Decentralized Physical Infrastructure Networks (DePIN) are fundamentally changing how the world builds and operates critical infrastructure.

According to The Block’s 2025 report, this emerging sector has attracted over $744 million in venture capital funding since early 2024, with more than 165 disclosed deals signaling strong institutional confidence in distributed infrastructure models.

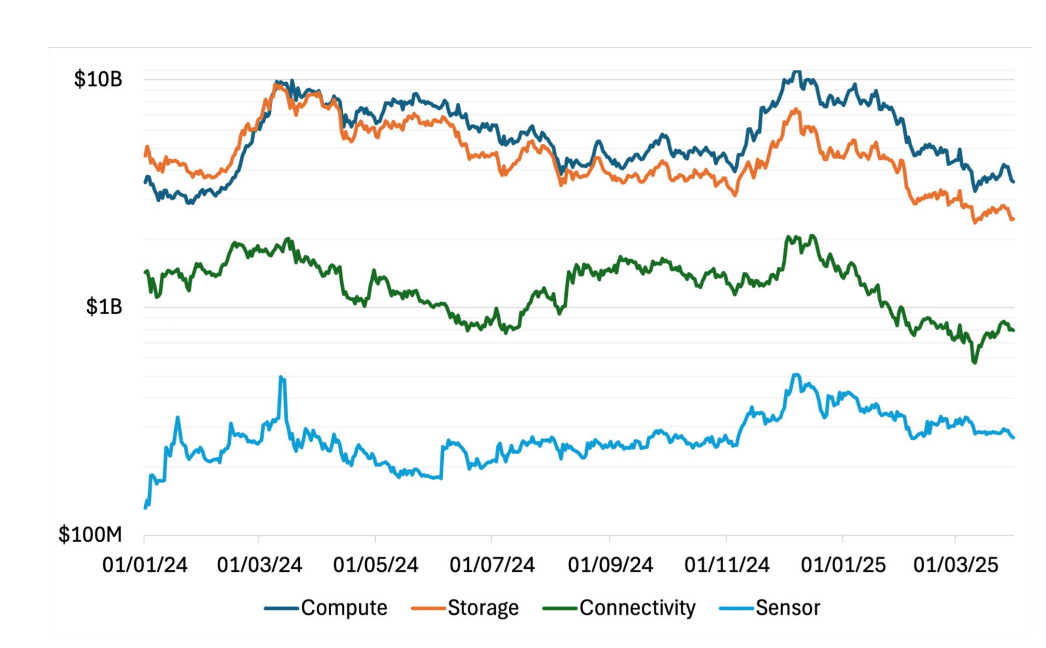

The DePIN ecosystem spans four primary sectors: computation, storage, connectivity, and sensor networks. Each category addresses specific infrastructure bottlenecks through token-incentivized participation models that coordinate distributed resources at scale.

Market Performance Shows Strong Sector Correlation

Market analysis reveals that leading DePIN tokens like Bittensor’s TAO and Render Network’s RENDER experienced significant price movements throughout 2024, with compute and storage sectors each surpassing $10 billion market capitalizations at their peaks.

The data shows a 77.6% correlation between these sectors, indicating shared market dynamics despite different technical architectures.

Performance patterns suggest DePIN tokens remain closely tied to broader crypto market cycles, with TAO demonstrating periodic decoupling before reverting to sector trends. This correlation underscores how macro sentiment continues to influence project valuations despite growing real-world utility.

Technical Innovation Driving Practical Application of DePIN

DePIN projects are solving tangible infrastructure challenges through innovative tokenomics and distributed coordination mechanisms. Companies like io.net aggregate underutilized GPUs for AI workloads, while Hivemapper creates real-time mapping data through community-contributed dashcam footage.

These applications demonstrate how token incentives can mobilize distributed resources more efficiently than traditional infrastructure models.

The report highlights several breakthrough partnerships, including io.net’s integration with Dell as an official cloud service provider and Helium’s collaboration with AT&T for mobile traffic offload capabilities. These enterprise partnerships validate DePIN’s technical maturity and commercial viability.

Looking ahead, The Block’s analysis positions DePIN as critical infrastructure for the AI economy, providing democratic access to computational resources while maintaining decentralized governance.

As hardware costs decrease and regulatory frameworks evolve, DePIN networks are expected to capture increasing market share from traditional centralized infrastructure providers.

The sector’s growth trajectory suggests 2025 will be pivotal for mainstream DePIN adoption across multiple industries.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.