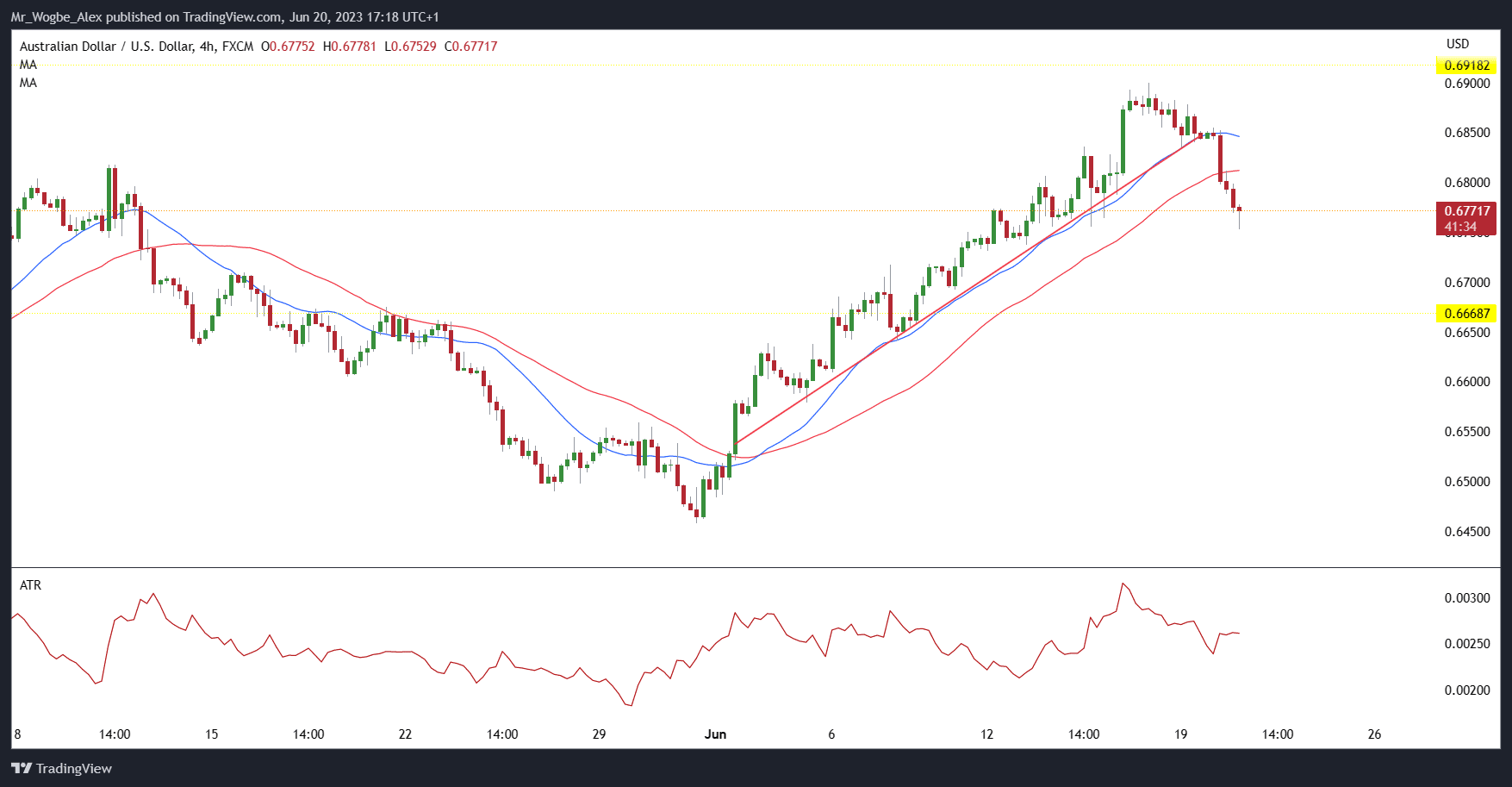

The Australian dollar is encountering downward pressure in today’s market against the US dollar (DXY), despite the relatively stable performance of the greenback as indicated by the DXY index. This decline can be attributed to initial apprehensions surrounding the Chinese economy. This apprehension was triggered by the People’s Bank of China’s (PBoC) decision to cut both the 1-year and 5-year loan prime rates by a mere 10 basis points each.

Analysts anticipate that further rate cuts may follow as China seeks to stimulate its economic growth. With China experiencing low inflation compared to other major global economies, there are minimal constraints impeding the continuation of accommodative monetary policies.

The dim outlook for China’s economy is expected to hinder Australia’s commodity exports, considering its significant trading partnership with the country. This adverse effect on exports is consequently exerting downward pressure on the Australian dollar.

RBA’s Uncertain Stance and Market Expectations

Following the PBoC’s rate cuts, the Reserve Bank of Australia (RBA) released the minutes of its recent meeting, highlighting the lack of consensus regarding a rate hike. The surprise rate hike in July seems less likely now, aligning with the trend observed in the policies of the US Federal Reserve. As the RBA increasingly emphasizes data dependence, economic indicators leading up to the meeting will be of the utmost importance.

Australian Dollar Market Focus: Fed Speak and US Building Permits

Later today, AUD/USD traders’ attention will shift toward remarks from the Federal Reserve and the release of building permit data in the United States. Although recent data releases have shown a decline, estimates indicate a slight improvement, which could potentially benefit the US dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.