Market Analysis – October 31

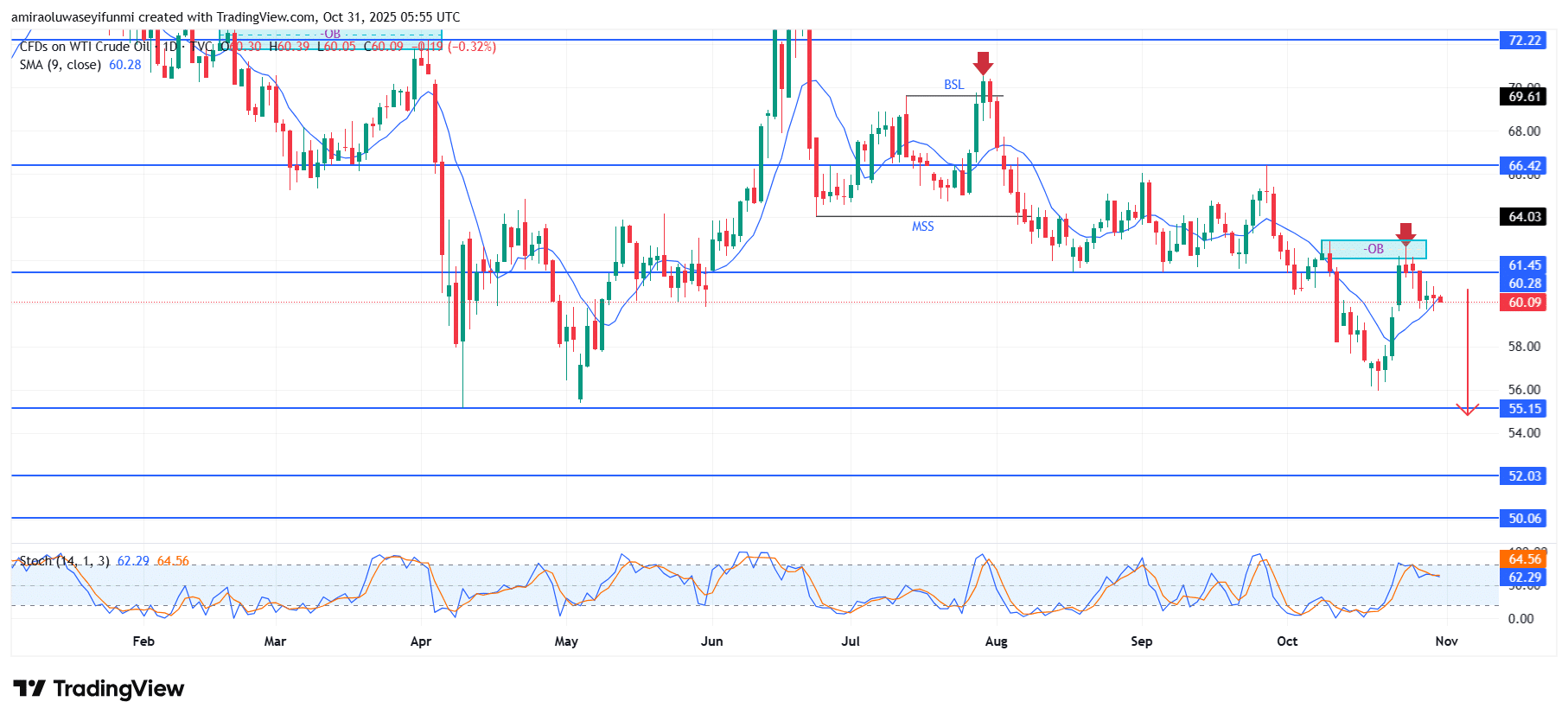

USOil extends its downside trajectory amid eroding buyer conviction. The commodity maintains its prevailing bearish outlook, showing a gradual decline in momentum across both short- and medium-term structures. The 9-day Simple Moving Average (SMA), fluctuating around $60.280, currently acts as a dynamic resistance level, suppressing any meaningful upward retracement. Meanwhile, the stochastic oscillator is descending from the overbought zone, signaling weakening buying interest and reinforcing the prevailing bearish sentiment that continues to shape the broader energy market.

USOil Key Levels

Resistance Levels: $61.50, $66.40, $72.20

Support Levels: $55.20, $52.00, $50.10

USOil Long-Term Trend: Bearish

From a technical standpoint, the asset recently faced rejection around the order block (OB) region near $61.450, confirming renewed selling activity at that resistance level. The emergence of a consistent lower-high formation, alongside a prior Market Structure Shift (MSS), underscores sustained bearish control. Multiple failed attempts to break above the $64.030 level further emphasize the persistent influence of sellers and the market’s limited capacity for meaningful upward recovery.

