XRP wrapped up Q2 2025 sitting pretty as the fourth-biggest crypto by market cap at $132 billion. That’s an 8.5% bump from the previous quarter, though it didn’t keep pace with Bitcoin, Ethereum, and Solana’s combined 23.4% jump.

The big story here is what’s coming next. The SEC finally released its crypto ETF rules in July, and XRP checks all the boxes.

You need six months of futures trading before getting ETF approval, and XRP hit that milestone when it launched on Coinbase Derivatives in April and CME in May.

Eight companies have already filed to launch XRP ETFs, so we’re looking at approval sometime this fall.

Corporate buyers are also piling in. Following MicroStrategy’s playbook, companies have committed over $1 billion to XRP purchases. Trident Digital Tech Holdings leads the pack with $500 million, followed by Webus International at $300 million.

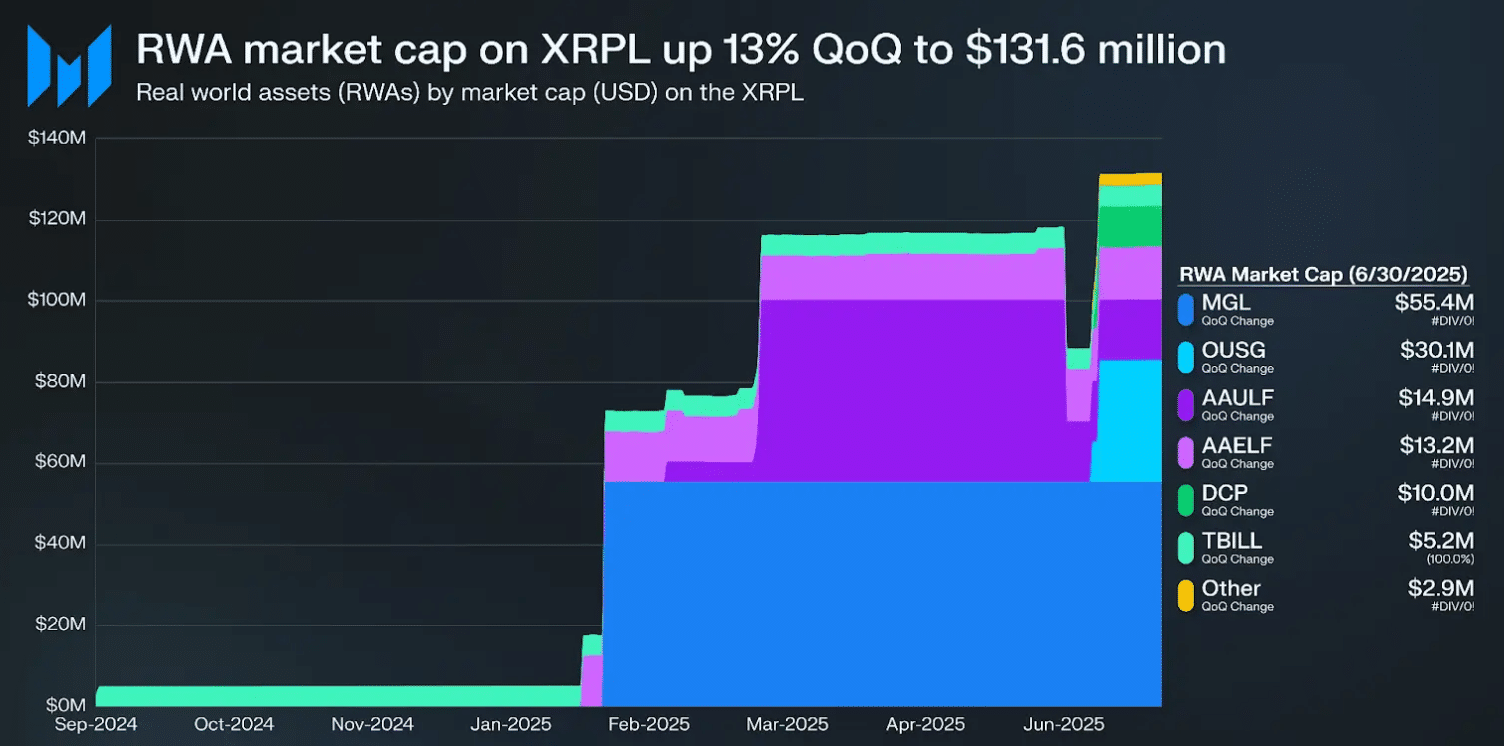

Real-World Assets Hit New Heights

The tokenized asset space on XRP Ledger exploded in Q2. Real-world assets (RWAs) reached a record $131.6 million market cap. Ondo brought their treasury fund to XRPL, Guggenheim launched digital commercial paper, and Dubai started tokenizing real estate through Ctrl Alt.

This growth makes sense when you look at XRPL’s compliance features. Token issuers can claw back assets if regulators demand it, just like traditional banks. That’s huge for institutions that need regulatory cover.

Ripple’s stablecoin RLUSD also gained serious traction, growing to $65.9 million market cap on XRPL alone. Circle joined the party by launching USDC, while regional players added euro and Singapore dollar options.

XRP Network Activity Shows Mixed Signals

The numbers tell an interesting story about actual usage. Total addresses grew to 6.5 million, but daily active users dropped 41.2% to 75,200. Transaction fees fell 38.7% in dollar terms to $680,900.

This disconnect suggests speculation drove much of the price action rather than organic usage. For traders, this means watching network metrics closely as ETF approval approaches.

The August legal settlement with the SEC removes a major overhang. XRP’s retail sales are definitively not securities, giving institutions confidence to build on the platform.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.