S&P 500 Price Analysis – August 11

S&P 500 Futures bounce from 3360 levels, and up 0.70% on a day, during the European opening hour on Tuesday. The price seems to be steering its path into unknown territory towards a high of 3398 levels of around February. Coronavirus woes, concerns of escalating conflict between the US and China are getting a little bit of coverage. Rising chances of US stimulus are also to support the mild optimism.

Key Levels

Resistance Levels: 3450, 3430, 3400

Support Levels: 3360, 3300, 3250

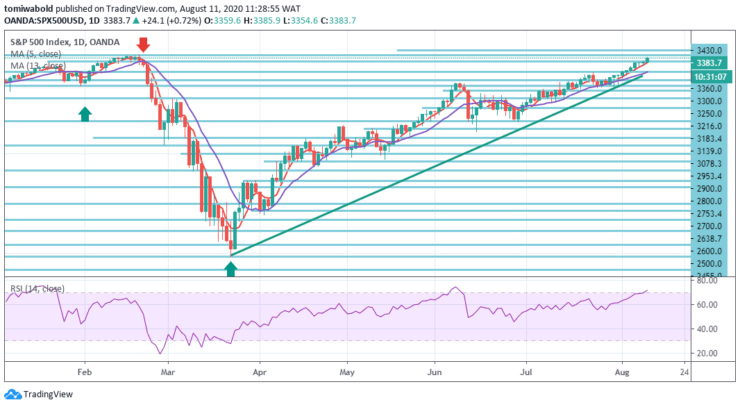

The price moved steadily higher on the daily chart after finding traction again at the moving average of 5 while bouncing off the horizontal line at 3360 levels. Aiding this progression from the 3200 levels is bounce on the ascending trendline coming from March 20 low and the positive bearing in the MAs.

The horizontal resistance line at 3400 levels is immediately constraining upside moves towards the high of 3398 levels in February. If buying interest succeeds in breaching the historic peak, resistance may grow from level 3430. The resistance at 3450 and the 3500 handles may then be confronted with more gains.

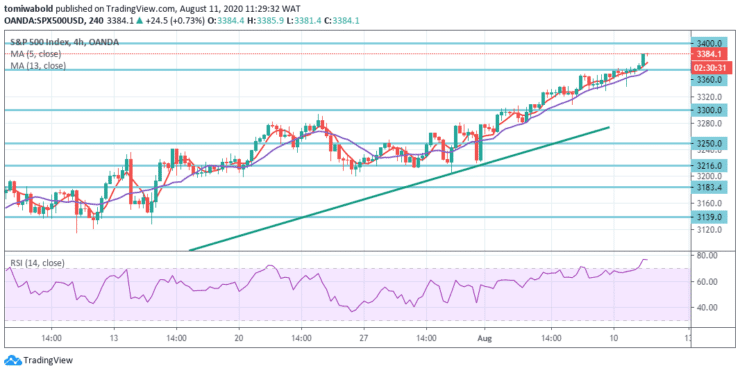

Technically its near-term upward channel support appears to be well held in the short time frame and its emphasis is on 3400 level resistance to confirm the trend. It could be shifted to the near-term horizontal support level at 3360 to signal the resumption of the selloff.

As bulls remain firmly in control, in the medium term the S&P 500 is targeting both the 3400 price zone and the 3430 marks. On the other hand, support may initially be seen near the levels 3360, 3300, and 3250.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.