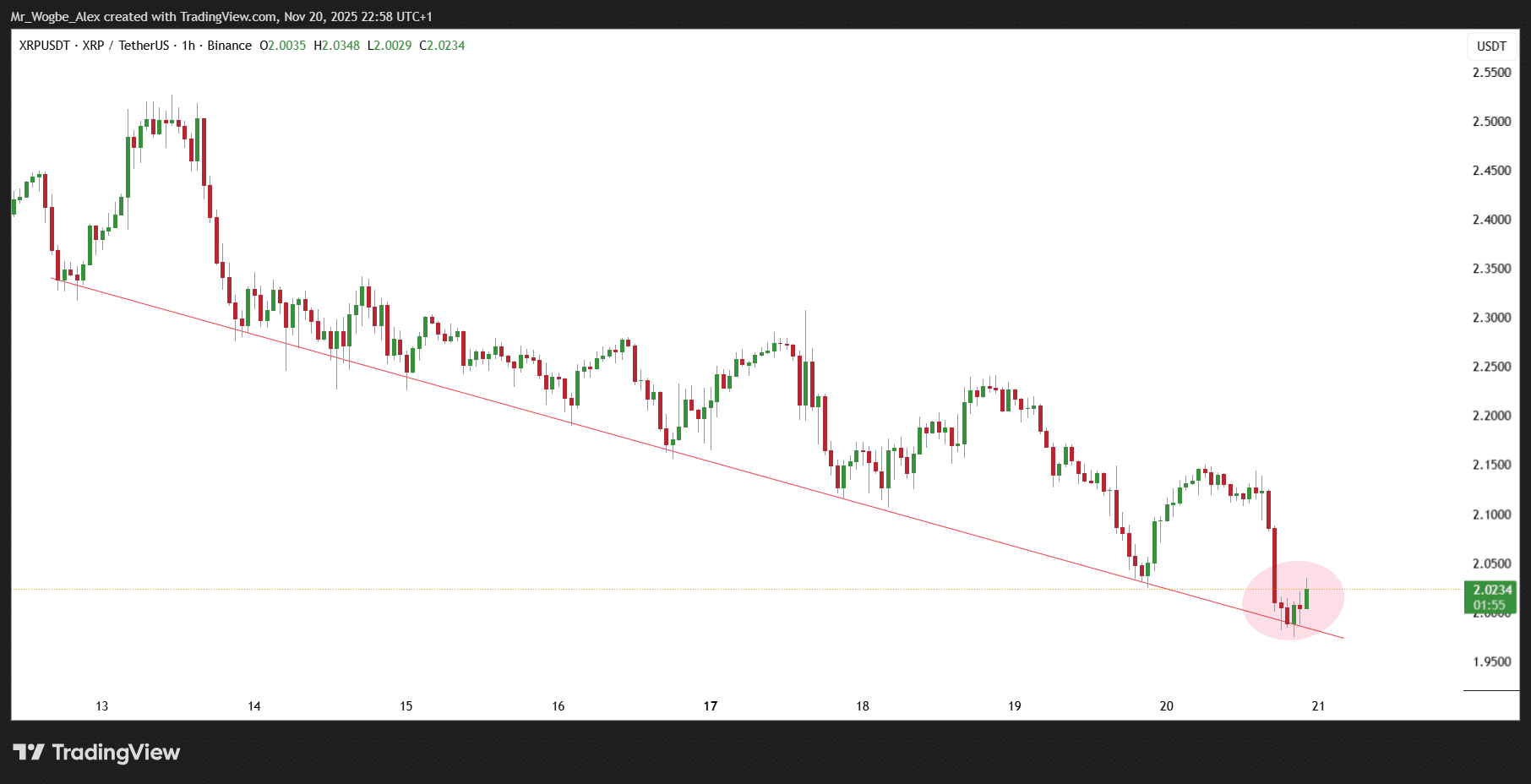

The past week has been rough for XRP, with exciting developments failing to lift its price. While Ripple’s native token grabbed headlines with new ETF launches and discussions about potential staking features, the market responded with a sharp decline.

On November 20, XRP fell below the $2 mark for the first time since mid-October, trading at around $1.97.

This represents a 13% decline over the past week, even as Bitcoin’s drop below $87,000 triggered over $800 million in liquidations across the crypto market.

New ETF Products Hit the Market

The timing is particularly notable because XRP’s price decline coincided with Bitwise’s spot XRP ETF launch. The product began trading on the NYSE, joining Canary Capital’s offering, which launched a week earlier.

Milestone day for the XRP community!

This morning, the Bitwise XRP ETF began trading on NYSE (ticker: $XRP). With today’s launch, investors have a new, convenient way to get spot exposure to XRP, the crypto asset looking to disrupt the $250 trillion market for global payments.… pic.twitter.com/DA295tl6tO

— Bitwise (@BitwiseInvest) November 20, 2025

Despite the price weakness, institutional interest appears strong. Canary Capital’s ETF has already pulled in over $257 million, while Bitwise’s product saw $22 million in trading volume within its first few hours.

To attract investors, Bitwise is waiving its 0.34% management fee for the first month on the first $500 million in assets.

Ripple Explores Native Staking for XRP

RippleX Head of Engineering J. Ayo Akinyele and CTO David Schwartz shared early concepts for how native staking might work on the XRP Ledger. Currently, XRP transaction fees get burned rather than distributed to network participants.

Staking would create reward mechanisms similar to Ethereum and Solana, potentially making XRP more competitive.

However, both emphasized these ideas remain highly exploratory. Any implementation would require major technical changes and extensive testing.

Schwartz outlined two potential approaches: a two-layer validator system with staking rewards or using network fees to support zero-knowledge proofs.

Market Signals Point to Weakness

On-chain data suggests XRP may face continued pressure. Glassnode reported that only 58.5% of XRP’s supply is currently in profit—the lowest level since November 2024, when the token traded at $0.53. This means roughly 41.5% of the supply (about 26.5 billion tokens) is held at a loss.

The share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when price was $0.53.

Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss — a clear sign of a top-heavy and structurally fragile market dominated by late buyers.

📉… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD— glassnode (@glassnode) November 17, 2025

Adding to the concern, whale activity shows large holders offloaded approximately 200 million XRP within 48 hours of the ETF launches—a significant distribution event that likely contributed to the price decline.

Some analysts believe it could take until 2026 before institutional flows through XRP ETFs meaningfully impact the crypto asset’s price, as issuers typically accumulate assets gradually rather than rushing in all at once.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.