Uniswap (UNI) emerged in 2021 as one of the largest decentralized exchanges and accounted for the lion’s share of DEX trading volume. Unlike centralized exchanges, DEXs like Uniswap use mathematical formulas to price assets in the market. The technology used in achieving this is called an automated market maker (AMM), and it eliminates the need for a third-party intermediary to set prices.

The original version of Uniswap was launched on the Ethereum blockchain in late 2018 and has since undergone numerous incremental upgrades and changes.

The native token, UNI, launched without an ICO or token sale in late 2020. Instead, UNI community members and liquidity providers received free airdrops of up to 400 UNI (worth $1,500 at the time).

The airdrop is one of the biggest innovations by Uniswap and has become a kind of standard practice for most token launches today.

Uniswap Revenue Structure

As a decentralized exchange, Uniswap has two streams of revenue for two main parties, including the INI development team and the liquidity providers (LP).

Uniswap Team Revenues

The protocol is managed by the Uniswap company, which was formed by Hayden Adams. In the last few years, the company has received notable financial backing from top institutional investors, such as Andreessen Horowitz, Paradigm VC, and Union Square Ventures.

Apart from its massive revenue reserves, the Uniswap protocol also makes some of its revenue from charging small fees on trades and transactions on the DEX, but the majority of this fund is paid out to LP.

Another revenue source for the team is the UNI token itself. While most of the tokens were airdropped at the launch of the project, 20% were kept in the protocol’s reserves. With a total supply cap of 1 billion UNI, these reserves amount to 200 million tokens worth $1.26 billion, using the current exchange rate.

Uniswap LP Revenues

Interested crypto holders have the freedom to become liquidity providers on UNI. Uniswap allows this freedom to encourage more people to become LPs on the blockchain, considering LPs are a sort of lifeblood for the exchange.

Instead of the traditional trading pair liquidity system adopted by centralized exchanges, which allows for transactions to happen in a peer-to-peer manner between buyer and seller, Uniswap adopts a liquidity pool method. With this method, the counterparty is not one person but a pool of funds.

Due to their importance to the network, LPs are rewarded massively by the protocol. As mentioned earlier, most of the revenues generated from transaction fees go to LPs as a reward. In 2021, over $1 billion generated in revenues went to liquidity providers.

Uniswap Revenue Timeline

Uniswap recorded a massive boom in 2020 following the launch of v2, which allowed users to trade whatever ERC-20 token pairs they desired. Before then (v1), users could only trade ERC-20 tokens against ETH.

After this upgrade, monthly revenues jumped from $4.8 million in July 2020 to $35 million by December of that year. However, this impressive performance was quickly overshadowed by the boom recorded in 2021 with the v3 upgrades.

By March 2021, the protocol had gained massive adoption and monthly revenues exceeded $100 million. Uniswap peaked in May of 2021, with revenues hitting a record high of $285 million. However, by November, monthly revenues had fallen to $180 million and have been on a downswing ever since amid the bearish bout plaguing the general crypto market.

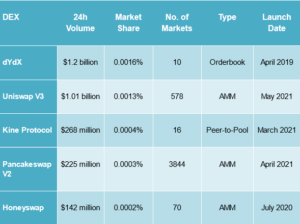

Over the past few months, several contenders have upped their game in the DEX space and are aiming to unseat UNI as the top DEX protocol. Some of these contenders include Compound (COMP), SushiSwap, PancakeSwap, Curve Finance, and dYdX.

Final Note

Uniswap currently faces an uncertain future as the crypto winter blows hard. While it still maintains a massive user base, it is steadily losing market share to DEXs not using the AMM model. Many liquidity providers are fighting massive battles to retain profits in AMMs due to what some have called “impermanent loss.”

Regardless, UNI has a history of being extremely innovative and delivering protocol game-changing upgrades. Also, Uniswap is more user-friendly and easy to navigate by the average user compared to tech-heavy protocols such as dYdX.

With more knockoffs and non-AMM protocols on the rise, Uniswap must innovate and bring new features to its protocol or risk losing its spot as a top DEX. It must also focus on improving user experience and building on its strengths.

That said, it is still too early to write off Uniswap to the sidelines as so much can change in the medium to long term.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.