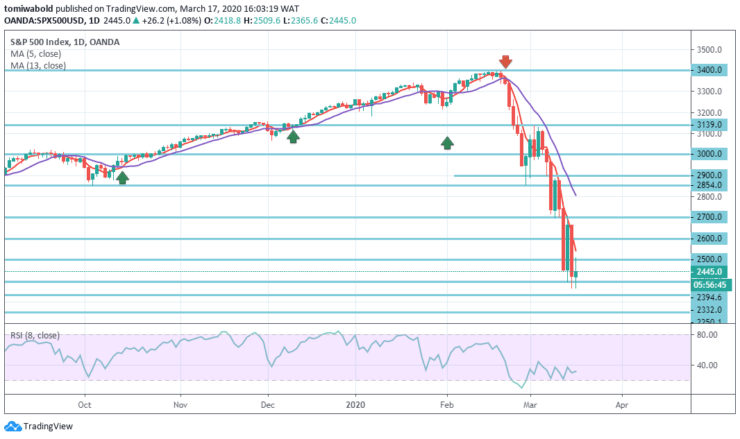

S&P 500 Price Analysis – March 17

The futures on the S&P 500, the stock index for Wall Street and the global equity benchmark, spiked up 3.87 percent early today, dropping 12 percent on Monday. However, it remains negative by another 11 percent trading as low as 2,365 level on Tuesday as the plans for US fiscal stimulus seem to spread fear rather than reassure investors.

Key Levels

Resistance Levels: 3400, 3000, 2600

Support Levels: 2332, 2250, 2000

S&P 500 Long term Trend: Bearish

Technical signals are not promising on the daily chart. Although the RSI and the moving averages appear to have found a bottom and overstretched in the oversold region, there is still a compelling rebound to the candle pattern to prove.

Should the price increase, the bulls would drive above the nearby 2,700 level of resistance and hold up to 2,854 level. The S&P 500, put in a nutshell, remains vulnerable to downside moves once the 2,332-level 2018 low fails to hold. A fall under that level will also invalidate the upward trajectory of the market in the long-term timeframe.

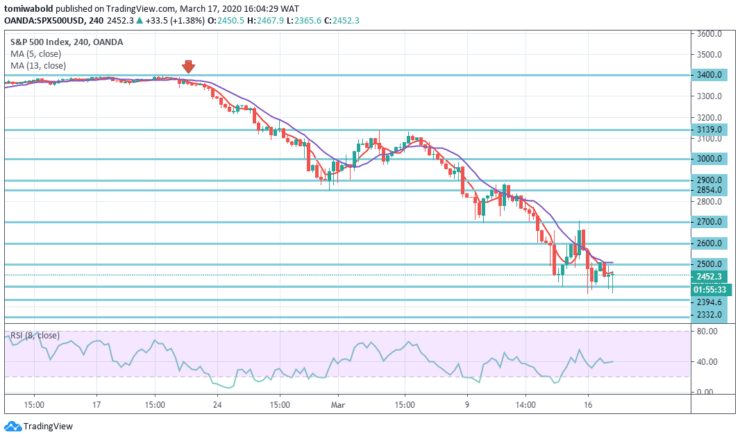

S&P 500 Short term Trend: Bearish

On the flip side of the 4-hour time frame, a drop below the 2.332-level 2018 trough may suggest another downside extension likely to 2,250-level where support was sought by the market between 2016 and 2017 year.

Piercing the barrier, the emphasis would then move to level 2190, while a fall beneath the level 2,100 could open the door to level 2000.

Instrument: S&P 500

Order: Sell

Entry price: 2500

Stop: 2600

Target: 2394

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.