Ripple has achieved a landmark victory in its years-long legal battle with the U.S. Securities and Exchange Commission (SEC). On Thursday, both parties jointly agreed to drop their appeals, officially ending a lawsuit that began in late 2020.

#XRPCommunity #SECGov v. #Ripple #XRP BREAKING: The parties have filed a Joint Dismissal of the Appeals. The case is over. pic.twitter.com/QMATRLnxnS

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) August 7, 2025

This development marks a turning point for Ripple and the broader cryptocurrency industry.

The original case centered on whether XRP, Ripple’s native token, qualified as an unregistered security. In July 2023, Federal Judge Analisa Torres delivered a mixed ruling that proved crucial for the industry.

She determined that XRP sales on public exchanges did not constitute securities transactions due to their programmatic nature. However, direct sales to institutional investors were classified as unregistered securities offerings.

Judge Torres initially ordered Ripple to pay $125 million in penalties—significantly lower than the SEC’s requested $2 billion. This ruling triggered appeals from both sides, which have now been permanently dismissed.

Ripple Price Surge Reflects Market Optimism

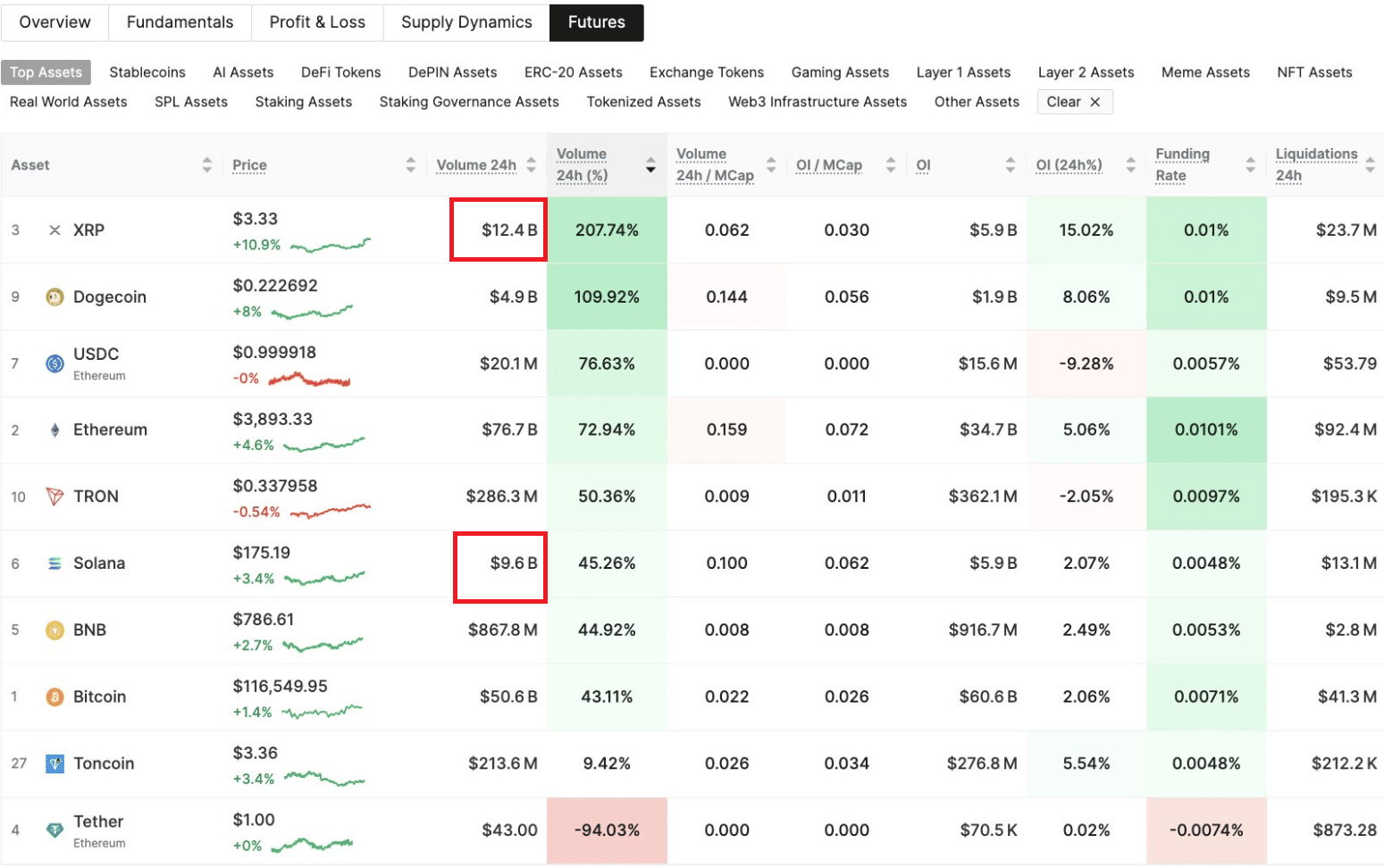

The lawsuit resolution has created substantial momentum for XRP’s price performance. The token jumped over 10% following Thursday’s announcement, with futures trading volume spiking more than 200% to reach $12.4 billion within 24 hours.

This volume surge even surpassed Solana’s $9.6 billion, according to Glassnode data.

Technical analysis suggests XRP has broken above a bull flag pattern, pointing to potential targets around $4.50—representing approximately 35% upside from current levels.

Multiple analysts have expressed bullish sentiment, with some projecting targets as high as $10 by year-end.

Strategic Acquisitions Signal Growth Ambitions

Beyond the legal victory, Ripple continues expanding its market presence through strategic acquisitions.

The company recently agreed to purchase Toronto-based payment firm Rail for $200 million, adding to its $1.25 billion acquisition of Hidden Road earlier this year.

These moves position Ripple to capitalize on the growing stablecoin market, which experts estimate could reach $2 trillion by 2028. The company’s RLUSD stablecoin has already surpassed $500 million in circulation since its December 2024 launch.

The lawsuit’s conclusion removes a significant regulatory overhang that has suppressed XRP’s institutional adoption for nearly five years.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.