Forex is the most traded financial sector globally, which is hardly surprising – the market is open 24/5, is prone to high liquidity, and offers plenty of profitable opportunities.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

If you want to trade currencies from the comfort of home – you will be happy to hear that you can learn forex for free!

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Stick with us, whilst we take you on a journey through the ins and outs of forex trading. Starting from the ground up, this covers how to choose a broker, FX pairs, orders, bankroll management, trading strategies, automated forex trading, and more.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Selecting the Right Forex Broker

Before we dive into how to learn forex for free, let’s share the most important considerations when searching for a broker to facilitate your trading endeavors.

- Potential Fees and Commissions: One of the first things to check when looking for the perfect broker for the job is potential fees and commissions. Even small fees can have an impact on any gains in the long run. As such, if you sign up with a commission-free trading platform, you only need to think about the spread and overnight financing fees.

- Regulatory Standing: Regulatory bodies ensure that online brokers are kept in check – enforcing rules such as client fund segregation, KYC, fee transparency, and more. As such, it’s important that the forex broker is regulated by one or more of the following financial authorities: FCA, ASIC, CySEC, MAS, or FINRA.

- Payment Methods: Seldom are forex providers exactly the same, so make sure you check what payment methods are accepted before committing. For instance, some online brokers only accept bank transfers, which can take 2-7 days to clear. Whereas others are compatible with credit and debit cards as well as e-wallets (think along the lines of PayPal and Neteller). Thus offering faster and convenient ways to fund your account.

- Supported Pairs: Whilst seemingly obvious, you don’t want to sign up to a trading platform, only to discover you can only access a small selection of pairs. Granted, you might only have eyes for EUR/USD now – but later you are likely going to want to diversify your trading portfolio, and perhaps add some emerging currencies into the mix.

As is clear from above, choosing a place to learn forex for free shouldn’t be taken lightly – there is much to think about.

To save you hours of research, we have left no stone unturned when seeking out the most reputable online forex brokers in 2023.

1. AvaTrade – Best Forex Broker With Heaps of Trading Tools

AvaTrade is licensed to provide a service in more than 100 jurisdictions. This regulation comes from countries such as the UK, the EU,Japan, Australia, South Africa, and more. In terms of markets, you will find hundreds, including CFDs, indices, commodities, stocks, cryptocurrencies - and a diverse selection of over 50 forex pairs. This includes majors, minors, and exotics - all of which can be traded on a commission-free basis.

Our guide found that spreads are tight on currencies, and most financial assets can be traded with leverage. This broker provides access to a multitude of trading tools to allow you to learn forex for free. This includes trading videos about everything from forex basics, key principles, and specifications to platform tutorials, technical analysis lessons, and trade planning videos. You can also look at various economic indicators, order calculators, trading strategies, and more.

AvaTrade also enables you to learn forex using a demo account with $10,000 in paper funds right away. This account has been designed to work well on both mobile and desktop. As with most demo platforms of this type, when you feel like you are ready to enter the real market you can switch to a real portfolio. This forex provider is giving away a free eBook of 'Forex Trading Strategies' to all new sign-ups. You can get started from $100, and compatible payment types include debit and credit cards or bank transfers.

- Learn forex for free with $10,000 demo money

- Regulated in countires such as the UK, the EU, and Australia

- Trade forex on a commission-free basis

- $50 inactivity fee after 3 months

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 2: Grasp the Fundamentals

It goes without saying that before you can really learn forex for free – you need to understand the basics of the currency market.

Tradable Forex Pairs

For those unaware, currencies are always traded in pairs. As such, you will be trading one currency, such as British pounds, against another, such as the US dollar. Both currencies will have an exchange rate and the price quoted will change on a second by second basis. This is the nature of supply and demand.

When looking to learn forex for free, you will see that currency pairs fall into different categories – majors, minors, and exotics.

Majors

Let’s start with a brief explanation of majors to clear the mist. A major currency pair invariably contains the US dollar, as USD is the global reserve currency. The other half of the pair will also be a strong currency – such as Australian dollars, British pounds, euros, or the Japanese yen.

