USDCHF Price Analysis – October 30

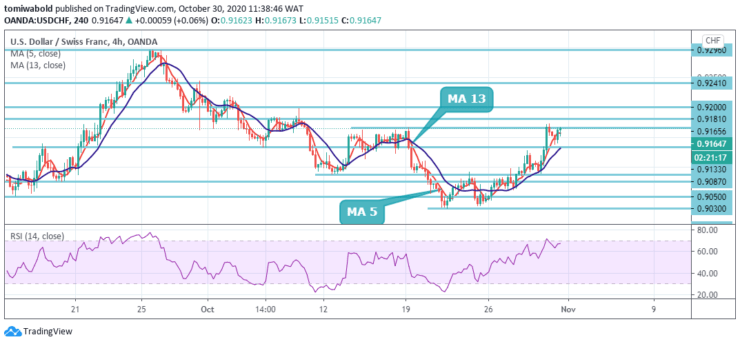

The USDCHF is increasing for the 5th day in a row on Friday as its upsurge hits 14 days high beyond the 0.9150 marks. The pair has accelerated its uptrend supported by the broad-based USD strength as US Dollar Index clings to positive gains above 94.00.

Key Levels

Resistance Levels: 0.9296, 0.9241, 0.9165

Support Levels: 0.9087, 0.8998, 0.8746

USDCHF rallied beyond the 5 and 13 moving averages and is now testing the 0.9160/65 resistance area. A break above could lead to a test of the 0.9200 level. Even a close near current levels could exacerbate a near-term bullish trend. A slide below 0.9133 would ease the bullish pressure to reveal the next support at 0.9087.

In a broader context, the decline from 1.0231 is seen as the third phase of the trend from 1.0342 (high). There are no clear signs of completion yet. On resumption, the next target is 138.2% forecast from 1.0342 to 0.9181 from 1.0231 at 0.8746 levels. However, a strong breakout of the 0.9296 resistance level would be an early sign of a trend reversal and would draw attention to the key 0.9902 resistance level for confirmation.

Attention is now focused on the 0.9165 resistance area as the rebound from 0.9030 continues. A solid break there will indicate that the corrective pattern from 0.8998 has started the third cycle. The short-term oscillators are currently reflecting an improvement in positive momentum. RSI is trying to maintain a positive trajectory towards 70 levels.

Primarily, the intraday bias will be upward towards the 0.9296 level. The break could approach the 38.2% retracement from 0.9902 to 0.8998 at 0.9362 levels. On the other hand, a breakout of the 0.9030 level would retest the 0.8998 low.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.