The rally this week was broad-based, with the usual suspects like Apple (NASDAQ: APPL) and Microsoft (NASDAQ: MSFT) topping the charts. The financial and energy sectors were also strongly bullish yesterday and helped in boosting the performance of the S&P 500 (SPX).

While the rally cannot be attributed to just one factor, many analysts have cited the drawn-out debacle over another round of COVID-19 stimulus as the major factor.

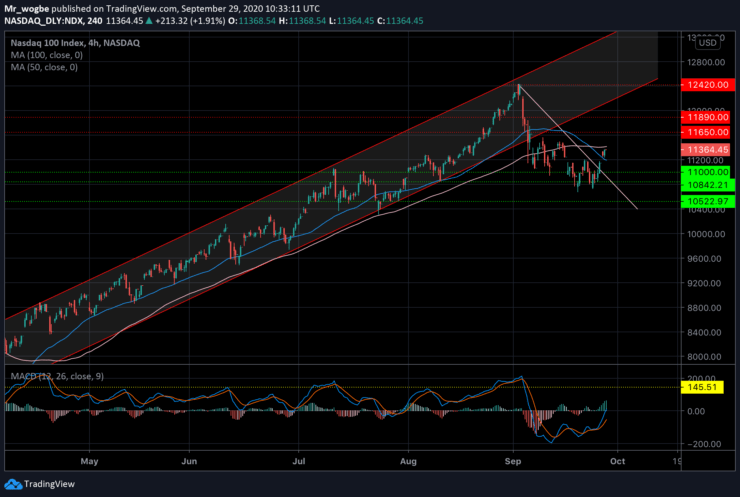

They also cited that a technical factor had a bolstering effect on the index on Friday. The NDX broke above the strong 11000 psychological area followed by the month-old descending trendline around 11200.

Regardless, the technical factor will take the second seat to the fundamental landscape, which is poised to see the release of the Micron (NASDAQ: MU) earnings today and the US Jobs data scheduled for Friday.

That said, NDX traders will be looking for key takeaways from the Micron report set for later today, as the data is expected to have a significant influence on the price dynamics of the Nasdaq 100 today. After that, attention, across markets, will be shifted to the US Non-Farm Payrolls report.

Nasdaq 100 (NDX) Value Forecast — September 29

NDX Major Bias: Bullish

Supply Levels: 11420, 11650, and 11890.

Demand Levels: 11200, 11000, and 10842.

The NDX has rebounded healthily from the 10842 support and has found some balance above 11300. As mentioned earlier, Nasdaq 100 has broken above the prevailing descending trendline and is now heading for the 11650 resistance.

At press time, the index has to scale the 100 SMA line at 11420, before it can make any significant climb higher.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.