anticipate further strengthening of the yen in 2024 as the BOJ contemplates moving away from its negative interest rate policy, a stance held since 2016. The Commonwealth Bank of Australia predicts the dollar/yen to fall below 140 next year, while ING forecasts a decrease to 130 by the end of 2024, according to Reuters.

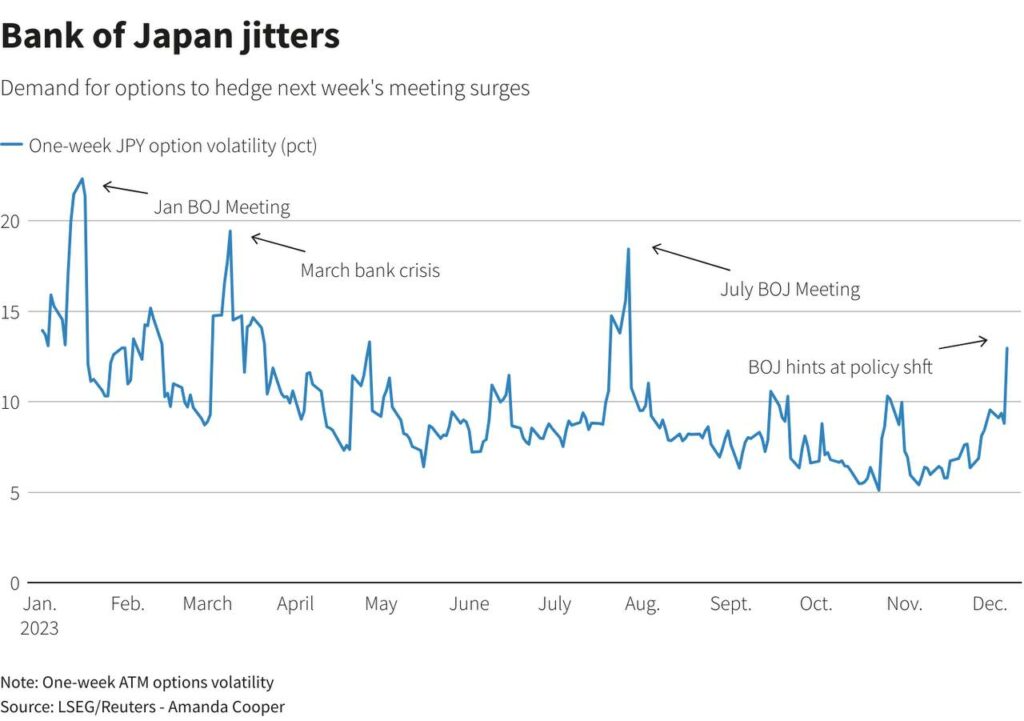

All eyes are now on the BOJ’s upcoming meeting on December 18–19, where more clues about its future plans are expected. Governor Ueda affirmed that various options for the interest rate target were under consideration, emphasizing that no final decision had been reached.

As the yen experiences this unprecedented rally, global markets are closely watching the potential repercussions of Japan’s policy shift, adding a new layer of complexity to the dynamics of international currency markets.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.