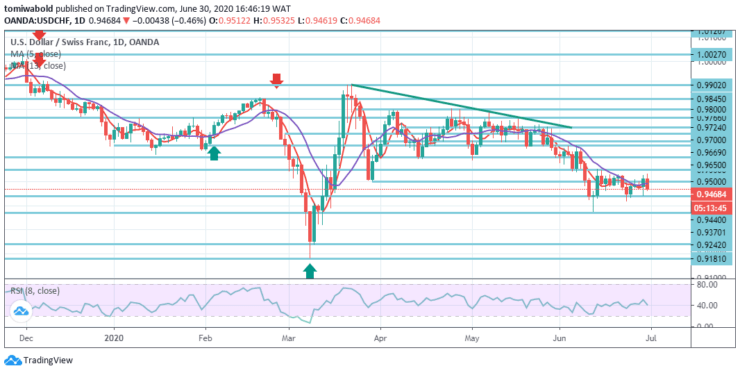

USDCHF Price Analysis – June 30

Although the USDCHF gained more than 30 pips in the prior session on broad-based USD strength and the bullish market mood. It has lost its momentum, however, and returned to trade beneath the level of 0.9500, where it was down 0.35% on the day. As attention turns to Powell’s statement, the US Dollar Index is up 0.12 percent, holding the selling bias intact.

Key Levels

Resistance Levels: 1.0027, 0.9766, 0.9550

Support Levels: 0.9440, 0.9370, 0.9181

Within the wider context, the decrease from level 1.0231 is perceived as the third step of the trend from level 1.0342. Having reached 0.9242 main support (low) level, it should have finished at 0.9181 level.

The breach of level 0.9902 may expand the recovery from level 0.9181 to resistance level 1.0027. After all, medium to long-term trade in ranges is inclined to maintain for some longer between 0.9181/1.0231 levels.

For the moment, the intraday bias in USDCHF is still neutral. Lower than 0.9440 minor support level on the downside may bring 0.9370 low-level retests. The break may restart the entire decline from 0.9902 and aim 100 percent projection from 0.9902 to 0.9500 at 0.9242 levels.

On the positive, a steady breach of 0.9550 level will instead restart the recovery from level 0.9370. In this scenario, it might look to yet another rally (now at 0.9600 level).

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.