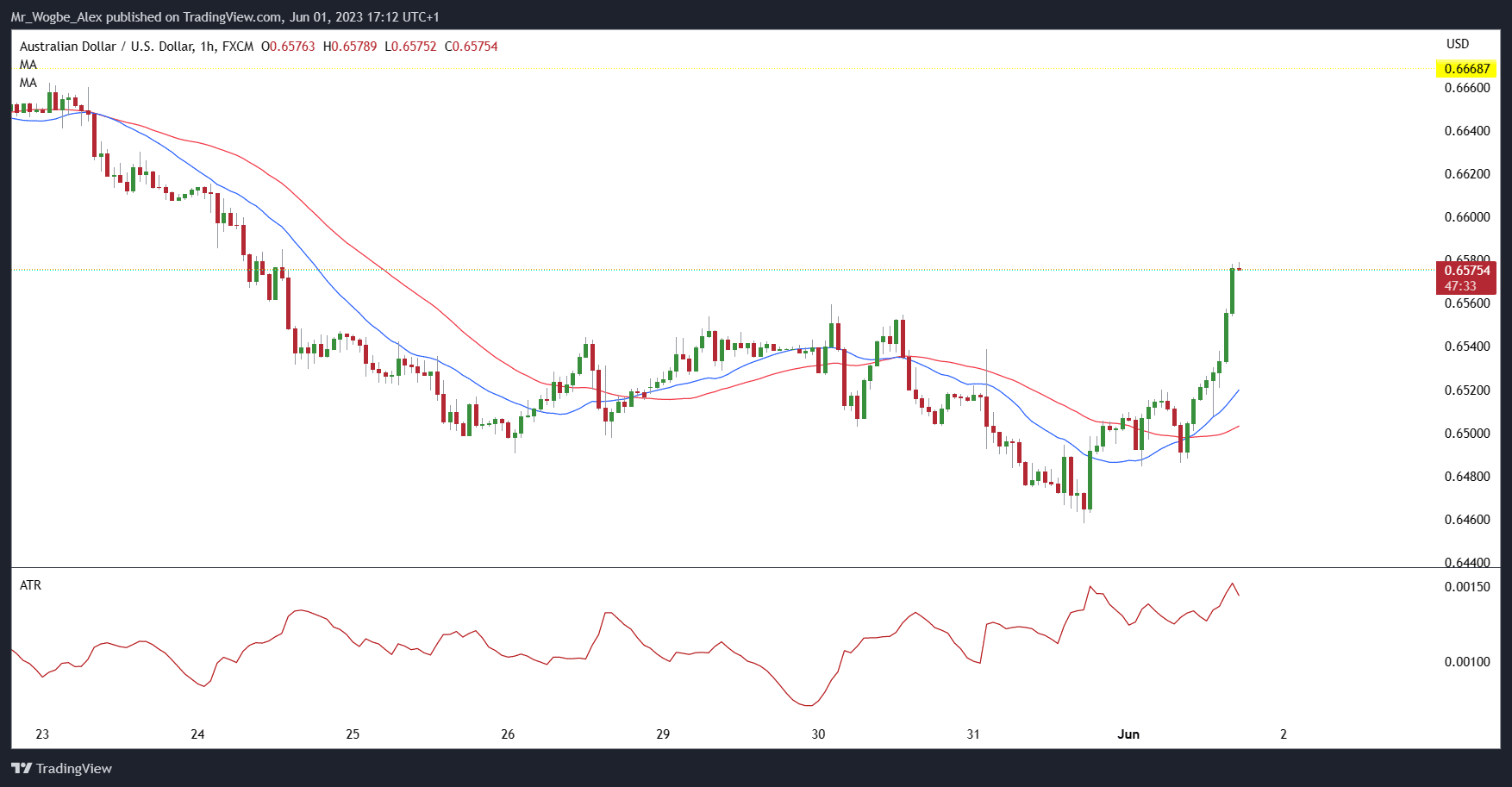

The Australian dollar (AUD) took investors on a thrilling ride yesterday as it fluctuated around the 0.6500 handle following significant progress in the United States debt ceiling legislation.

In a remarkable display of bipartisan cooperation, Republicans and Democrats united to push the deal through the House, resulting in a decisive 314–117 split in favor of the agreement. The Senate, where strong support is expected, now holds the key to the deal’s fate. Amidst this political saga, market sentiment soared, favoring risk appetite, while the USD felt the pressure as Federal Reserve officials reiterated their dovish stance.

Positive Economic Data Lifts the Australian Dollar

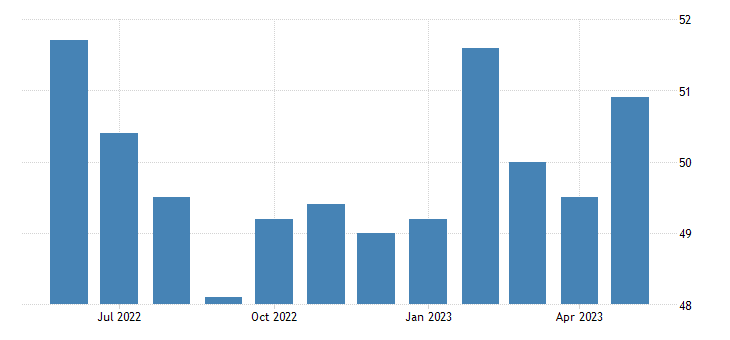

Thursday morning brought a ray of sunshine for the AUD as manufacturing Purchasing Managers’ Index (PMI) figures for both Australia and China, two prominent importers of Australian commodities, surpassed expectations. This upbeat data infused confidence in the Australian dollar.

Although the National Bureau of Statistics (NBS) manufacturing PMI fell short of estimates, the Caixin report, considered a more reliable private sector measure, garnered widespread market support. Furthermore, commodity prices year-on-year (YoY) showed a smaller decline than initially forecasted, providing an additional boost to the AUD.

Shifting our focus to the USD, the economic calendar is brimming with vital job-related data, along with the Institute for Supply Management (ISM) manufacturing PMI. These indicators are widely recognized as leading measures, offering valuable insights ahead of tomorrow’s highly anticipated Non-Farm Payroll (NFP) report.

If the labor statistics and the manufacturing sector display signs of weakness, it could foreshadow a lower NFP figure for tomorrow. However, it is worth noting that recent history has proven the ADP print to be an unreliable gauge for NFP predictions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.