USDCHF Price Analysis – September 18

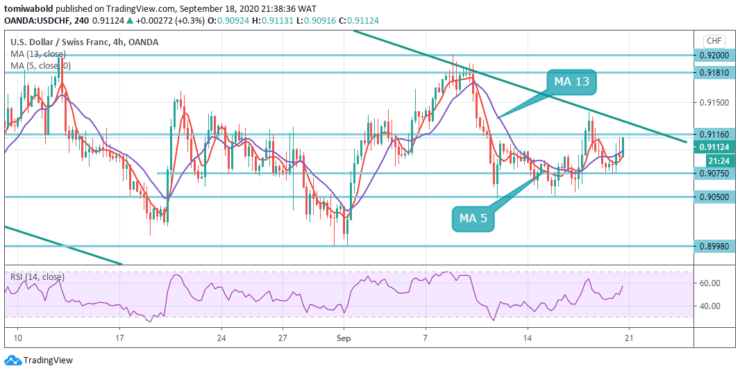

The USDCHF pair maintained its upside tone through the early North American session, with bulls making a fresh attempt to build on the momentum further beyond the 0.9100 marks. The greenback struggled to capitalize on the post-FOMC short-covering move and came under some fresh selling following the prior day’s weaker US economic data.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9200

Support Levels: 0.9050, 0.8845, 0.8639

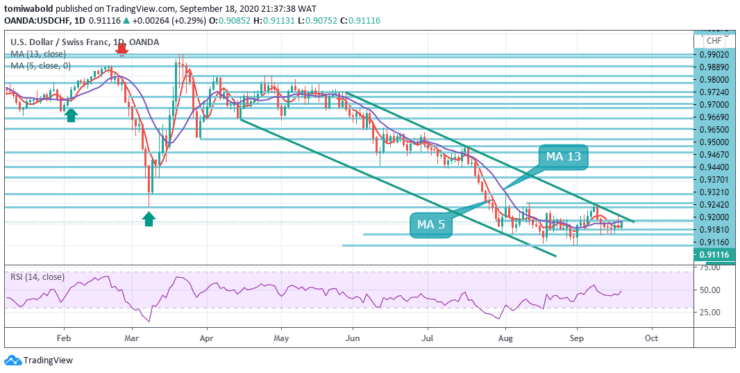

As seen on the daily, the risk-off mood might undermine the Swiss franc’s safe-haven demand and keep a lid on any strong gains for the USDCHF pair, warranting some caution for bullish traders. Hence, it will be prudent to wait for some strong follow-through buying, possibly beyond the overnight swing high, around the 0.9140 regions.

The sustained trading below 100% projection of 1.0342 to 0.9242 from 1.0231 at 0.9081 levels will pave the way to 138.2% projection at 0.8639 levels. On the upside, a break of 0.9370 level resistance is needed to be the first sign of medium to long term bottom.

USDCHF is extending the consolidation pattern from 0.8998 low level and intraday bias remains neutral at this point. On the downside, a break of 0.8998 low level will resume a larger downtrend.

Nevertheless, a break of 0.9200 level will resume the rebound towards 38.2% retracement of 0.9902 to 0.8998 at 0.9321 levels. On the contrary, a downside break of the immediate support line near 0.9075 level may take rest near 0.9050 levels before challenging the month-start bottom around the 0.9000 round-figures.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.