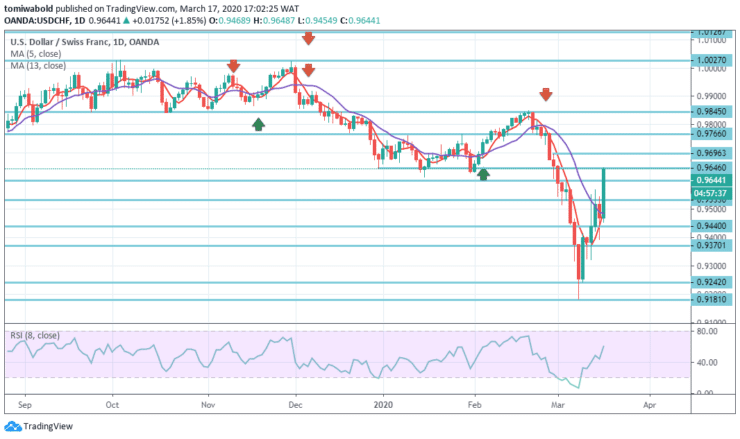

USDCHF Price Analysis – March 17

Throughout the early North American session, the USDCHF pair kept scaling higher and shot to tops of over two weeks, with the price above the 0.9600 marks. A mixture of reinforcing elements – including a fast increase in the US dollar market – supported the pair to attract some fresh offers on Tuesday.

Key levels

Resistance Levels: 1.0231, 10027, 0.9696

Support Levels: 0.9533, 0.9370, 0.9181

USDCHF Long term Trend: Ranging

The decline from the level of 1.0027 in the larger structure is seen as the third leg of the sequence from 1.0231 level. As long as 0.9646 support turned resistance level holds, more decline could be seen from 1.0231 at 0.9081 levels to the 100 percent estimate of 1.0231 at 0.9181 levels.

The firm break of 0.9600 level, however, may mean that 0.9181 main support (low) level has been shielded. In the long-term range trend, USDCHF would then have begun another advance leg through the resistance zone of 1.0027 and 1.0231 (high) level.

USDCHF Short term Trend: Ranging

The USDCHF recovery from the level of 0.9181 managed to take out level at 0.9533. Bias in intraday is back on the upside. Sustained breakage of 0.9600 level may indicate a bullish reversal and aim at 0.9646 resistance level and next.

On the other hand, rejection by the level of 0.9646 can maintain bearishness for the near term while the 0.9370 level break may alter the downside bias for the 0.9181/6 level main support zone to be retested.

Instrument: USDCHF

Order: Buy

Entry price: 0.9600

Stop: 0.9533

Target: 0.9696

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.