Alex Krüger, a well-known cryptocurrency economist, lists three fundamental factors largely responsible for the bullishness seen in the price of Bitcoin.

Firstly, he cites the current loss of faith in government institutions by the public globally as one of the reasons Bitcoin is now considered a preferred investment instrument. The weak response to the Coronavirus pandemic by governments across the globe speaks volumes of how unreliable the government and government institutions have become.

Krüger also cited that investors have been flushed out of the risk curve due to increased liquidity and diminished interest rates. These factors have driven many investors to more volatile assets like Bitcoin.

Finally, he mentioned that the negative interest rates executed by several central banks serve as a bolstering agent for Bitcoin considering that such policies will trigger inflation soon. These fundamental factors appear to be the drivers behind Bitcoin’s push for $10,000 and higher.

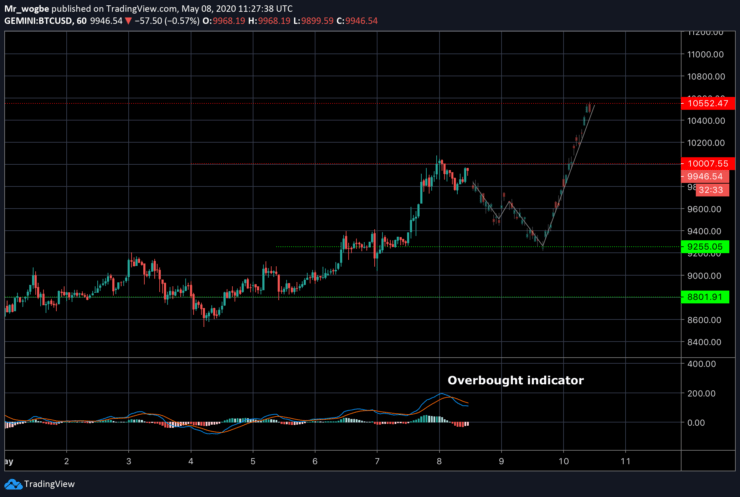

Bitcoin Value Forecast — May 8

Bitcoin Major Bias: Bullish

Supply Levels: $10,000, $10,550, and $12,300.

Demand Levels: $9,500, $9,250, and $8,800.

Bitcoin, in an unprecedented bull run, tested the $10,000 level after destroying the strong resistance at $9,500 some hours ago. Although the price of BTC could likely continue to the $10,500 level and higher, a quick pullback to the $9,250 level is expected to occur soon.

However, bulls will have to take a stand at that support line should this pullback occur. Failure to defend it could send the price of BTC to lower support levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.