Decentralized Finance, or DeFi, has emerged as a revolutionary force in the financial world, leveraging blockchain technology and smart contracts to redefine traditional financial services. Among the myriad applications of DeFi, decentralized loans stand out as a beacon of innovation, allowing users to borrow and lend crypto assets without the need for intermediaries like banks or centralized platforms.

The DeFi loan landscape is witnessing unprecedented growth in 2023, with demand and supply reaching unparalleled levels.

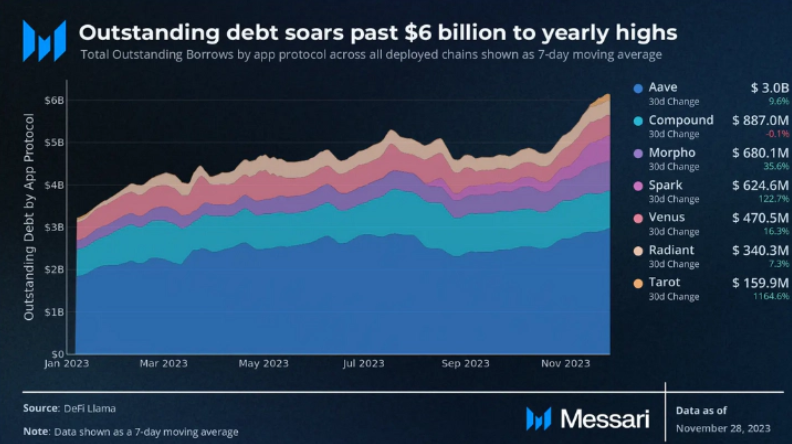

According to a recent report from Messari, a prominent crypto research firm, the total outstanding loans across the top seven DeFi lending platforms soared to an impressive $6 billion as of November 30. This marks the highest level this year and a notable surge since August 2022, indicating a substantial increase in users tapping into the advantages offered by DeFi loans.

What Makes DeFi Loans So Appealing?

Several factors contribute to the increasing allure of DeFi loans in 2023. Firstly, the surging prices and market caps of major crypto assets like Bitcoin and Ethereum, which reached yearly highs in November, serve as collateral for DeFi loans. This allows users to borrow more in USD terms against the same amount of crypto, unlocking additional financial opportunities.

Another driving force is the escalating demand for leverage in the crypto market. As optimism prevails and the market turns bullish, users seek ways to amplify their profits by borrowing more crypto to invest in various DeFi protocols, including yield farming, liquidity mining, and trading.

Moreover, the diversity and innovation within the DeFi lending space play a pivotal role. Platforms such as Aave and Compound offer users the flexibility to choose between fixed and variable interest rates based on their risk appetite and market expectations.

Additionally, platforms like Tarot and Spark incentivize borrowers and lenders with governance tokens, airdrops, and discounts, adding an extra layer of engagement.

Leading DeFi Lending – Guide, Tips & Insights | Learn 2 Trade Platforms

Among the top seven DeFi lending platforms, Aave emerges as the clear frontrunner, boasting $3 billion in outstanding loans, capturing half of the total market share. Aave’s recent 9.6% increase in debt over the past thirty days is attributed to its innovative features, including flash loans, credit delegation, and liquidity mining.

Compound secures its position as the second-largest platform, with $887 million in debt, characterized by its simple design and the COMP token, providing users with a stake in the protocol’s governance.

In the third spot is Spark, a newcomer rapidly gaining traction with a debt increase of over 100% in the last thirty days, reaching $624 million.

Spark, functioning as a layer 2 solution, focuses on reducing transaction costs and latency, along with enabling cross-chain interoperability. A unique feature offered by Spark is airdrop farming, which allows users to earn tokens from other DeFi projects by participating in lending activities.

Tarot, the fourth-largest platform, experienced an astonishing 1,164% monthly increase, reaching $159 million in debt. As a Compound fork, Tarot prioritizes optimizing capital efficiency and maximizing returns for users, introducing the Tarot Oracle, a feature providing accurate and reliable price feeds.

The remaining platforms in the top seven include Maker, the oldest and most established DeFi lending platform allowing users to create the stablecoin DAI, and Venus, another Compound fork tailored for the Binance Smart Chain ecosystem.

The Future of DeFi Loans

DeFi loans are poised to remain a driving force in the ongoing DeFi revolution, offering users financial services that are more accessible, flexible, and efficient than their traditional counterparts. As the crypto market matures, several opportunities and challenges lie ahead for DeFi loans:

- Integration of Layer 2 Solutions: Solutions like Spark are set to enhance the scalability, speed, and affordability of DeFi transactions, fostering cross-chain compatibility and interoperability.

- New Collateral Types: The emergence of collateral types such as NFTs, real-world assets, or synthetic assets can diversify and enhance the utility of DeFi loans, opening up new use cases and markets.

- Regulation and Compliance: The regulatory landscape remains a double-edged sword, presenting both threats and opportunities. Clear guidelines can provide legal recognition and support while addressing potential challenges like taxation, KYC, AML, and consumer protection.

- Security and Reliability: DeFi loans must tackle potential threats to security, such as technical issues, human errors, or malicious attacks. Robust mechanisms, including audits, insurance, and governance, are crucial to ensuring user safety and trust.

Final Word

2023 has seen DeFi loans shatter records, and the trajectory suggests this trend will persist. Beyond being a means to borrow and lend crypto, DeFi loans enable active participation in and contribution to the DeFi movement, reshaping the financial landscape and beyond.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.