Major pairs are the most traded in the world, and as such, they are highly liquid markets. Consequently, they tend to come with super tight spreads and higher leverage.

- EUR/USD (euro/US dollar)

- GBP/USD (British pound/US dollar)

- USD/JPY (US dollar/Japanese yen)

- USD/CAD (US dollar/Canadian dollar)

- AUD/USD (Australian dollar/US dollar)

- USD/CHF (US dollar/ Swiss franc)

- NZD/USD (New Zealand dollar/US dollar)

Major pairs are well suited to beginners, thanks to the aforementioned market liquidity.

Minors

Minor pairs, unlike majors, never include the US dollar. Instead, this category will always be made up of two alternative strong currencies.

For example:

- EUR/GBP (euro/British pounds)

- GBP/CAD (British pound/Canadian dollar)

- EUR/JPY (euro/Japanese yen)

- GBP/JPY (British pound/Japanese yen)

- NZD/JPY (New Zealand dollar/Japanese yen)

- EUR/AUD (euro/Australian dollar)

- CHF/JPY (Swiss franc/Japanese yen)

Whilst minor pairs do have a modest forex market share when compared to majors, they are still less volatile to trade than exotics, which we talk about next.

Exotics

Exotic pairs invariably include a strong currency and one from a developing or emerging economy (such as Mexico or Turkey)

The most traded exotic pairs in the world are as follows:

- USD/HKD (US dollar/Hong Kong dollar)

- EUR/TRY (euro/Turkish lira)

- AUD/MXN (Australian dollar/Mexican peso)

- NZD/SGD (New Zealand dollar/Singapore dollar)

- JPY/NOK (Japanese yen/Norwegian krone)

- GBP/ZAR (British pound/South African rand)

Take note – these pairs are usually traded by seasoned forex investors as the market is much more volatile than that of majors and minors. Consequently, they are likely to come with wider spreads.

Forex Orders

Now that you are caught up with the basics, we can move on to forex orders. Crucially, if you are looking to learn forex for free – you will need to have a good grasp of orders to prepare you for the real market.

Buy or Sell

To start, you will always need to choose between ‘buy’ and ‘sell’ when placing an order. Placing the order couldn’t be easier, albiet, the hardest part is trying to predict the future price of the forex pair in question.

Let’s offer an example based on a scenario where you are trading US dollars against Canadian dollars:

- If you believe USD/CAD is undervalued and will see a price increase – place a buy order with your broker

- On the other hand, if you think USD/CAD will experience a price decrease – place a sell order

Finally:

- If you enter the position with a buy order – exit with a sell

- Alternatively, if you enter your forex trade with a sell order – exit with a buy

Ultimately, the purpose of placing a buy or sell order is to tell your broker whether you think the pair’s exchange rate will rise or fall.

Market or Limit

Next, you will need to choose between a ‘market’ and ‘limit’ order. Both enable you to enter the forex market, but in different ways.

See an example below:

- Market Order: A market order will be selected by you if you are happy with the current market price. The broker will execute your order immediately to get you this or the next best market price. Due to natural price shifts – there will be a slight disparity between the current price and the one you get.

- Limit Order: Let’s say you are trading GBP/USD and are quoted $1.39. You don’t like that price and want to enter the trade at $1.46. As such, you select a ‘limit’ order and set the price at $1.46. If the FX pair rises to $1.46 – the broker will execute your order. This order will remain how it is until you cancel it or the price point has been reached.

Unless you spot a forex trading opportunity you can’t miss – you are most likely to make use of the price-specific nature of limit orders.

Pips and Spread

‘Pips’ and ‘spreads’ are words you will see all over the place when researching how to learn forex for free.

See an explanation of both below for clarification.

