USDCHF Price Analysis – September 29

USDCHF plunges lower and traded around intraday low at 0.9200 level, currently down 0.54% on a day beneath 0.9200 level, while heading into Tuesday’s American session. The selling pressure on the USD seems to be causing the pair to remain under bearish pressure with the US Dollar Index (DXY) falling for 2nd day in a row at 94.04.

Key Levels

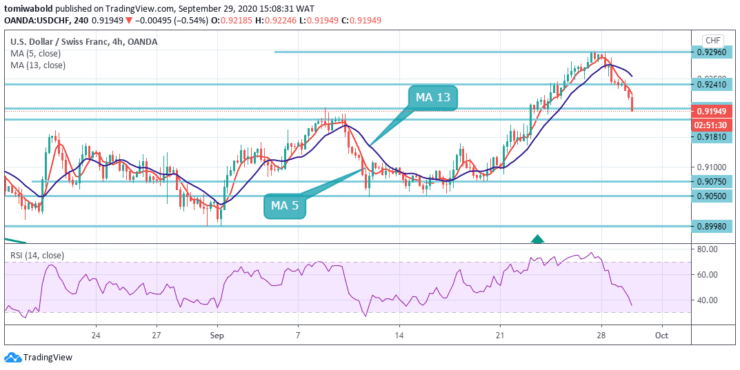

Resistance Levels: 0.9467, 0.9362, 0.9241

Support Levels: 0.9181, 0.9075, 0.8998

The USDCHF is likely to weaken further towards an area comprising highs marked since August 12, close to 0.9200 level. Meanwhile, 0.9241 and 0.9280 levels can offer immediate resistance to the pair ahead of fueling it to the monthly high of 0.9296 level.

The decrease from the 1.0231 level is seen as the third phase of the trend from the 1.0342 (high) level in the wider sense. There is still no definite mark of closure. Even so, an inevitable consequence of trend reversal might be a strong break of 0.9362 support turned resistance level but may shift attention back to 0.9902 key resistance for validation.

The pullback of USDCHF from the level of 0.9296 today extends lower but stays beneath the level of support that turned as 0.9200 resistance. The intraday bias holds firm and it is still in support of another increase. The recovery from 0.8998 level to 38.2 percent retracement from 0.9902 to 0.8998 at 0.9362 levels would be extended by a breach of 0.9296 level on the upside.

A continuous breach of 0.9200 level, moreover, may suggest that the recovery has ended and turn bias back to the downside for the 0.8998 level to be re-tested. The short-term bias is still neutral, and a lower split may open the path for further losses.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.