USDCHF Price Analysis – September 22

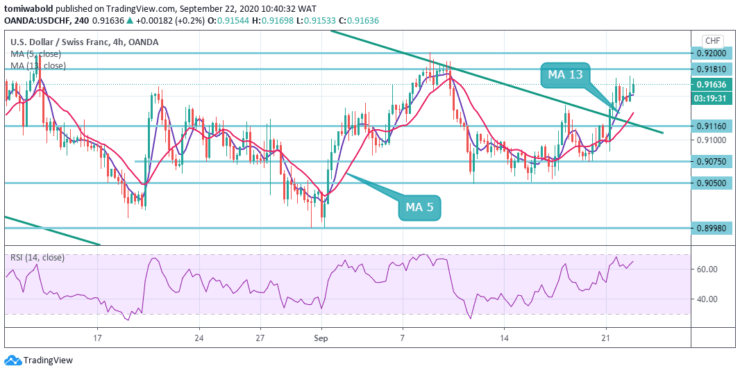

USDCHF increases for the 3rd day in a row as the pair remains mildly bid while trading near 0.9160 level on Tuesday. The pair is aiming to breach upwards the 0.9181 level in the present session.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9200

Support Levels: 0.9050, 0.8845, 0.8639

The pair bulls successfully broke the descending trendline amid bullish RSI conditions but the horizontal resistance line 0.9181 level seems to limit the immediate upside. Even if the quote closes beyond the resistance level of 0.9181, a seven-week-old resistance line near 0.9198 level may question further upside by USDCHF.

On the contrary, a downside break of moving average 5 and 13, currently around 0.9116 level, will not be enough to recall the sellers as there are multiple supports adjacent to 0.9050/45 levels that also includes September 10 bottom.

Range trading continues in USDCHF and intraday bias remains to the upside. On the downside, a break of 0.8998 level will resume a larger downtrend. Nevertheless, a break of 0.9200 level will resume the rebound towards 38.2% retracement of 0.9902 to 0.8998 at 0.9321 level.

The sustained trading below 100% projection of 1.0342 to 0.9181 from 1.0231 at 0.9050 level will pave the way to 138.2% projection at 0.8639 level. On the upside, a break of the 0.9370 resistance level is needed to be the first sign of medium to short term bottoming.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.