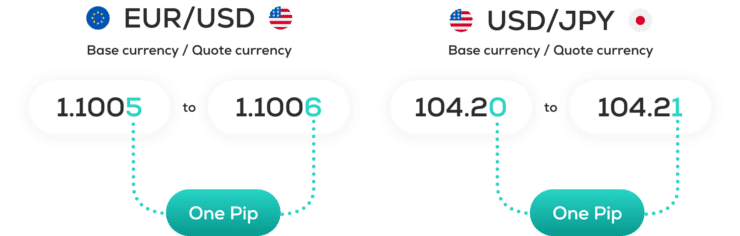

Pips

For those unaware, price fluctuations in the forex market are displayed as ‘pips’ (Points in Percentage). Understanding this is going to aid you in working out profits, losses, and spread. We talk about spreads shortly.

See an example of pips in a forex trade below:

- Let’s say you are trading USD/CAD

- You are quoted $1.2590 for this pair

- A couple of hours pass and USD/CAD is now priced at $1.2581

- As you can see, this pair has fallen in value by 9 pips

- You can calculate any potential gains or losses quite easily by multiplying the initial stake per pip against 9 (in this case)

If you are trading a pair inclusive of the Japanese yen, you will see that the price only has 2 decimal places. For instance, the value of NZD/JPY might be displayed as $78.20. In some cases, there will be 3 decimal places in the quotation.

Spread

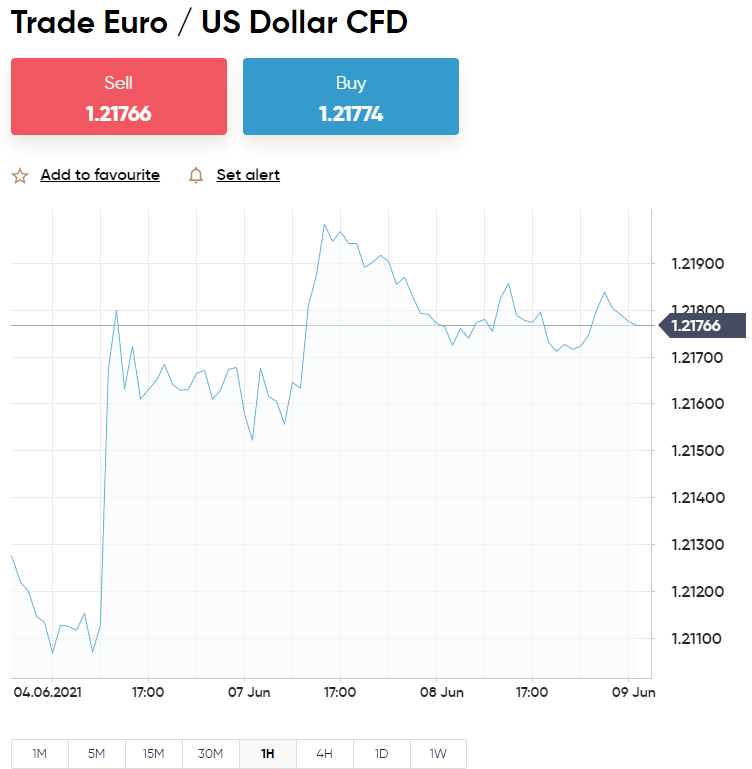

Now that we have covered pips, we can move onto the spread. Having a grip on the spread is not just another way to help you work out your potential profits and losses. Instead, it lets you know how much you are paying to trade the respective pair.

After all, the spread is a fee charged by trading platforms, covering them against market volatility. The fee is quite simply the difference between the ‘buy’ price and ‘sell’ price of the forex pair. This is sometimes referred to as the ask/bid spread.

See further clarification with a simple example:

- You are trading AUD/USD

- The buy price is $0.7810 – this is the highest price the market will pay for the pair

- The sell price is $0.7809– this is the lowest price the market will sell the pair

- The spread here is 1 pip

As the spread is an indirect fee, it’s important to remember that you must take this into account when working out any potential gains. This is because, if you start your trade with a spread of 1 pip – you are 1 pip in the red when your position is opened.

As such, if you make 1 pip on your AUD/USD position – this is the break-even point. Anything over this is actual profit.

Part 2: Money Management and Trading Goals

Being able to learn forex for free is useless if you don’t have a comprehension of bankroll management when you elect to actually trade.

