EURJPY Price Analysis – May 8

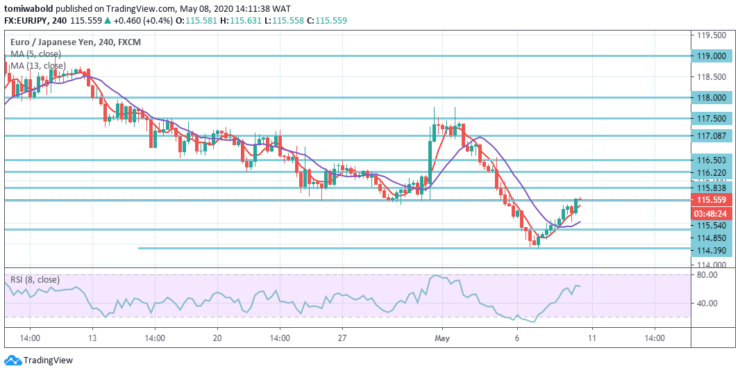

Since the prior trading session, the common European currency has risen 77 basis points or 0.67 percent against the Japanese Yen. The currency pair on Friday surpassed the upward moving average of 5. While emerging upwards after a low-level rebound at 114.39, the selling bias in EURJPY stays far in a position which seems to be the likelihood of a broader selloff.

Key Levels

Resistance Levels: 122.87, 119.00, 117.50

Support Levels: 114.39, 113.70, 100.21

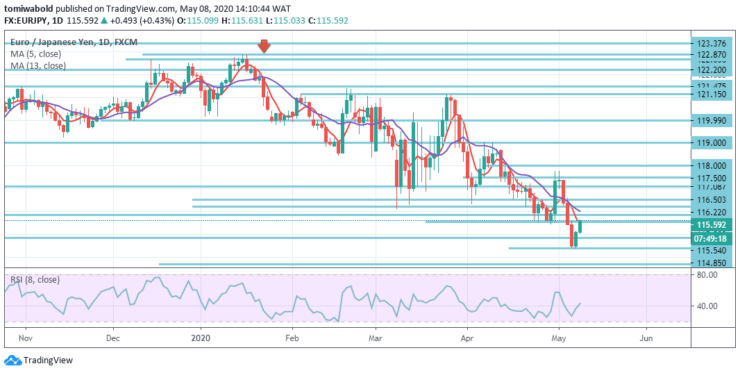

EURJPY Long term Trend: Bearish

Towards the context of rising downward risk, the cross is undergoing another critical contest in the lows of November 2016 in the 113.70 area. Aiming at the wider context, it is anticipated the downside tension may forfeit such traction beyond the initial resistance, now around 117.08 level.

The exchange rate is currently positioned close to a cluster of resistance established by the monthly support and the moving average of 5 at 115.54 level. The EURJPY pair may slip lower within this session if the resistance cluster stays. Though, when the exchange rate rises towards a higher moving average 5 another goal for the price would be in the region of 116.00 level.

EURJPY Short term Trend: Bearish

EURJPY has reached a brief low of 114.85 level, ahead of a 100% forecast of 122.87 to 116.22 from 119.00 at 114.39 levels. With consolidations, the intraday bias is rendered neutral. However, to deliver on another fall, recovery should be restricted underneath the 117.50 resistance level.

On the drawback, the 114.39-level breach may continue a broader downward trend to the 100.21-level estimate of 161.8 percent. In either scenario, the trend may likewise stay bearish as long as 122.87 resistance level stays intact, in the event of a further rebound.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.