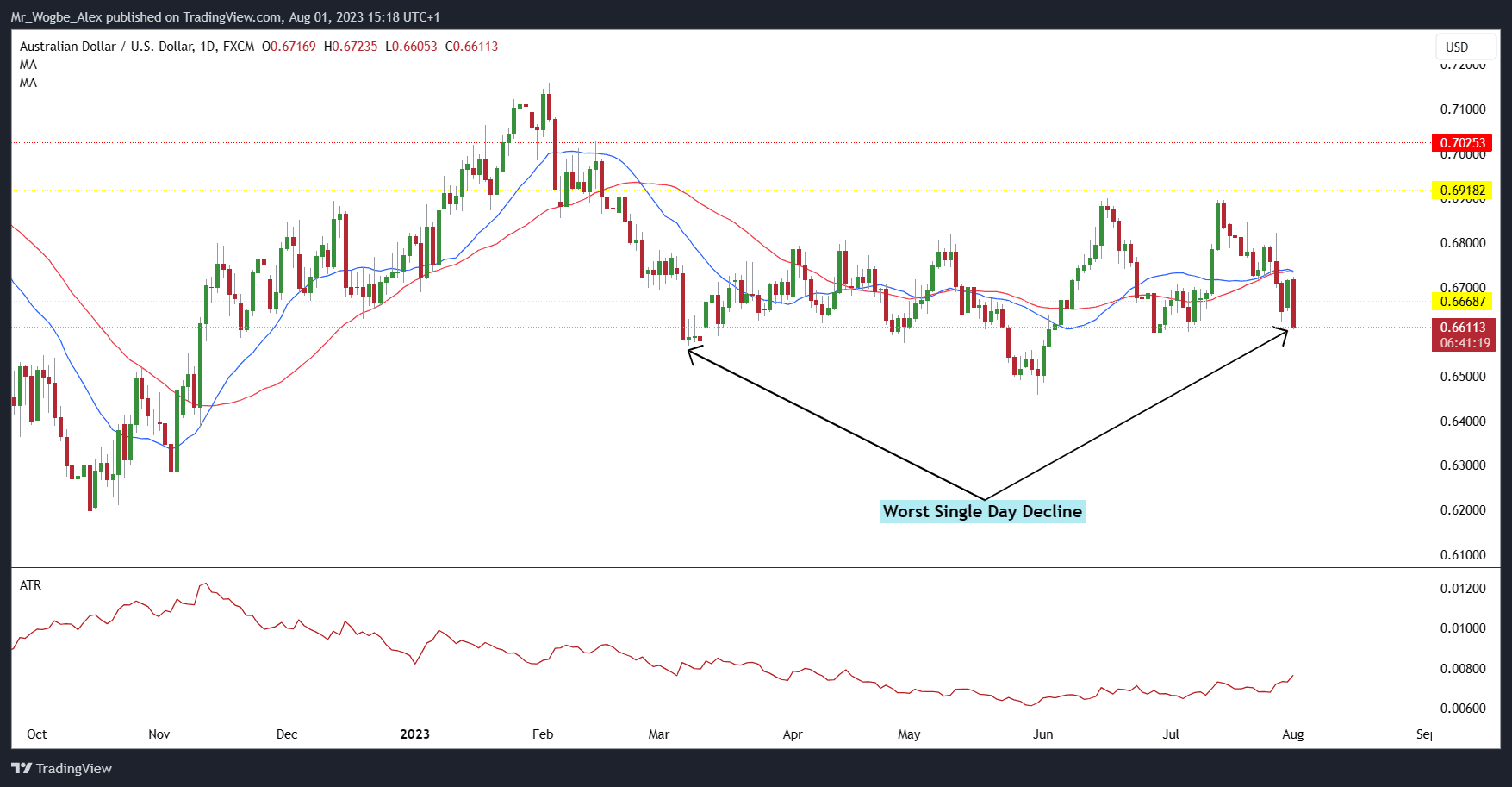

In a surprising turn of events, the Australian dollar suffered a sharp decline on Tuesday after the Reserve Bank of Australia (RBA) decided to maintain its cash rates unchanged for a second consecutive month.

This decision came as a shock to many market participants, with the currency plummeting 1.5% to $0.6617 against the US dollar. This marked its most substantial daily drop since March 7, effectively erasing all the gains the AUD/USD pair had accrued in July.

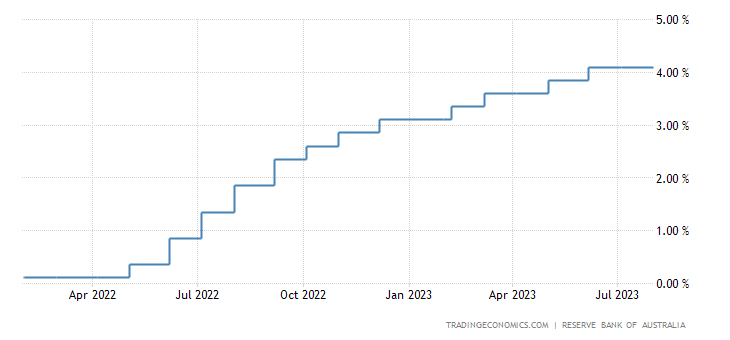

The RBA, in defense of its hold on interest rates, asserted that previous rate hikes had effectively cooled demand in the economy. However, the central bank also hinted that it may consider implementing further tightening measures in the future to address concerns surrounding inflation.