The good news is, you don’t have to have a degree in mathematics to better manage your capital when trading. See below for inspiration.

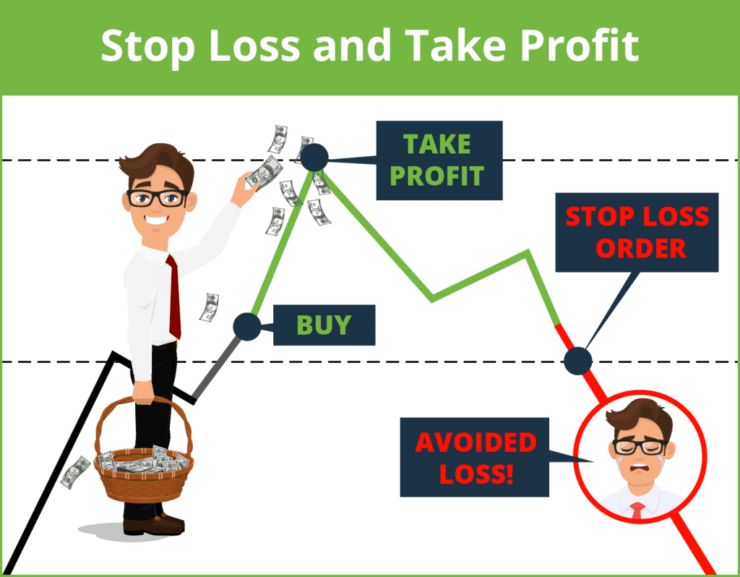

Stop-Loss and Take-Profit Orders

Having made it to Part 2 of our guide, you will now have a grip on orders and how they facilitate your entry into the forex market. We are of course referring to the previously explained ‘buy’ and ‘sell’, and ‘market’ and ‘limit’ orders.

Stop-Loss

Put simply, a stop-loss order enables you to predetermine at which point your trade will be closed and your losses stopped (from spiraling out of control).

To better explain, see an example below:

- You place a buy order on EUR/AUD, which is priced at $1.5430

- Having performed some research, you decide you are not willing to risk more than 3% from this position

- As such, you set your stop-loss order to 3% below the entry value of $1.4810 ($1.5430 – 3%)

- Alternatively, if you enter the trade with a sell order, believing the price will fall, the stop-loss order needs to be set to 3% above $1.5430

This order tells the trading platform that if the aforementioned price point is reached, you want the broker to action your order. By setting up a stop-loss order on each and every forex trade – your losses will never get out of hand. In the above scenario, no matter which way the markets go, you will not lose more than 3% on your trade.

Take-Profit

Once you get the hang of stop-loss orders, take-profit orders should come naturally. In contrast, rather than stopping your losses, this particular order will enable you to lock in a pre-determined profit.

See a simple example below:

- You go long on EUR/AUD by creating a buy order

- After deciding you wish to make gains of no less than 5% – you set up a take-profit order at 5% above the entry price

- Using our previous example, you would set the take-profit order at $1.6200

- Had you instead gone short on EUR/AUD – your take-profit value would be set to 5% below the entry price

Your trade will be closed as soon as the specified price has been reached – or you manually it.

Leverage and Margin

For those unaware, leverage is comparable to borrowed trading funds. This means your broker is facilitating a bigger forex position than you would otherwise have been able to create with your current trading balance. This will usually be shown as a ratio such as 1:2, 1:10, 1:20, or a multiple of x2, x10, x20.

To clear the mist, if you use leverage of 1:2, you are boosting your stake twofold. So, if you put in $100 from your trading account you can increase your position to $200. Ergo, if the leverage applied is 1:10 – $100 can become $1,000.

Leverage can be a blessing as well as a curse. As such, the best time to practice using leverage is when trading forex for free.

