S&P 500 Price Analysis – September 29

S&P 500 declines to 3343 levels, after hitting up to 3374 level intraday high, amid the initial hour of European open on Tuesday. Brexit hopes expectations of US stimulus keep trading sentiment unwavering towards the 3400 levels.

Key Levels

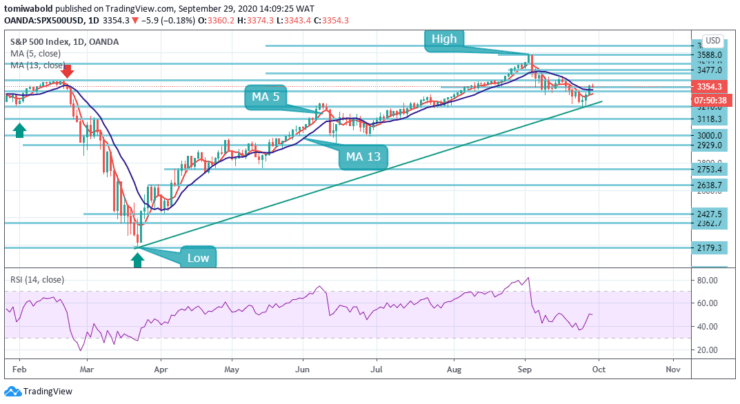

Resistance Levels: 3522, 3477, 3400

Support Levels: 3318, 3210, 3118

A rebound from 3210 near term low level suggests the S&P 500 could rise to 3400 levels, targeting potential upside of September 17. A longer-term target of 3588 levels from the technical-analysis pattern is in motion. If the index fails to close the day above the moving average 5 and 13, which is currently seen beneath the level at 3350 levels, the buying pressure could remain intact.

The MA 5 and MA 13 seem to have formed stable support in the 3318-3350 area. On the downside, 3210 (psychological level) aligns with the ascending trendline as key support. A daily close below that level could force the index to extend its slide toward the 3118 levels.

The S&P 500 index has been printing a series of lower lows and lower highs since the start of September in the four-hour chart, reaching a two-month low of 3210 levels last week. The S&P 500 may push for some recovery in the near-term given the improvement in the RSI, which has bottomed twice near its lows before bouncing up.

The price has also managed to overcome its moving average 13 giving another green light to the bulls. In the event, the market pulls back below the 4-hour moving average 13, and horizontal support at 3210 levels, it may open towards the 3118 floors.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.