While this move was met with some apprehension, financial experts emphasized that it was a prudent decision given the closely matched trimmed mean inflation and unemployment figures that aligned with the RBA’s forecasts.

Weakness in Australian Dollar Worsened By Weak Economic Data from China

The Australian dollar’s downturn was further exacerbated by weaker-than-expected data from China, a significant trading partner for Australia. The risk-sensitive currency felt the weight of the disappointing economic indicators, creating additional pressure on its value.

According to a Reuters report, Matt Simpson, a senior analyst at City Index, highlighted the market’s lack of readiness for the RBA’s decision. This unpreparedness likely contributed to the extent of the currency’s drop. Additionally, weaker data from China further compounded the impact and led to increased volatility in the market.

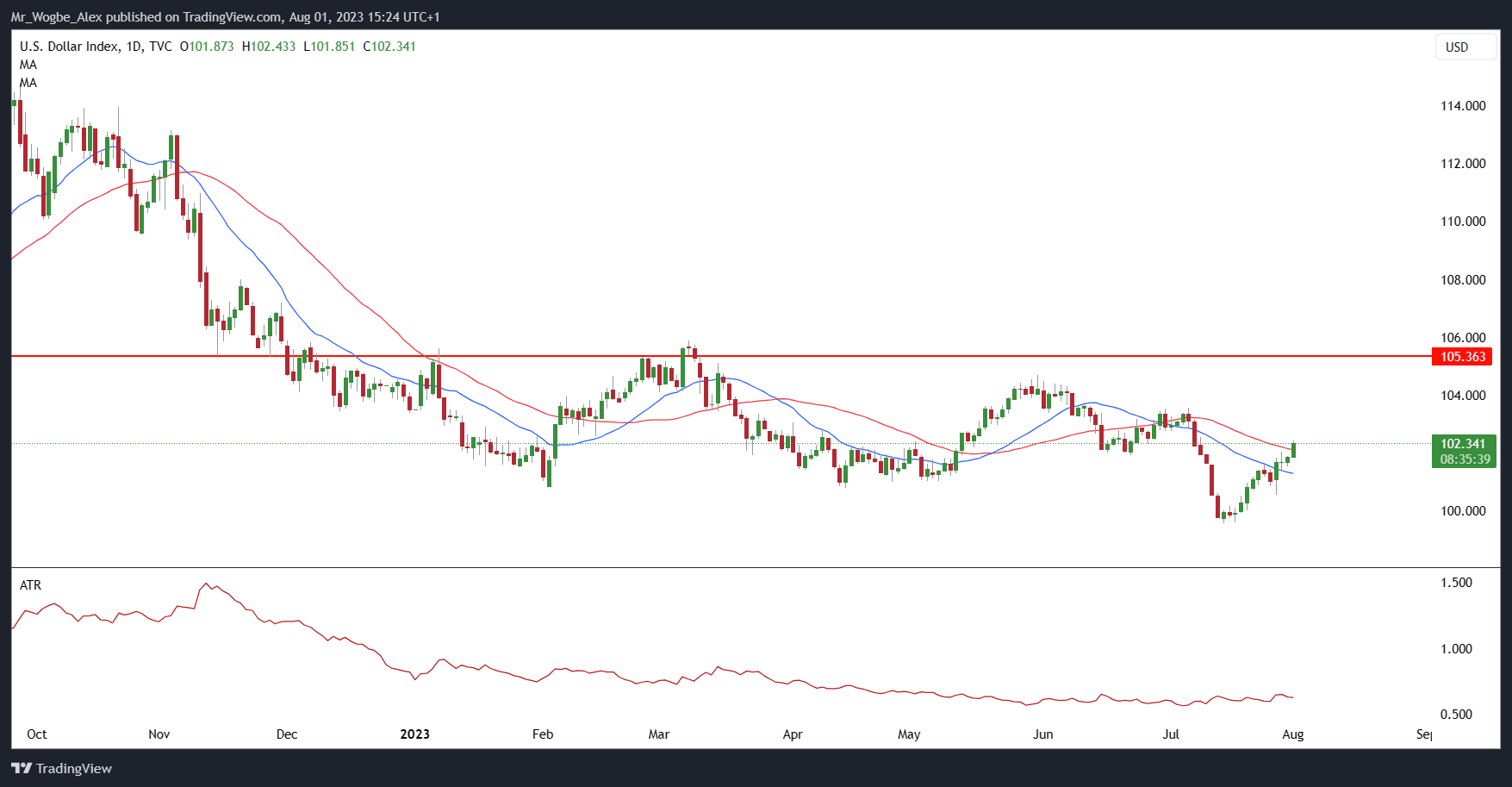

Dollar Surges Ahead of Upcoming US Fed Monetary Policy

The global market was not devoid of other significant developments. The US dollar rose to a fresh three-week high, registering 102.43 against a basket of currencies. Market participants keenly awaited the release of job data that could shed light on the Federal Reserve’s future monetary tightening plan. Concerns surrounding weak economic data in Asia only added to prevailing global growth fears, reinforcing the safe-haven status of the US dollar.

Underpinning these concerns were reports from the Federal Reserve showing tighter credit standards and weaker loan demand from both businesses and consumers in the second quarter. These indicators demonstrated the tangible impact of rising interest rates on the US economy, further emphasizing the importance of keeping a watchful eye on global economic conditions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.