See an example of a non-leveraged forex trade below:

- You stake $100 on a sell order on USD/HKD

- Your prediction was correct – the pair falls in value by 5%

- As such, you cash out your position with a buy order

- Your profit from this trade is $5

Now see the same trade with added leverage:

- You stake $100 on a sell order on USD/HKD

- You apply leverage of 1:20

- Your position is now worth $2,000

- The pair falls in value by 5%, so you exit the market with a buy order

- Your profit from this trade is $100

As you can see, leverage made a big difference to your take-home profit on this trade. However, had USD/HKD increased in value on this short-selling order – your losses would also have been magnified by 20. As such, you should use leverage with caution.

Finally, the amount of leverage you are offered by your forex broker will depend on various factors, such as the pair you are trading and the size of your stake. Furthermore, platforms in some countries are capped at the amount of leverage they can legally offer clients.

As we are here to talk about forex, we’ve listed some leverage restrictions by location below to see where you stand:

- If you are from Australia, the EU or the UK – you can access leverage of up to 1:20 on minor and exotic pairs, and up to 1:30 on major pairs

- As per NFA/CFTC rules, US traders can access up to 1:20 on minors and exotics, and up to 1:50 leverage on major pairs

- Other places in the world have no restrictions and could offer as much as 1:500 or 1:1000

If you pass the test and meet the criteria as a professional client, you will be able to access more leverage than retail clients – regardless of your location.

In case you are unsure, a retail client is your average Joe Trader. In contrast, a professional-client is someone who has worked within the financial sector in a professional capacity for over a year. The pro must open significant-sized trades, have an acceptable amount of capital and savings, and is usually required to have hundreds of thousands of dollar in their portfolio!

Set Trade Size Limits

This money-management system is easy – think realistically about much you are willing to risk and for what reward. The simplest way to work this out is in percentage terms.

To give you an idea of where to start, the majority of new traders apply a 1% or 2% minimum trade size to each forex position. This means that if you have $100 in your trading account, the 1% system would see you risk no more than $10. As such, the 2% strategy would limit you to $20 per trade.

The beauty of this system is that it’s easy to recalculate your maximum stakes, as your trading account balance inevitably goes up and down.

Part 4: Decide on a Predefined Strategy

When looking to learn forex for free, you will soon realize that it is crucial you enter the market with a predefined strategy.

Whilst that might sound complicated, there are various ways in which you can avoid trading in the dark. All in all, it’s super important to have clear goals, and means of helping yourself to achieve them.

Trade via Free Demo Accounts

Whilst a bit of a no-brainer for people who want to learn forex for free – utilizing demo accounts is a good strategy at any time in your currency trading adventures. Free demo accounts are often given to new clients automatically at modern online forex brokers.

The ‘virtual portfolio’ will be loaded up with paper funds (demo money) and will mimic real-world market conditions and volatility. As you can imagine, this is invaluable for newbies who want to learn the markets and hone in on skills such as creating orders and understanding technical analysis.

It’s also superb for later down the line, when you might just want to try out a new theory or a strategy idea on a different pair.

Day Trading

This is a short-term trading strategy. If you partake in day trading, you are looking to buy and sell currencies throughout the trading day. You will rarely maintain a position overnight – and will often cash out within minutes or hours.

As such, profits are usually expected to be modest, but frequent, so you catch profitable opportunities from price fluctuations. By trading forex using this strategy – you are able to reap the rewards in terms of leveraging your position. All whilst avoiding the overnight financing fees that forex invites.