Looking ahead, the bearish bias is expected to persist, with price action potentially extending toward the $55.150 support area. A decisive break below this point could expose deeper liquidity zones around $52.030 and $50.060 if downward momentum continues. However, a brief retracement toward the $61.000–$61.450 region remains possible before sellers regain full control, maintaining the overall bearish framework and providing critical insights for traders monitoring forex signals.

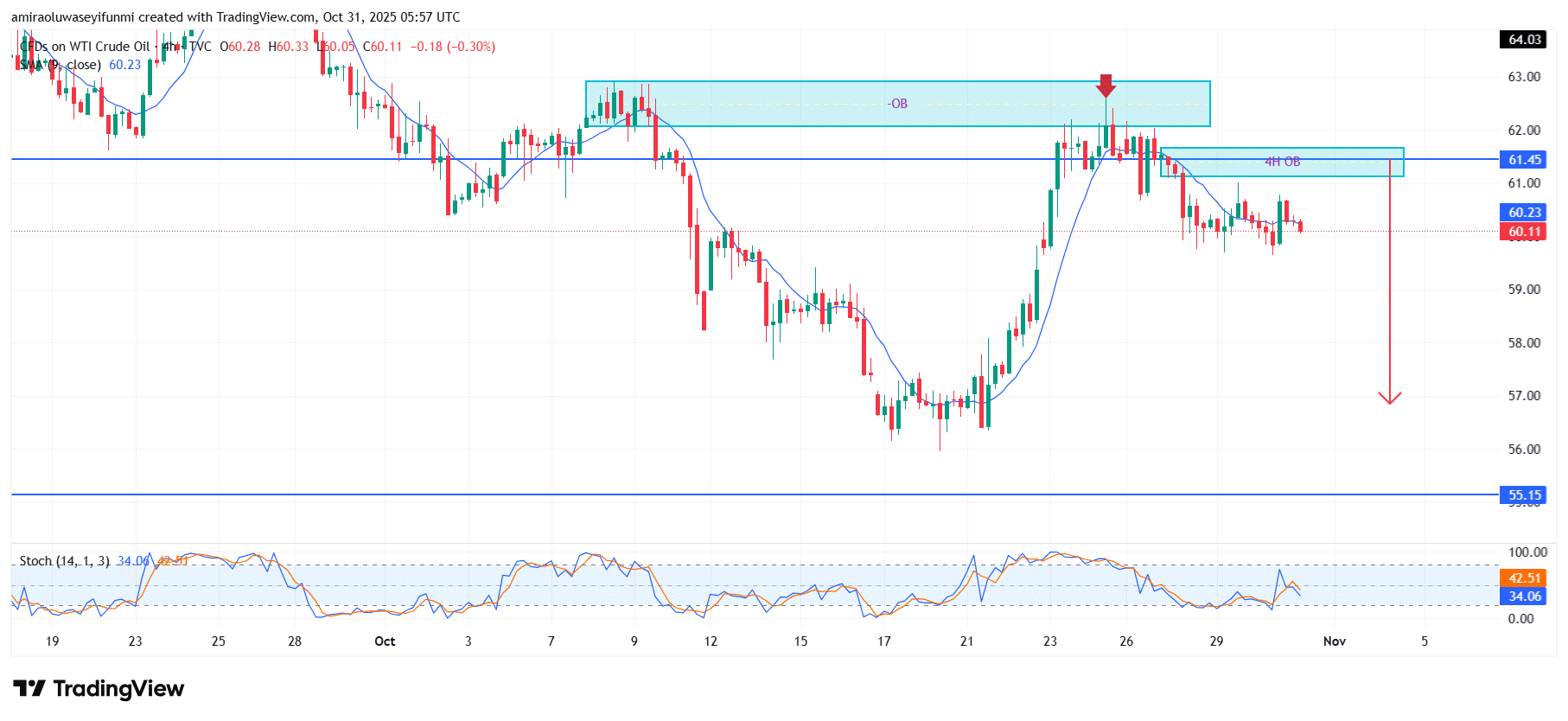

USOil Short-Term Trend: Bearish

USOil continues to face strong bearish pressure, with price movement remaining below the 9-day SMA near $60.230, highlighting persistent weakness in buyer momentum. The recent rejection from the $61.450–$62.000 order block validates active selling interest and reinforces the ongoing downward bias.

The Stochastic Oscillator shows a modest recovery from the oversold region but lacks strong momentum, suggesting limited potential for a significant rebound. A further decline toward the $55.150 support zone appears likely if sellers maintain their dominance in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.