The intensity of selling pressure it garners in this area indicates that bulls may not be dominating as once believed. This could mean that BTC could be on the brink of another major decline.

However, despite the lingering weakness, the current holdings of whales paint a different picture for the near-term possibility of the benchmark cryptocurrency.

Recent data from a crypto analytics firm, CryptoQuant, shows that whales are firmly holding on to their positions despite several rejections from the $11k level. The CEO of the firm made this announcement via Twitter, explaining that the Exchange Whale Ratio has now reached a fresh yearly low, keeping in mind that lower whale selling bolsters Bitcoin.

If this trend continues, it could indicate that there would be less macro selling pressure, which could help its bullish prospects in the coming days and weeks.

Key BTC Levels to Watch

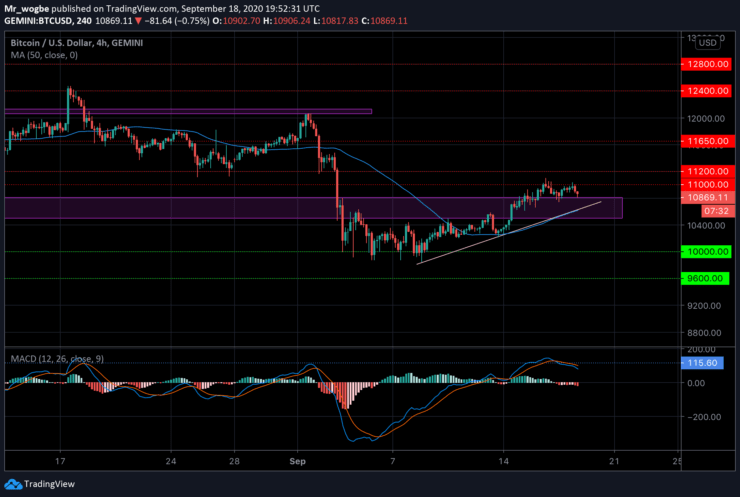

At press time, Bitcoin is trading lower around $10,860. It has been trading in a tight range between $11,050 and $10,700 for about three sessions now. As mentioned earlier, bulls have failed multiple times to clear the $11k resistance despite backing by whales. Every attempt has been met with strong selling pressure, which drives the price lower.

Meanwhile, bulls have likewise kept Bitcoin from falling below $10,800. However, a fall below that level will likely be supported strongly by the confluence of indicators below (ascending trendline and 50 SMA) at $10,600.

Total market capital: $350 billion

Bitcoin market capital: $201 billion

Bitcoin dominance: 57.4%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.