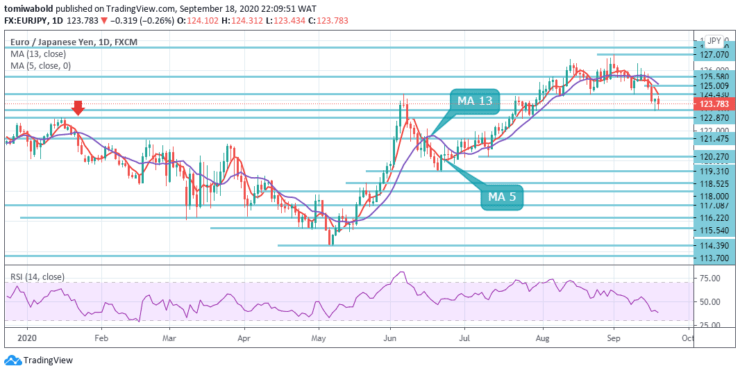

EURJPY Price Analysis – September 18

The persistent buying interest in the Japanese safe-haven continues to put EURJPY under pressure and forces it to extend the plunge to the 123.43 regions on Friday, or fresh 2-month lows. The recovery in the greenback following Wednesday’s FOMC event has been weighing on the sentiment surrounding the risk complex.

Key Levels

Resistance Levels: 127.07, 126.78, 124.43

Support Levels: 123.37, 121.47, 119.31

At the moment the cross is losing 0.23% at 123.83 level and a drop below 123.37 (low level of Sep.18) would aim for a 122.87 low level and finally 122.00 marks. On the upside, the next up barrier is located at 125.58 high level followed by 127.07 (2020 high Sep.1) level.

Following a brief test of the 124.43 regions, the selling bias resurfaced in EURJPY in response to the strong sentiment favoring the Japanese yen. The cross not only broke below the 124.00 marks soon afterward, but it also recorded fresh multi-week lows in the vicinity of 123.43 level.

EURJPY recovers after hitting the 123.43 level and intraday bias are turned bearish first. A further fall is expected as long as 125.00 near term resistance level holds. The fall from 127.07 level is correcting the rise from 114.42 level.

The break of 123.37 level will target a 38.2% retracement of 114.42 to 127.07 at 122.87 levels and also the risk will now stay on the downside as long as the 127.07 resistance level holds, even in case of a strong recovery.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.