In a surprising turn of events, the Australian dollar stood its ground despite a slight miss on the trade balance data. Market attention quickly shifted toward the recent interest rate decisions made by the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC). Both central banks caught investors off guard by raising their cash rates by 25 basis points this week.

Now, all eyes are eagerly watching the forthcoming monetary policy meetings of major players such as the Federal Reserve, the European Central Bank, and the Bank of Japan, as the unexpected rate hikes have sparked intense speculation about potential surprises in store.

Australian Dollar Displays Resilience Amid Trade Balance Data

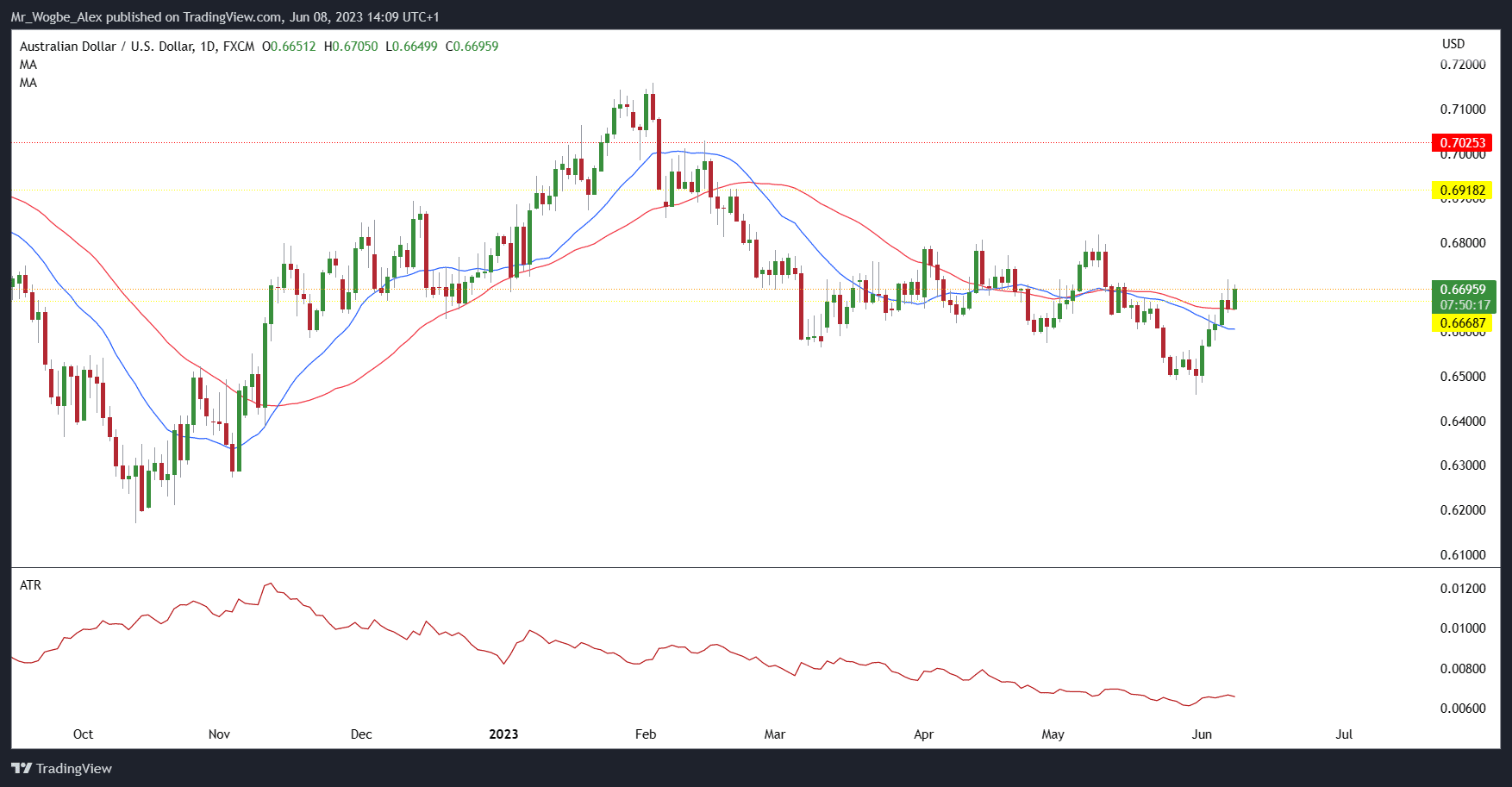

When it comes to Australia’s trade balance for April, the numbers didn’t quite hit the mark, falling short of the anticipated AUD 13.64 billion at AUD 11.158 billion. However, this setback failed to ruffle the feathers of the Australian dollar, which remained steadfast below the 70-cent mark against the US dollar. This confident stance suggests that despite the recent rate hike by the RBA, the Australian economy is still projected to maintain its fiery performance.

By springing their unexpected rate hikes, both the RBA and the BoC have injected a strong dose of speculation into the market. Traders are now eagerly waiting for the upcoming monetary policy meetings of influential central banks.

On the other hand, the US dollar enjoyed a shopping spree across the board following the Bank of Canada’s decision to raise rates. This unexpected surge suggests that investors are not entirely convinced that the Federal Reserve will follow suit with its anticipated rate hike at the upcoming meeting on June 14th. The uncertainty surrounding the Federal Reserve’s decision could send shockwaves through global markets and potentially disrupt the status quo.

While a myriad of factors influences crude oil prices, including supply and demand dynamics and geopolitical tensions, the recent range-bound trading has kept prices relatively stable. Although there has been a slight softening at the start of Thursday’s trading session, the West Texas Intermediate (WTI) futures contract remains below $72.50 per barrel, while the Brent contract sits just above $77 per barrel.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.