XRP made headlines this week as the first U.S. spot ETF launched with explosive trading volume. However, the token’s price tells a different story. While institutional demand surged, XRP dropped 1% as broader crypto markets posted gains.

The REX-Osprey XRP ETF (XRPP) shattered expectations on its debut day. Trading volume hit $24 million within just 90 minutes.

This figure crushed previous XRP futures products by five times. Bloomberg ETF analyst Eric Balchunas called the performance remarkable for a day-one launch.

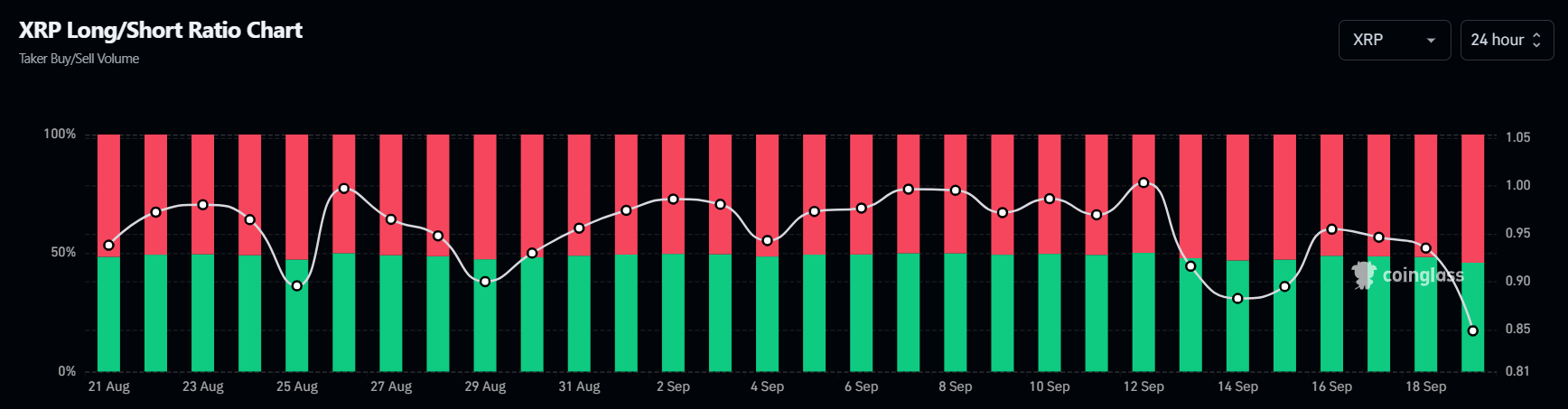

Market Sentiment Turns Bearish Despite Institutional Interest

Traders remain skeptical about XRP’s short-term prospects. The long/short ratio fell to a 30-day low of 0.848. This means more traders are betting against XRP than for it. Futures markets show a clear bearish bias despite the ETF success.

The disconnect between institutional and retail sentiment creates an interesting dynamic. Large financial firms see value in XRP’s utility for payments. Retail traders worry about near-term price action.

XRP Faces Critical Price Levels

Price action shows XRP trading near important support at $2.87. A break below this level could trigger more selling. Bulls need to push above $3.22 resistance to shift momentum.

The broader crypto market context matters here. Bitcoin and Ethereum posted gains while XRP lagged. This relative weakness concerns technical traders.

Meanwhile, institutional adoption continues growing. Ripple announced partnerships with DBS Bank and Franklin Templeton.

These deals bring tokenized money market funds to the XRP Ledger. Such developments support long-term value but may not impact short-term prices.

Cardano founder Charles Hoskinson recently praised Ripple as an “industry pillar.” This cross-project support signals growing unity as regulatory pressure increases across crypto.

For traders, the key question remains timing. Institutional money flows into ETFs slowly. Retail sentiment can shift quickly based on technical levels and market news. Smart money might wait for clearer directional signals before making major moves.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.