Market Analysis – July 4

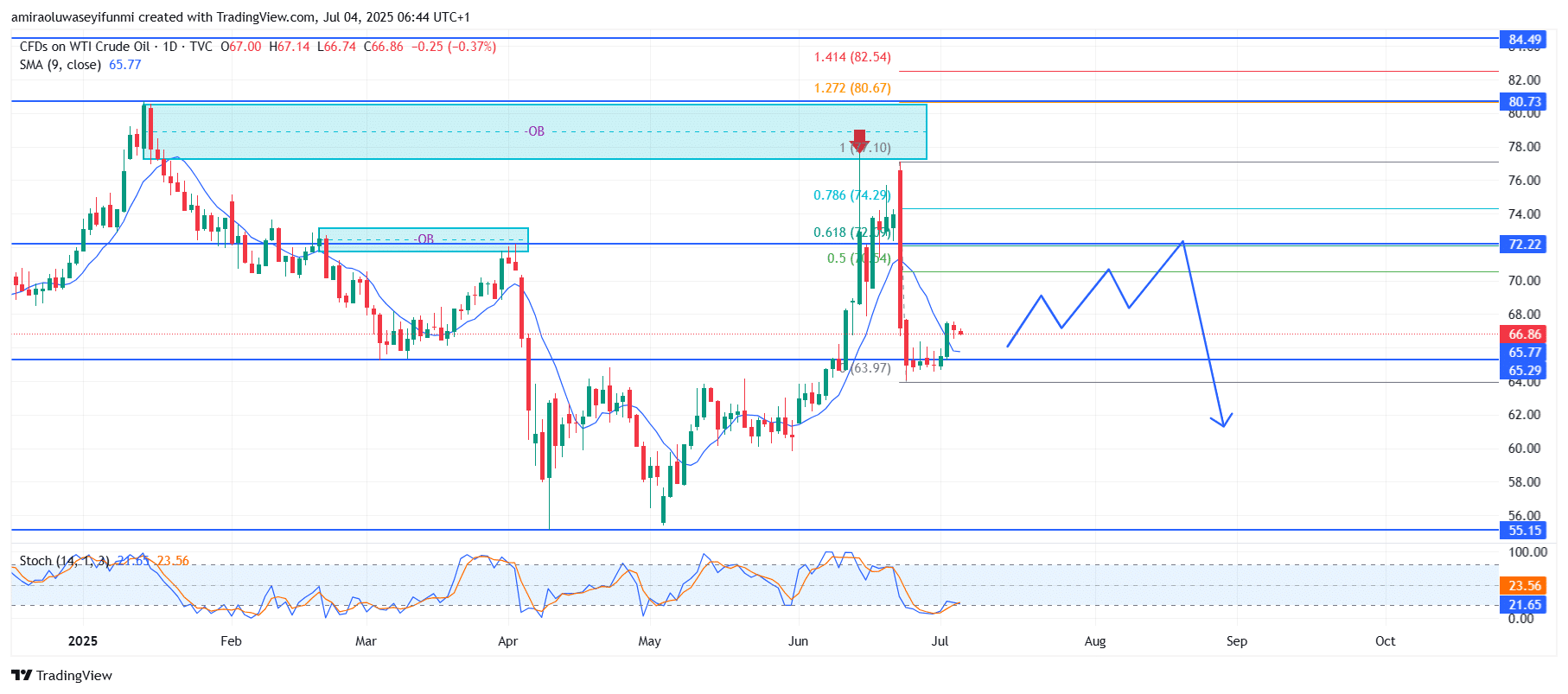

USOil signals a bearish rejection from the premium supply imbalance region. The USOil daily chart shows a strong rejection from the premium supply zone near $78.00, aligning with the 1.0 Fibonacci retracement level of the previous decline. Price action has since moved below the 9-day Simple Moving Average, currently positioned at $65.80, indicating a shift from a bullish expansion phase to a corrective decline. The Stochastic Oscillator remains near oversold territory at approximately 23.60, reflecting weakening buying pressure and suggesting a possible continuation of the downward move.

USOil Key Levels

Resistance Levels: $72.20, $80.70, $84.50

Support Levels: $65.30, $55.20, $52.00

USOil Long-Term Trend: Bearish

Structurally, price has formed a clear swing high just below the $77.10–$80.70 order block, an area where substantial liquidity was absorbed before the reversal occurred. The inability to break above the $72.20 resistance level has further confirmed bearish dominance in the market outlook.

