The Australian dollar (AUD) finds itself grappling with a myriad of challenges as it strives to stave off further depreciation against the US dollar (USD). Meanwhile, the USD is caught in a delicate balancing act, navigating mixed signals emanating from the global economic landscape and the Federal Reserve’s policy decisions.

Last week, the US stock market experienced a surge in response to lackluster economic data, with investors hoping for a postponement of the Federal Reserve’s plans to taper its stimulus program. However, this optimism could prove fleeting, given the Fed’s consistent messaging that its course of action hinges on incoming data and the evolving economic scenario.

On the home front, the AUD’s struggles are exacerbated by a deteriorating domestic economic outlook. Recent data reveals a stark decline in building approvals for August, signifying a notable slowdown in the housing sector. Furthermore, despite the mounting cost of living pressures on many Australians, the inflation rate remained subdued throughout September.

The Reserve Bank of Australia (RBA) is expected to maintain its current interest rate at the historically low 0.1% this Tuesday, as previously indicated. Incoming RBA governor Michelle Bullock, slated to take the reins from Philip Lowe in February 2023, has underscored the RBA’s commitment to flexibility and adaptability in response to changing economic conditions.

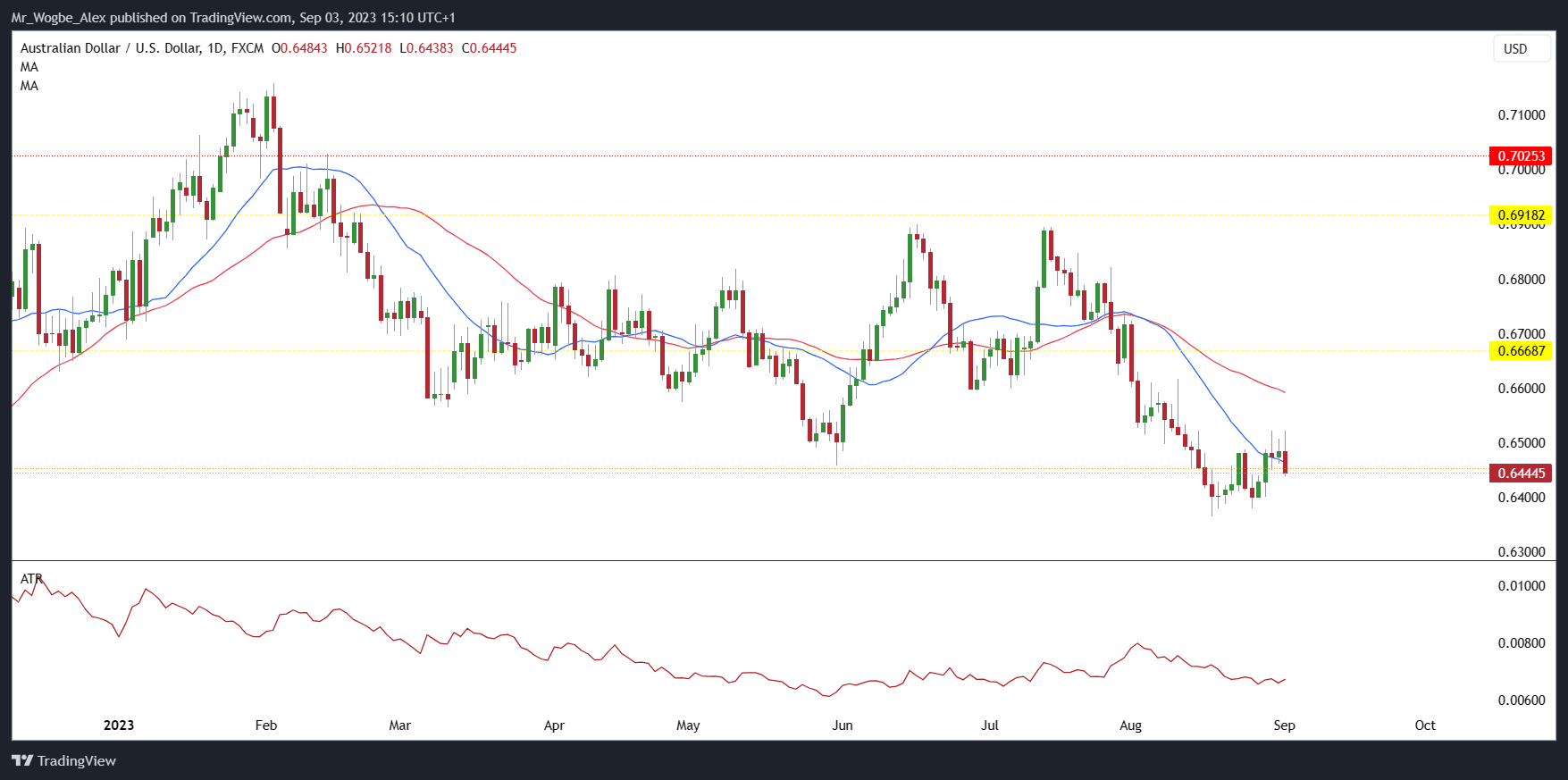

Australian Dollar Falls By 4% in August

Presently, the AUD/USD exchange rate hovers around 0.6444, marking a decrease of more than 4% from its August opening and peak of 0.6723. Nonetheless, the currency pair’s future path remains uncertain, with increased volatility anticipated in the ensuing weeks as market participants eagerly await further guidance from central banks and monitor the evolving global risk landscape.

In this environment of economic flux and policy ambiguity, the Australian dollar faces an uphill battle. Navigating these tumultuous waters requires a careful calibration of economic indicators and central bank communications, both domestically and abroad. As the world watches and waits, the AUD must remain resilient in the face of ongoing challenges and uncertainty on the horizon.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.