USDCHF Price Analysis – May 8

USDCHF sits close to 0.9700 level, slipping 0.15 percent on the day as it continues to the American session on Friday. The FX pair extends downward retracement to level 0.9700 while remaining restricted under level 0.9800. The selloff lasted for Friday’s second day in a row session and was backed by the dominant selling sentiment on the US dollar.

Key Levels

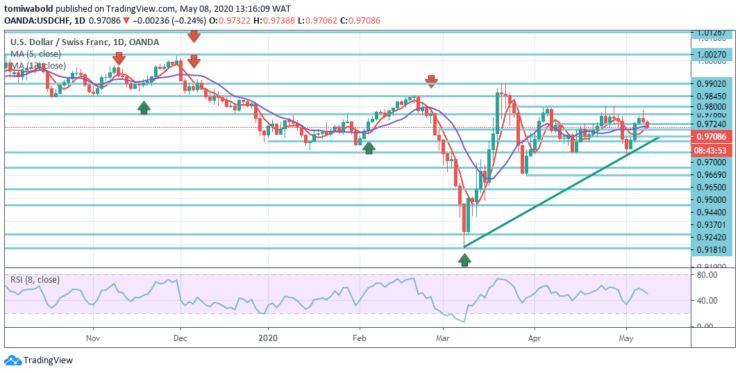

Resistance Levels: 1.0231, 1.0027, 0.9800

Support Levels: 0.9600, 0.9440, 0.9181

USDCHF Long term Trend: Ranging

As a consequence, the retracement level of the pair’s one-week-old surge in USDCHF at 23.6 percent attracts bulls about 0.9724 mark. A horizontal line from the previous session, nevertheless, retains the barrier for the pair’s subsequent break-up to the monthly peak of 0.9784 level around 0.9766 level.

The foregoing horizontal support about 0.9700 level on the downward serves as an instant obstacle for bears. A convergence of the MA 5 and MA 13 at a retracement of 38.2 percent between 0.9720/24 level would then be a hard nut to crack for bears to smash.

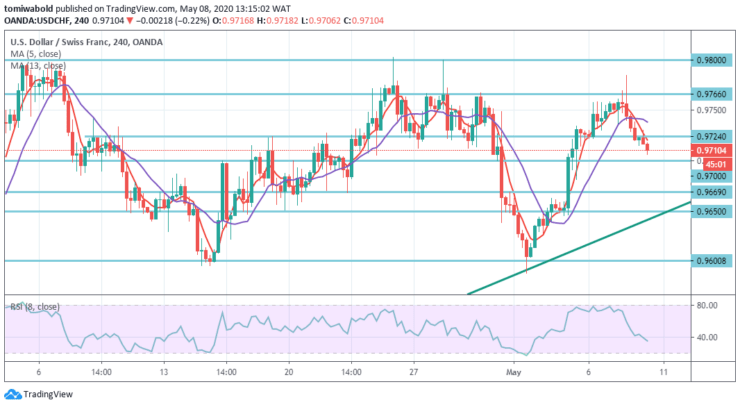

USDCHF Short term Trend: Ranging

USDCHF has withdrawn ahead of the resistance level of 0.9800 and intraday bias is first rendered cautious. As a whole, consolidation from level 0.9902 is yet ongoing. Beneath 0.9669 minor support level, the downside for 0.9600 support level, and probably beneath, may shift bias.

However, uncertainty may bring a turnaround and may be limited by a 61.8 percent retraction of 0.9181 to 0.9902 at 0.9440 levels. On the contrary, the resistance level breach of 0.9800 may reach a test at the resistance level of 0.9902.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.