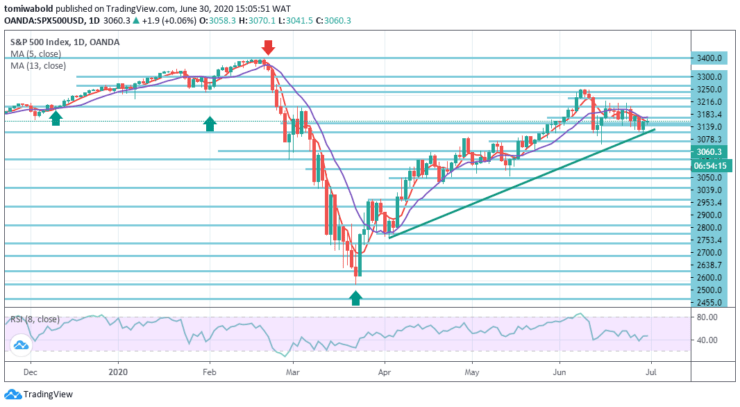

S&P 500 Price Analysis – June 30

The S&P 500 potentially stays beneath 3078.3 level to hold the initial risk lower for a leap beneath its moving average of 13 during its wider corrective period. The S&P 500’s most recent high at 3233 levels around the region corresponded to the moment when COVID-19 incidents shot up again.

Key Levels

Resistance Levels: 3250, 3139, 3078

Support levels: 3050, 3000, 2953.4

The daily bias holds beneath the level at 3078.3 to proceed to potentially cap with support initially seen at level 3050, then the ascending trendline at level 3039. A close rear beneath here may add additional volume to the corrective view with support next seen at 3000 levels beyond the 2953 level.

It is appropriate to see a further price complete below the support level at 2953 to increase the possibility of further weakness with support at level 2900. The perfect path is for a 2800-level eventual test of the 38.2 percent retraction of the entire rally from April.

On the 4-hour time frame, the technical indicator confirms that some support awaits the S&P 500 at around 3050 level, which is the convergence of the 5 and 13 moving average. Stronger support awaits at level 3000, which is the meeting point for the horizontal line and the ascending trendline.

However, within the short-term oscillators, a contradictory scene is painted which reflects the optimism of further progress, while the RSI soars past the 50 levels after a bounce. On the upside, initial resistance might emerge at moving average 5 and, should such obstacles be overcome, an area of 3139-level highs may come into view.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.