Looking forward, the technical setup supports a continued bearish trend, with expectations of deeper retracements. A likely scenario involves a temporary consolidation or rebound toward the $70.00–$72.20 zone to attract liquidity, followed by renewed bearish pressure driving prices down toward the $65.30 and $55.20 support levels. If bearish momentum strengthens, a firm close below $64.00 could pave the way for a sharper drop toward $55.20 over the medium term. Traders may benefit from integrating forex signals into their strategy for clearer directional cues.

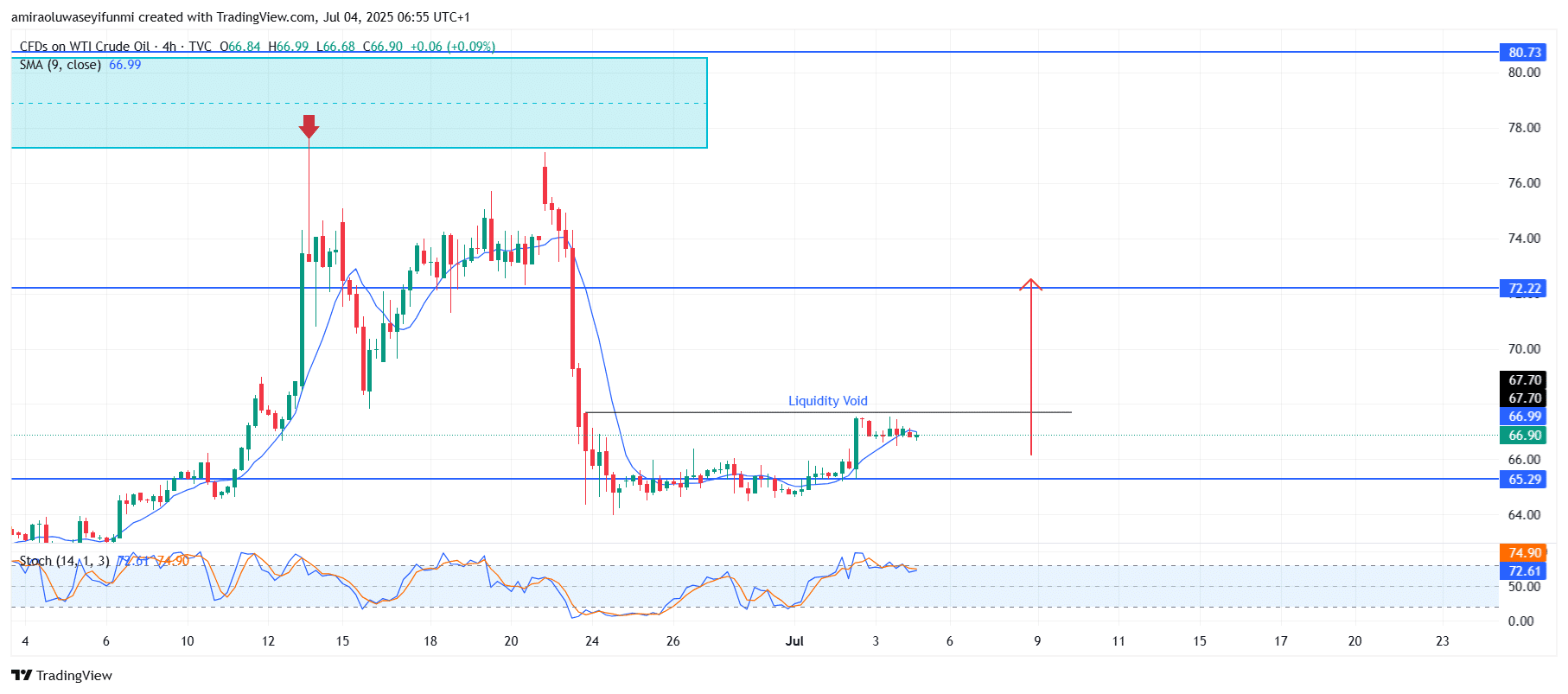

USOil Short-Term Trend: Bullish

USOil currently exhibits short-term bullish momentum after filling the previous liquidity void, with price consolidating just above this zone. The 9-period SMA is now positioned below the price action, confirming short-term upward pressure.

The Stochastic Oscillator is in the overbought region, indicating strong buying interest but also pointing to the possibility of brief pullbacks. A likely short-term target for buyers is the $72.20 resistance level, with potential continuation toward $80.70 if the momentum persists.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.