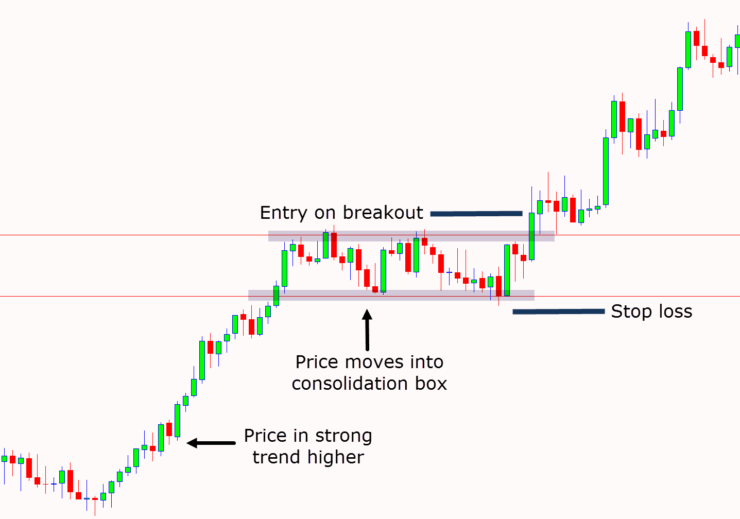

Swing Trading

Swing trading is a short-term strategy, often opted for by newbies. This is because it is highly conducive to following currency trends and doesn’t usually involve opening and closing multiple positions in a single day.

Instead, you are more likely to hold a position for days, weeks, or even a couple of months. As such, this strategy is more flexible and less full-on than day trading.

Scalping

Scalping is another short-term strategy, and this one is not for the faint-hearted. Scalping entails opening dozens, or more often than not, hundreds of positions within hours – ‘scalping’ the forex markets for profitable opportunities.

Part 5: Contemplate Forex Signals or Algorithmic Trading

When looking to learn forex for free, many people opt for forex signals or algorithmic trading whilst they find their feet.

Forex Signal Service

Forex signal services are comparable to trading tips. This might be preferable to beginners who have yet to learn technical analysis effectively. Alternatively, many seasoned pros who lack the time to research the markets use this kind of service.

For those unaware, a forex signal will outline the suggested price and order details of a specific pair. For instance, here at Learn 2 Trade, our experienced and dedicated in-house analysts perform intense technical analysis and scour the markets for money-making trading opportunities.

All members of our forex signals Telegram group will receive the following information:

- Forex pair

- Buy or sell order

- Limit order price

- Stop-loss price

- Take-profit price

Whether or not you go to your chosen trading platform and place this order is up to you. However, the key point is that you will not need to perform any research to trade the forex markets – making signals ideal for those seeking a more passive investment experience.

Forex Robot

If you are looking for an entirely passive way to trade forex, you may want to consider a forex robot. Sometimes referred to as an EA, this is an automated service, tasked with placing buy and sell orders on your behalf.

The pre-built algorithmic software scours the markets 24/7 for potentially profitable trading opportunities – using predetermined criteria. After performing some research to find a suitable forex robot, you will need to download the file as instructed. This is followed by installing third-party trading software such as MT4/5 or cTrader. As such, you must ensure the online broker is compatible with the platform.

Forex Copy Trader Feature

We mentioned the Copy Trader feature in our eToro review. This feature is a real crowd pleaser and is also offered at some other modern online forex brokers.

In a nutshell, you are able to select a seasoned trader based on various aspects such as preferred asset class, tollerance for risk, average monthly gains, and more. Additionally, at eToro, you can access heaps of data to help you make your decision.

When you feel confident you have found the right person to follow, click ‘Copy’ and invest from $500. Anything the trader proceeds to buy or sell will be reflected in your portfolio. So, if the Copy Trader has positions open on EUR/USD, GBP/JPY, and AUD/CAD – you will see the same in your portfolio – in proportion to your investment.

See an example:

- You decide to invest $1,000 in a forex Copy Trader

- The pro has $100,000 in bankroll

- They enter a $5,000 sell position on GBP/JPY – this equates to 5% of their bankroll

- As such, you are passively staking $50 on GBP/JPY (5% of your $1,000 investment)

Copy Trading enables you to trade without doing a thing, by saving you from having to research and time the forex markets yourself.

Part 6: Start Trading Forex

Having reached Part 6 of our guide, you are no doubt keen to learn forex for free in the real world. First, you will need to sign up with a regulated broker that offers lots of currency pairs, educational content, and a free demo account.

We are using eToro for our sign-up walkthrough – as the commission-free platform is great for first-time forex traders wishing to use a demo account facility.

Sign up and Provide ID

Head over to eToro and click ‘Join Now’. When the sign-up box pops up, you will need to fill in the particulars as indicated – name, address, and so on.

