The Japan 225 market spent most of the sessions of the week in the red. However, there was a turn of events when Powell opened the door to a September rate cut. At this, the market leaped as investors picked up the hint of a fairer outlook for the stock market.

Key Levels

Resistance: 44,500, 45,500, 46,000

Support: 42,000, 40,500, 39,000

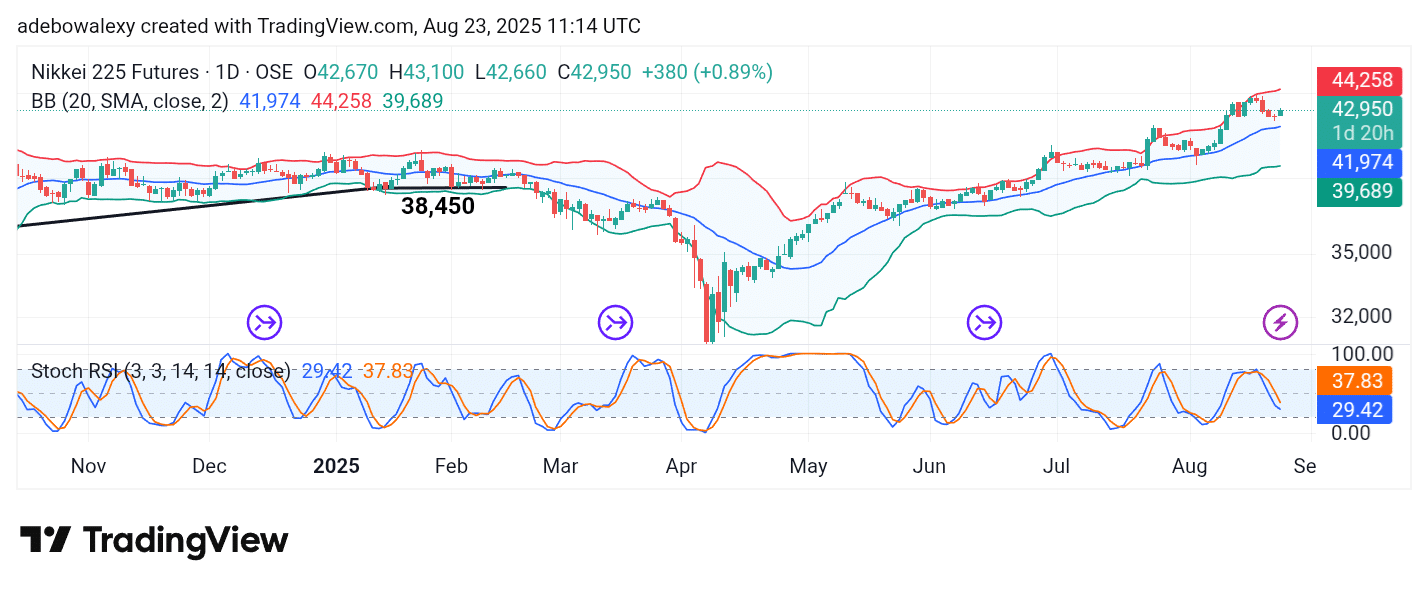

NIKKEI Resumes Upside Retracement Toward the 44,000 Mark

While the Japan 225 market had seen a smooth price decline in the previous session, we can see that the market managed to close in the green. However, the support off which the market had rebounded suggests that upside forces may have a good chance at recovering further upward.

This is observable as price action rebounded above the upper limit of the Bollinger Bands (BB) indicator. As a result, the Stochastic Relative Strength Index (SRSI) lines can be seen deflecting toward an upside crossover from the oversold region. This suggests that price action may proceed further upward subsequently.

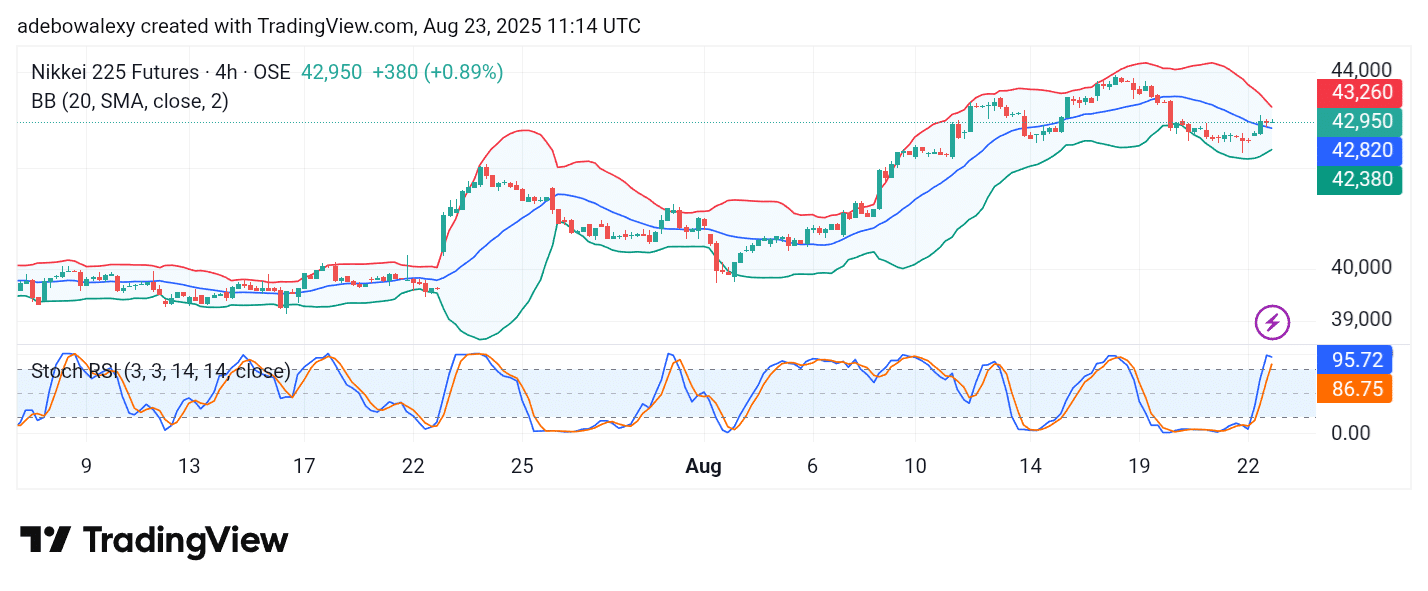

Japan 225 Market Thins Out but Retains a Good Base

The NIKKEI 225 market on the 4-hour chart has revealed that price forces are in a phase of indecision. This is observable via the spinning-top-like appearance of the last two price candles on the chart. However, this phenomenon can be seen occurring just above the middle limit of the BB indicator.

Likewise, the upper and lower limits of this indicator are converging with price action positioned above the mid-band. This technically hints at an impending strong one-sided move. In this case, it seems we may see a strong upward rebound. Meanwhile, the lines of the SRSI have reached the overbought region. Consequently, it appears that upward forces may further propel this market toward the 44,000 price mark subsequently.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.