The Australian dollar has been on a roller-coaster ride recently, facing pressure from various economic factors. The lingering bearish sentiment appears to remain unabated after the AUD/USD pair resumed its losing ways today.

This comes after a bout of depression triggered by the release of Chinese GDP data. Investors were closely watching the situation, and the currency’s spirited recovery after the Reserve Bank of Australia (RBA) Minutes were unveiled came as a pleasant surprise.

RBA Interest Rate Decision and Monetary Policy Outlook

The RBA has been carefully navigating the economic landscape, and its prior interest rate announcement resulted in a rate pause. The central bank took a prudent approach, choosing to review both local and external factors impacting the economy before making any further moves. The recently disclosed RBA Minutes revealed that the decision was not unanimous, with some policymakers favoring a 25 basis point hike.

Nevertheless, the RBA left the door open for potential future monetary policy tightening, giving investors a glimpse of their cautious yet optimistic stance. Market expectations are now pointing towards another 25 basis point hike later this year, while the focus remains firmly fixed on the tight labor market and the persistent inflationary pressures.

The Long-Term Decline for the Australian Dollar and China’s Influence

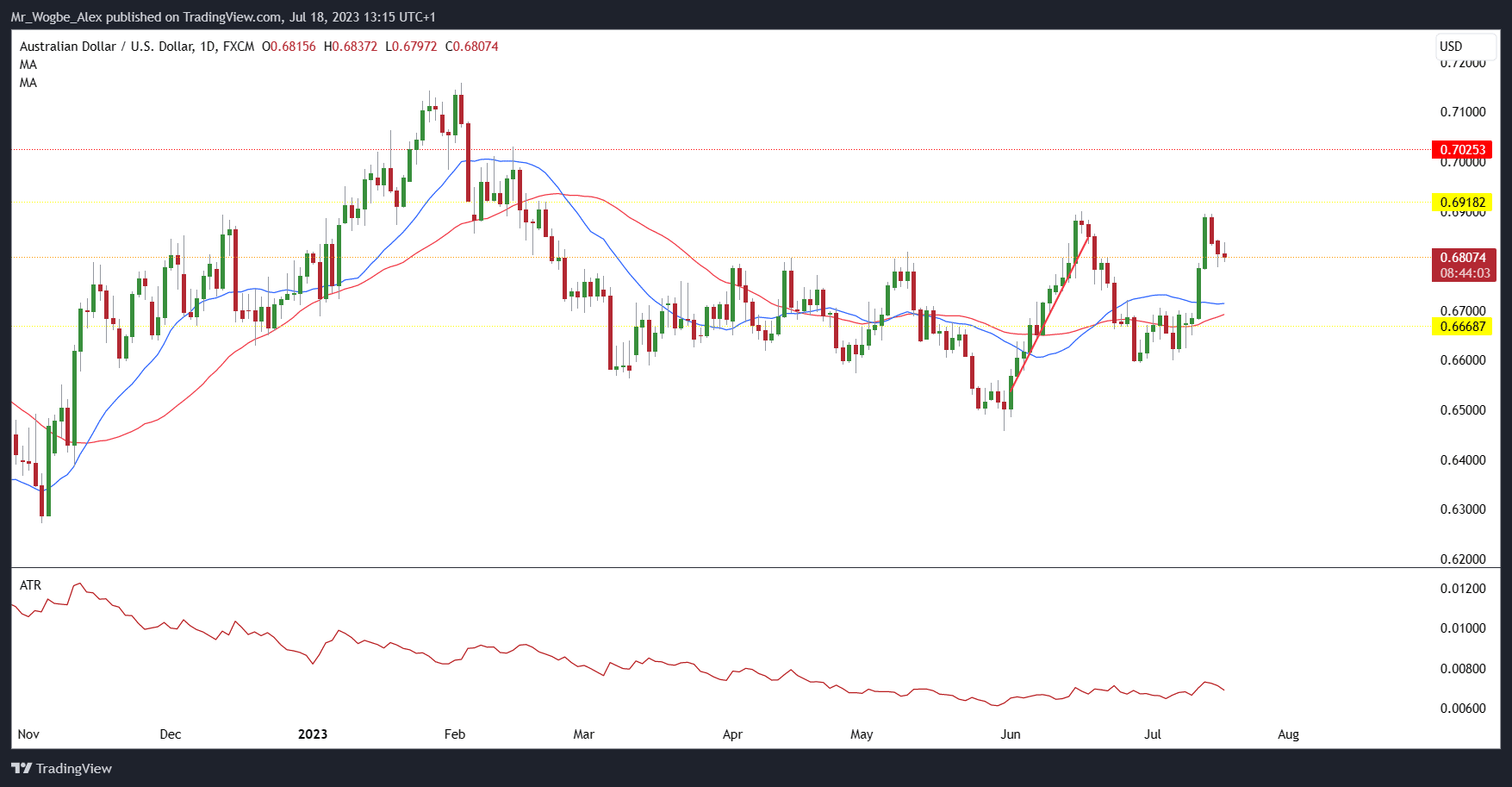

Over the past months, the Australian dollar has faced headwinds, experiencing a steady decline against its American counterpart since February. Among the key contributors to this downturn is the looming fear of a slowing Chinese economy.

China’s economic health has been an influential factor in shaping the AUD’s performance, transcending the impact of domestic economic conditions. However, market experts now speculate that any glimmer of positivity from China, such as fiscal and monetary stimulus, could be a potential game-changer for the Australian dollar.

Such developments may have a more significant impact on the AUD’s upside than the market has already priced in concerns about China’s economic slowdown.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.