The markets found some relief yesterday following President Trump’s decision to halt the ban on Chinese social media apps WeChat and TikTok. However, traders are monitoring developments on the TikTok-Oracle deal to get clearer insights into the state of the market.

Furthermore, the developing geopolitical crisis in the Taiwan Strait also remains in the eyes of investors in the near-term.

Meanwhile, the Chinese media giant Global Times announced in a recent report that Beijing was considering placing HSBC in its Unreliable Entity List (UEL) following the discovery of its linkage with the embattled Huawei CFO Meng Wanzhou’s case.

In other news, the VIX volatility index has etched lower over the past two weeks, suggesting that the NDX’s recent bearishness might be a healthy correction in the middle of a bull run. However, indicators show that there could be more consolidation in the coming days and weeks.

Moving on, market participants will be looking at the FOMC meeting tomorrow for clues on what the market could do next.

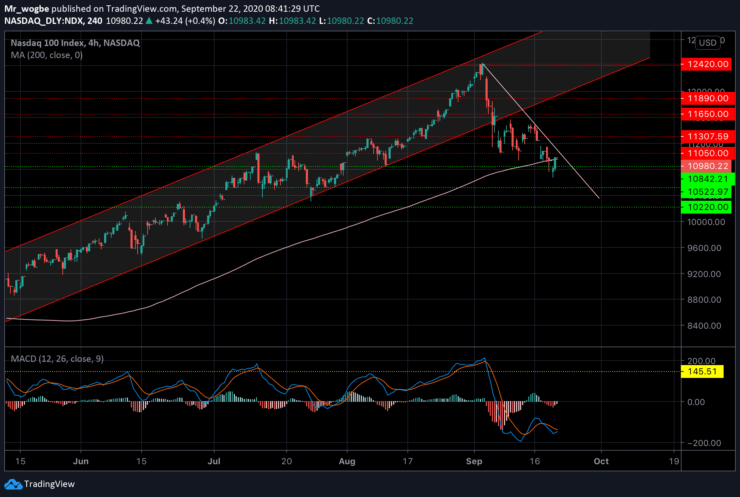

Nasdaq 100 (NDX) Value Forecast — September 22

NDX Major Bias: Bearish

Supply Levels: 11050, 11307, and 11595.

Demand Levels: 10840, 10522, and 10220.

The NDX is currently struggling with the 200 SMA around the 10963 area, where the price currently is. Also, a new downward-facing trendline has emerged, indicating that this bearish spate could last a while longer. The index might have a hard time breaking above the 11050 resistance, which could send it on another bear-run below the 10522 support and closer to the 10220 support.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.