On aggregate, the tech behemoths posted strong earnings figures, especially considering the COVID-19 economic crisis backdrop. All four companies posted better-than-expected earnings and revenues. However, hours after these figures dropped, Amazon and Apple stocks have seen negative price action so far; Facebook remains almost unchanged, while Alphabet climbs higher.

Big-4 Earnings Report

Apple recorded significant growth in its Q3 figures and made a record-breaking revenue of $64.7 billion. However, the recent weakness seen in Apple stock performance is likely as a result of the weaker-than-expected iPhone sales this year.

Amazon reported strong Q3 figures with $12.37 per share post-dilution, trumping estimates. The company also recorded a staggering $96.1billion in revenue.

Alphabet Inc. recorded a strong $38.01 billion in quarterly revenue, beating estimates of $35.35 billion. An Alphabet executive stated that this revenue jump was as a result of increased advertiser revenue across its search and YouTube platforms.

Facebook’s active daily users’ number, a key metric used by investors to evaluate the company, was at 1.82 billion in September, a 12% YoY spike. However, the company expects significant uncertainty in its numbers next year.

It will be interesting to see how the index reacts to all these amid the growing US political tensions and the second wave of the virus ravaging the globe.

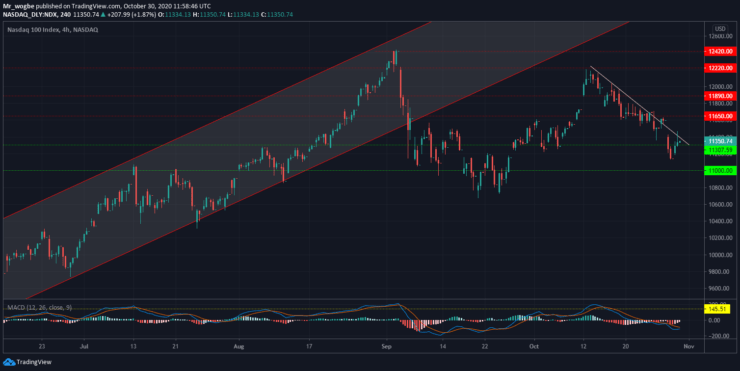

Nasdaq 100 (NDX) Value Forecast — October 30

NDX Major Bias: Bullish

Supply Levels: 11495, 11560, and 11890.

Demand Levels: 11307, 11000, and 10680.

The Nas100 appears to be recovering from the brutal sell-off from two days ago. However, the index was met with fresh bearish pressure at the 11495 resistance earlier today—based on pre-market data. Although uncertainty is ruling the market at this point, we should expect a decent bullish price action today.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.