The Nasdaq 100 (NDX) was badly affected as traders ‘cashed-out’ of most of their positions on big tech stocks, which have been rallying since March. The NDX dropped by about 1% as several FANG stocks were bearish on Monday. Facebook (NASDAQ: FB) and Netflix (NASDAQ: NFLX) fell by about 2% each, while Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) fell by 1.5% each, and Alphabet (NASDAQ: GOOG) slipped by 0.9%.

Investors have been ‘holding their breaths’ over a Coronavirus stimulus package for a while now. President Trump signed several executive orders over the weekend, most of which were aimed at prolonging Coronavirus relief for Americans.

The orders will prolong the distribution of unemployment benefits at a diminished rate, extend student loan repayments as far as the end of the year, increase federal protections on evictions, and implement a payroll tax holiday. Many analysts are confident this move will appease lawmakers to settle on a deal.

Trump’s executive order comes after Congress failed to agree on a Coronavirus stimulus package last week. Several benefits from the original package signed at the beginning of the year have already elapsed since July, eliciting worries over the US economy in the coming months. Some analysts predict that this could usher-in economic weakness this month.

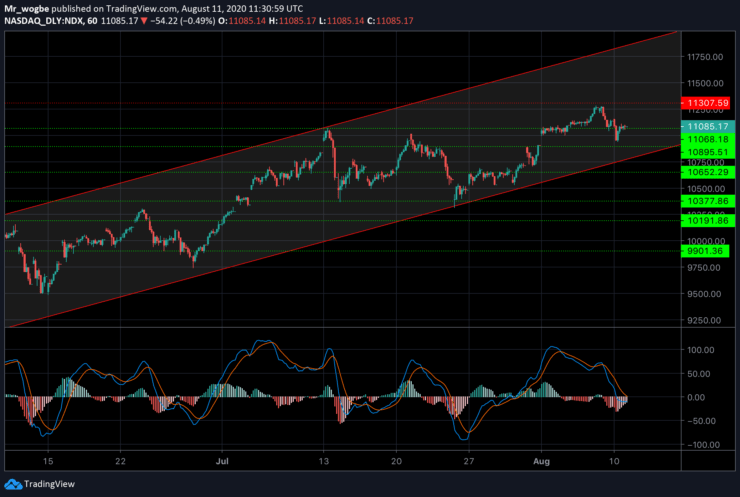

Nasdaq 100 (NDX) Value Forecast — August 11

NDX Major Bias: Bullish

Supply Levels: 11148, 11307, and 11400.

Demand Levels: 10895,10652, and 10500.

As projected in the last analysis, the NDX has begun a descent to the 11000 – 10890 levels after failing to climb above the 11307 resistance. Although it is unlikely at this point, we could see a correction to the baseline of our ascending channel (10895) where the NDX will likely find strong support.

On the flip side, however, the NDX could bounce off the 11068 support and approach the 11307 area once again.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.