S&P 500 Price Analysis – September 22

The S&P 500 increases to 3301 levels up 0.33% on a day, during early Tuesday. In doing so, the equity derivative rises from the 5th day in a row plunge. The S&P 500 plummeted further in the previous day as fears of the coronavirus (COVID-19) resurgence roiled the global markets.

Key Levels

Resistance Levels: 3400, 3350, 3318

Support Levels: 3192, 3118, 3000

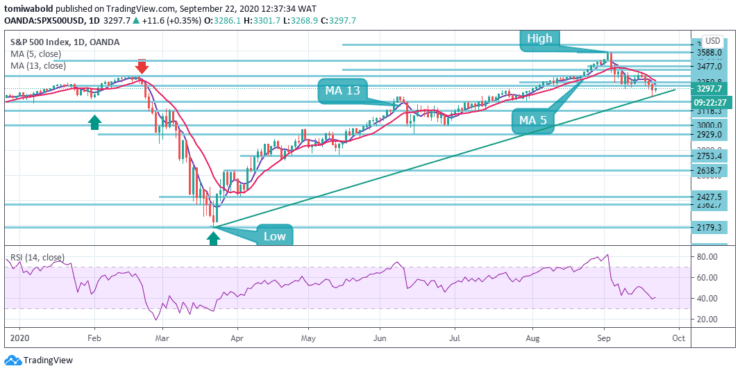

The S&P 500 has managed to depart from its daily lows. The S&P 500 is up 0.33% and down about 9% from its all-time high set at the beginning of this month. If the index fails to close the day above the moving average 5 and 13, which is currently seen above the level at 3318, the selling pressure could remain intact.

The MA 5 and MA 13 seem to have formed a strong resistance in the 3318-3350 area. On the downside, 3192 (psychological level) aligns with the ascending trendline as key support. A daily close below that level could force the index to extend its slide toward the 3118 levels.

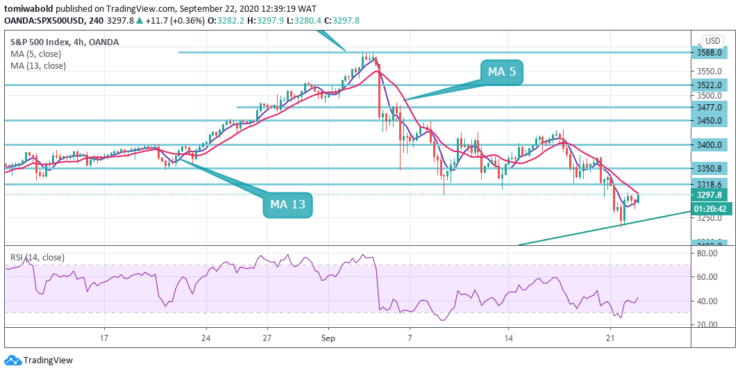

On the 4-hour time frame, although the S&P 500 index is looking ready to recoup previous losses, buying exposure may not increase unless the price overcomes the 3318 barriers. In the event, the market pulls back below the 4-hour moving average 13, and the ascending trendline support, it may open towards the 3192 floors.

The RSI has posted higher lows, indicating an improving short-term bias. However, any additional upside correction may not be attractive enough unless the index jumps past the 3350 levels. However, if the bears win the battle at this point, a more aggressive sell-off may prevail.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.