USDCHF Price Analysis – August 11

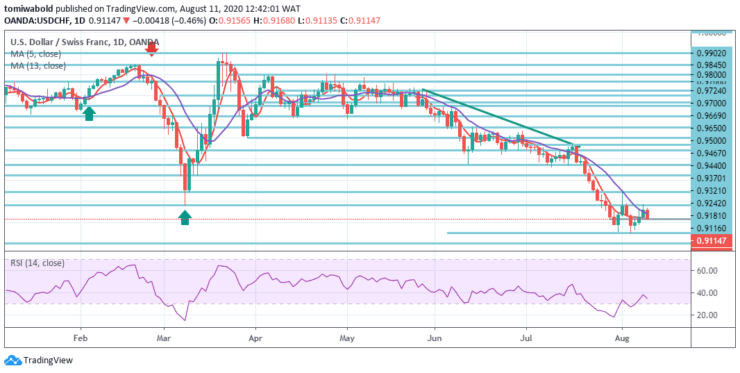

Given its recent rebound near a 5.5-year low of 0.9050 level, USDCHF continues to retain negative effect beneath the declining moving averages 5 and 13. If buying interest picks up, then in the next session we can see the pair trend higher.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9181

Support Levels: 0.9050, 0.9000, 0.8984

In the wider sense, the decline from level 1.0231 is seen as the 3rd stage of the analysis from level 1.0342 (low). The defined direction indicates that such trends are still being adjusted. Continuous trade beneath the 100% forecast of 1.0342 to 0.9181 levels from 1.0231 to 0.9081 levels may open the path for a forecast of 138.2 percent at 0.8639 levels.

On the positive side, the resistance level breach of 0.9370 is anticipated to be the first sign of medium to long-term bottoming. To the downside, if the bears manage to dip beneath the 5.5-year barrier at 0.9050 level, the level lows of 0.8984 and 0.8933 from the end of January 2015 may attract attention.

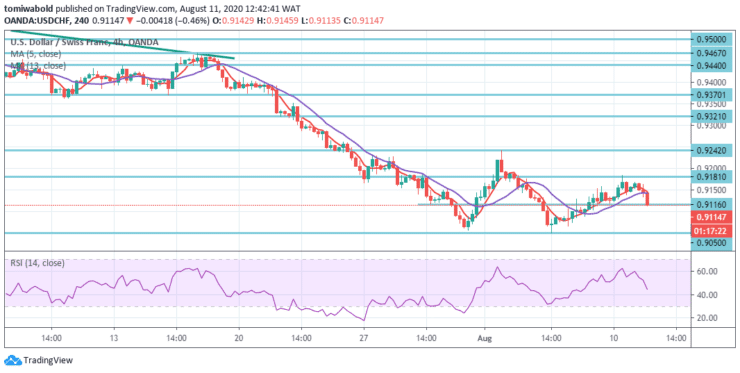

Intraday bias in USDCHF stays initial neutral and further decline with resistance level 0.9242 intact is predicted. On the downside, the 0.9050-level breach may restart a major downward slide. The breach of 0.9242 level, though, may validate short-term bottoming and turn the bias to the upside for 0.9370 support turned resistance level.

This being said, if taking a glance at the short-term oscillators generate positive momentum adjustments. Nevertheless, as the prevailing negative MAs 5 and 13 and the RSI retain their course this may prove brief.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.