You will also need to upload a copy of a photo ID – such as a passport, government ID, or driver’s license. You will also be required to send a clear or digital copy of a recent bank statement/utility bill as proof of address. This is all standard practice as per KYC rules that all regulated forex brokers must adhere to.

Trade Via Demo Account

If you want to trade forex for free – use the eToro demo account for as long as you wish. You can practice forex trading orders, learn how currency price trends work, and understand the risks and rewards of leverage.

Fund Your Account

When you are ready to trade forex with real money, you will need to fund your account. To do this – click ‘Deposit Funds’ and the following box will appear.

That’s it, simply enter the amount you wish to deposit, select the payment type, and hit ‘Deposit’ when you are happy to proceed.

Create a Real Forex Trade Order

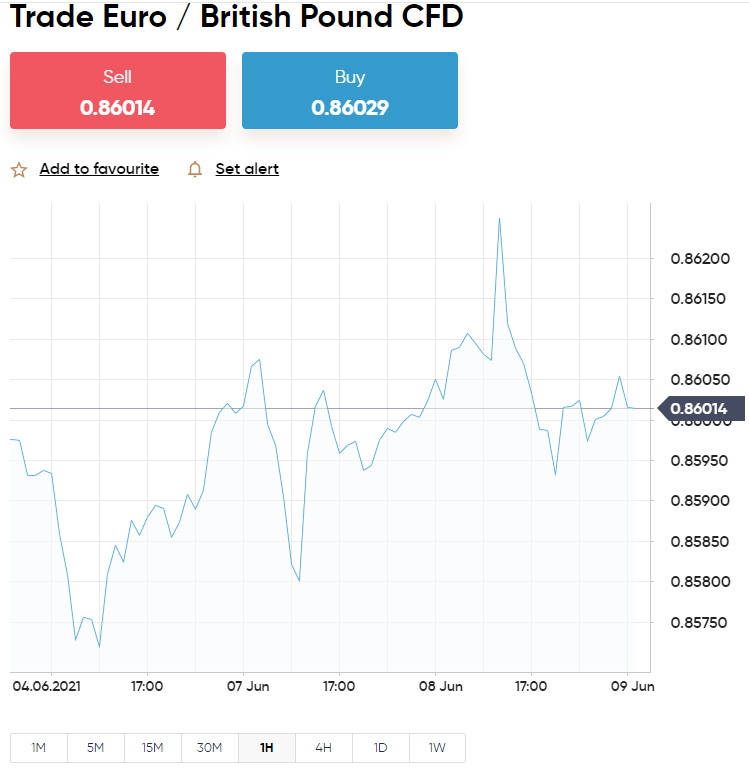

Now, you can search for the currency pair you would like to trade. Here we are looking for EUR/GBP.

If you are unsure what to look for, click ‘Trade Markets’ (to the left), followed by ‘Currencies’. All available forex pairs will appear on your account screen as per the above. Once you have found a pair you want to speculate on – click ‘Trade’ to reveal your order box.

Next, you need to enter:

- Market or Limit Order

- Stop-Loss Value

- Take-Profit Value

Finally, click ‘Open Trade’ to place your first forex trade on eToro!

Learn Forex for Free – The Verdict

When you are on a mission to learn forex for free, you will notice there are heaps of online brokers in the space – some good, some bad, and some ugly. As such, it’s important to take some time to really comprehend how the currency markets work, learn technical analysis, and understand what causes price shifts.

To learn forex for free, you will also need to sign up with a reputable broker offering educational trading tools and demo accounts. eToro offers a free demo account with $100,000 in paper funds to practice with. The account mirrors real-world forex market conditions to give you a realistic experience and enable you to practice strategy ideas.

There are no fears when it comes to safety either – as this broker is regulated by the FCA, ASIC, and CySEC. Furthermore, you can access free trading courses, buy and sell currencies on a commission-free basis, and deposit funds using a plethora of different payment types for when you eventually get to point of trading with real money!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

How will I be able to learn forex for free?

Is forex safe for beginners?

Can I start day trading for $100?

For what length of time do I need to study forex?

How can I make lots of money from forex trading?